North Point ready to walk away from stalled projects

North Point Global Group has said this afternoon that it is to dispose of its property interests, return deposits on apartments to buyers and cease operations after being “severely damaged by a series of events that have been neither their responsibility nor within their control.”

In a lengthy statement, NPG said: “Directors of the group and their advisors consider that it would be wholly unrealistic to return to site on any of their projects as they consider that the North Point Global brand has become tainted and damaged beyond salvage.

“Therefore the group will seek to dispose of all of their property interests, return monies to buyer clients and then cease operations.

“If this process cannot be concluded on a private treaty basis then the group will seek to appoint insolvency practitioners as and where applicable, but the intention will be to fully reimburse buyer clients wherever possible and this process will be undertaken with absolute clarity and transparency.

“For this reason the buyer clients will be asked to appoint a representative for each project to participate in the disposal process.”

Bennetts Cranes, a business based in Gloucester, has issued a winding-up petition against North Point Global Ltd, which is due to be heard in the Royal Courts of Justice on 14 August. NPG said the winding-up petition relates to a company that does not hold any of the sites, and “will in any event be dealt with in due course”.

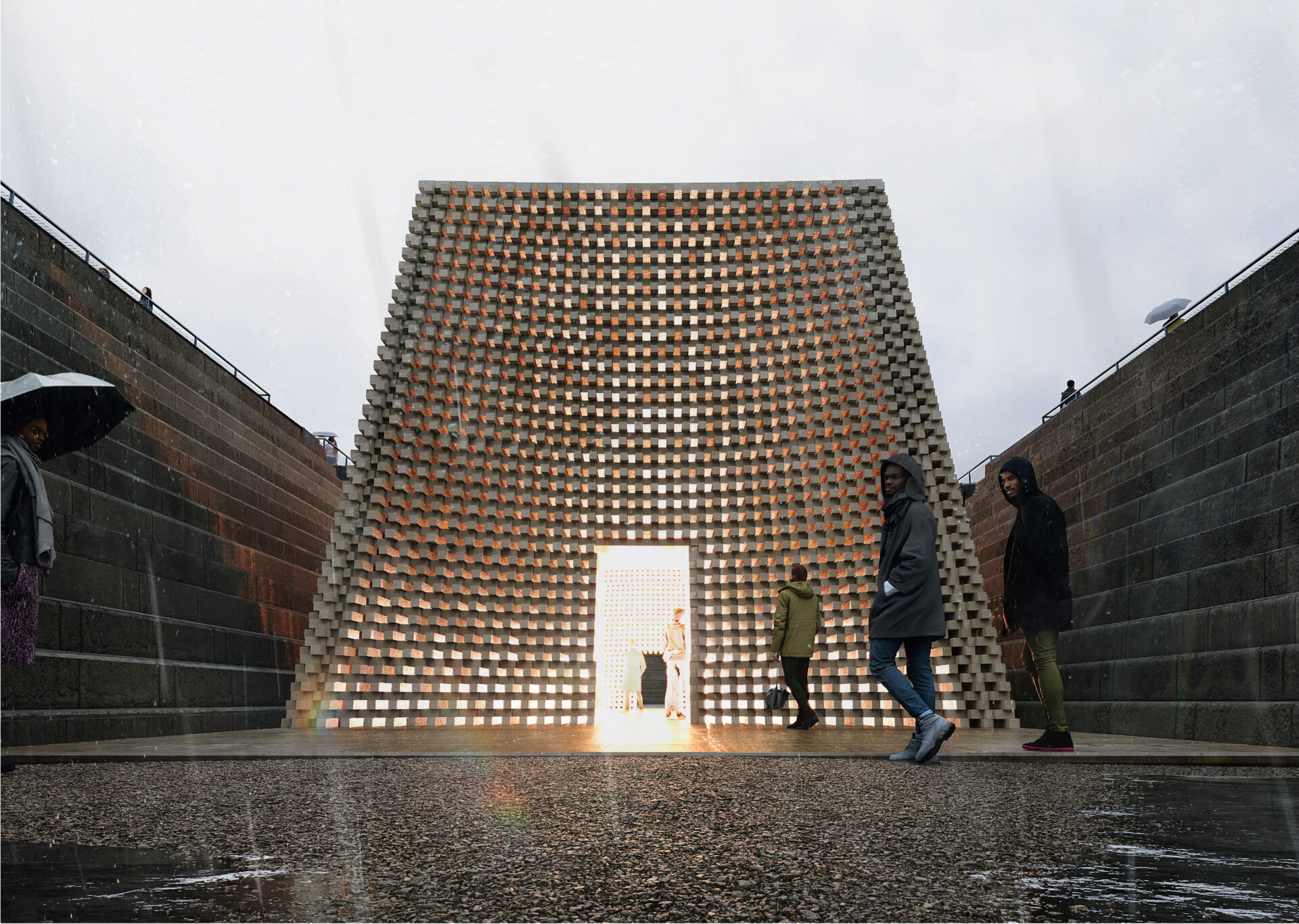

The action relates to North Point Pall Mall, billed by NPG as its signature development. Other schemes listed on its website include Gallery+ in the Baltic Quarter, The Element in Old Trafford, Manchester and New Chinatown.

It seems to be the £200m New Chinatown, consented in 2015, that has brought things to a head. Subsidiary business China Town Development Company is currently facing legal action from Liverpool City Council over the 800-apartment scheme.

In mid-July, the council announced that it was preparing to start the process of Compulsory Purchase Orders to gain control of the Great George Street site. A week later the council said that following legal advice, it had instead instructed solicitors to start legal proceedings for the forfeiture of two leases on the site.

A statutory demand for the outstanding sum of £950,000 owed to the council was also made.

NPG described its relationship with the council as “troubled,” saying of the Chinatown situation: “The council is seeking to forfeit the group’s leasehold interest in phases one and two of New Chinatown despite the fact that the group has sold 56 units on phase one to buyer clients with the full knowledge and support of the council.

“For the avoidance of any doubt the group has already paid considerable monies to Liverpool City Council for New Chinatown and the delay in payment has only become an issue now because it suits the council in their unknown ambitions for the site.”

The group said that it had only ceased construction work on the scheme to ensure an orderly handover to potential buyer Your Housing Group and that “Liverpool City Council was a willing participant in this whole process”. NPG said that negotiations with YHG had fallen apart after five months.

NPG criticised press releases and TV statements from council spokespeople concerning the business as “vitriolic and misleading” and refuted all allegations of criminality.

A Liverpool City Council spokesman said: “We are aware of North Point Global’s statement but it does not change the council’s position regarding its chosen course of action against China Town Development Company Ltd.”

Over the course of the next fourteen days NPG will issue details of disposal plans for each of its specific projects, the group said.

This is the latest rip off by the same group of people that are planning on repeating exactly the same stunt on another property in Liverpool – Lawton Property Company Ltd – on Leeds Street/Vauxhall Road (Liverpool-England). The net is closing in on this group for the money they took from us but thought to warn anyone who might be looking at this for investment.

By Anon.