The Subplot

The Subplot | Slaying real estate dragons

Welcome to The Subplot, your regular slice of commentary on the business and property market from across the North of England and North Wales.

THIS WEEK

- Here be dragons: why now is a great moment for real estate’s bold and brave

- Elevator pitch: your weekly rundown of what’s going up and what’s heading the other way

HERE BE DRAGONS

Northern property’s strange and exciting times

Today, and for a little while longer, a bold knight can make a fortune slaying real estate’s dragons.

St George’s Day naturally brings dragons to the top of the news agenda. This is timely because the mood is growing in the Northern real estate business that we’re living through some strange, dangerous times. For dragon slayers and fortune-seekers, this is a rare moment. Some property folk call it ‘fluid’, others use more colourful language. What’s driving this dungeons-and-dragons feeling is a combination of political instability at home and abroad, the likelihood that high interest rates will continue longer than many hoped, a tight labour market, and a change in the familiar cast of characters. The mightiest dragon is, of course, inflation – which isn’t falling anything like as fast as everyone expected.

Wirral opportunity

Let’s start this quest in Bromborough, one of Wirral’s agreeable suburbs, where the one-acre site of the former civic centre is up for sale. It once housed a library and community hall, as well as local council offices, until 2020 when council spending cuts forced its closure. The plot is next to a Co-op, and slap-bang in the middle of town. If you want a large fairly unconstrained central site in pleasant Bromborough – for, say, sheltered housing or apartments – this is pretty much your only option. Which is a massive help if you’re trying to sell it, like LSH head of land and development Charles McLean.

Fluid dynamics

“We’re not quoting a guide price,” says McLean, conscious that operators and care providers have different ideas of value compared with apartment developers. “We’ve interest from all sorts, this might go in any direction. We’re hoping for something with social value. It’s very early days in a six- to eight-week marketing campaign at a fascinating time. “It’s quite a fluid market. I don’t think there have been many moments like this when there is such a weight of money looking for opportunities.”

New knights

The weight-of-money argument is not just a figure of speech. New entrants to the market are well-armoured and well-resourced, and they are moving into dragon-filled sectors (like retail) with sword-slashing energy.

Three examples: this week Norges Bank, the Norwegian sovereign wealth fund, is in talks to buy the remaining 50% stake in Sheffield’s Meadowhall Centre for £363m. The same fund bought the other half in 2012 for £348m. Simultaneously Blackstone – no bigger beast exists –signalled a return to retail after a decade-and-a-half of soft-peddling, saying now was the moment of opportunity. Meanwhile, Pat Gunne, the Irish investor who co-parented Green Property and knows the North West of England well, re-entered the UK property market following his timely exit in 2019. His 3RE Capital Ventures has formed a joint venture with Aermont, and is said to have a £700m-plus kitty.

Old friends

At the same time as new knights-errant take advantage of an unusual market, others are on the retreat. Pension funds and other UK institutional investors have been rethinking for a long time: fund allocations to illiquid things like real estate are lower than they once were (because we’re all more short-term and trigger-happy). A lot of the slack was taken up by private equity, which thrived in a low-interest-rate world, but could be about to face a day of reckoning of its own. This week, the Bank of England repeated scary-sounding warnings that higher interest rates plus stacks of unquantified debt were a risk to financial stability.

Harken to the soothsayers

The result is dangerous terrain where the stakes are higher than ever, the risks and rewards unusually great. Valuation has turned into soothsaying: Salford’s 205,000 sq ft Trinity Bridge House was on the market for £36m this time last year and is now being reported as sold for £18m, or £25m. Get it right, your fortune is made. Get it wrong, it’s curtains.

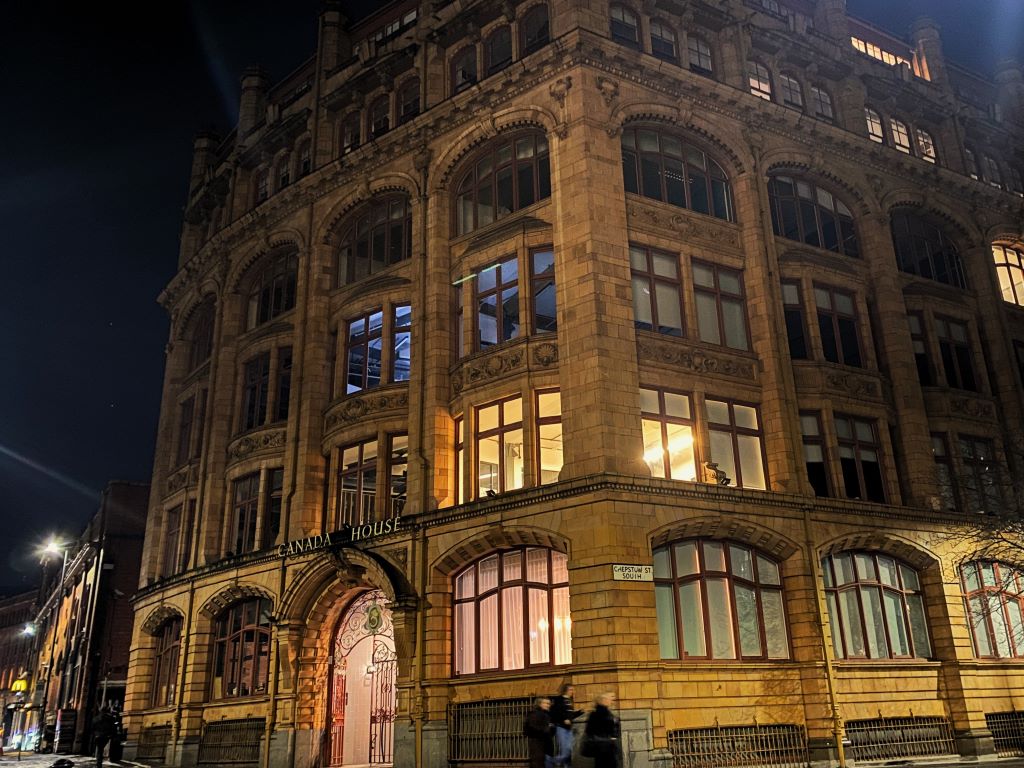

Adventurous knights like Gary Neville-fronted Relentless Group are scooping up the prizes – this week it claimed a 34,000 sq ft letting to Leeds and Manchester serviced workspace operator Gilbanks at its Manchester St Michael’s scheme. Others – you can all Google – are doing the Black Knight’s evergreen ’tis but a scratch routine from Monty Python and the Holy Grail. It’s all very undignified.

These are strange and unsettled times, the like of which we may not see again. Take courage, bold knights, slay the dragons, and fortune is yours. If you don’t – the dragons will burn you up.

ELEVATOR PITCH

ELEVATOR PITCH

Going up or going down?

Sunderland’s ambitious Riverside plans are nudging up after the city council made a new appointment, but unfortunately, Redcar and Darlington got trapped in the lift doors.

Redcar and Darlington

Redcar and Darlington

Yesterday saw one of the best data drops of the year: GDP figures for the regions and for each local authority. Well worth your time.

The most striking data set was that for local authority deflators – which sounds unpleasant but is massively significant. Table 8 in the local authority spreadsheet showed the rate of change over time rather than big misleading headline numbers. GDP in 2019 was set at 100, and the statisticians work backwards to say what proportion of 100 was represented by GDP in 1998, and what in 2022 (the most recent year). If it’s over 100 you’ve grown your economy since 2019. If not, then you haven’t.

A few examples. Manchester is now 110.7, so up nicely. But Stockport, which started from a higher base as the century turned (69.4 in Manchester, 73.4 in Stockport) ended up at 109.6. So not quite so hot, but still better than Salford, which oddly started even better than Stockport, but ended up at 107.6, which is pretty low by regional and national standards.

The longer-term picture is even more revealing. Look at Darlington and Redcar, near neighbours, but with very different outcomes. Darlington has seen a massive economic collapse – it was worth 167% of its 2019 economy back in 1998. Since 2019 it’s grown barely at all, and is scored at 102.5. Down the road in Redcar the century started with the borough in an average-to-weak position but it has raced ahead since 2019. Measured by rate of growth it’s a rocket, and one of the North’s fastest growing (113.8), growing at a rate comparable with affluent Cheshire West & Chester (114.7).

Sunderland’s high street

Sunderland’s high street

Sunderland’s Riverside Quarter took a step forward with the appointment of Stärka, the leisure property consultancy, to advise on the 60,000 sq ft plans for restaurants and bars. The scheme is on the site of a leisure centre, backed by the government’s Future High Streets Fund, and part of a wider venture to boost city living in, surprise surprise, the city centre.

The prospectus for Riverside is nothing if not ambitious. The “masterplan will create 1,000 homes for a community of 2,500 people, and 1m sq ft of offices and workspace for 8,000 – 10,000 quality jobs. Beautiful parks and public spaces will create a memorable landscape,” it proclaims.

Sunderland was one of just three locations to scoop the full £25m grant available from the Future High Streets Fund, largely because the city showed the potential to leverage the amount into something much larger. It’s more than encouraging to see that process get underway.

Get in touch with David Thame: david.thame@placenorth.co.uk

The reading of the economic data is incorrect. Stockport and Salford appear to have started the century at a ‘higher base’ because they have grown slower than Manchester in the two decades since then. I.e. there hasn’t been as much change in the position relative to the 100 index in 2019.

By Anon

The city to watch from this data, is Preston. Mark my words, Preston is beginning to motor.

By Elephant

@April 26, 2024 at 8:48 am

By Elephant

I second that. One problem though. It has a slow council of dinosaurs. Change than and the city will well and truly go gangbusters.

By Rye