Event Summary

Industrial + Logistics | Navigating the boom

A surge in demand for logistics space has driven up rents and land prices but, with supply dwindling, the public and private sector will have to find ways to keep pace with the booming sector.

At a Place North West event last week, experts from across the region discussed the factors driving unprecedented levels of take-up of industrial and logistics space, and the barriers that could smother the sector’s growth and strangle supply in the coming months and years.

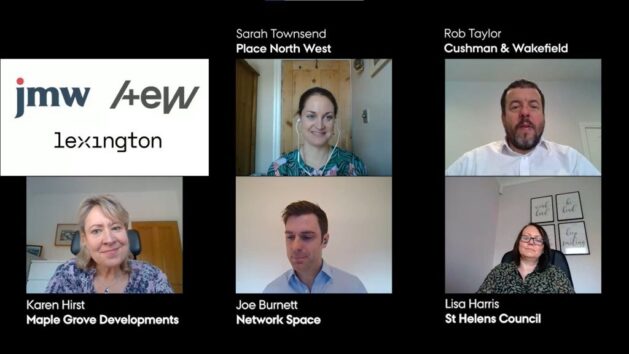

This event was sponsored by Lexington, JMW Solicitors and AEW Architects and hosted by Place North West editor Sarah Townsend.

St Helens – an industrial hotbed

Lisa Harris, executive director of place at St Helens Council, outlined the characteristics she claims make St Helens the ideal location for industrial development.

“Innovation is in our blood. St Helens is perfectly positioned at the heart of North West,” she said.

Some 3.4 million people live within an hour of St Helens, which is served by excellent transport links and good digital connectivity, Harris added.

St Helens is looking to bring forward 654 acres of employment land for development, including 355 acres at the former Parkside Colliery, which is earmarked for 1m sq ft of logistics space but has been called in for review by the Government.

Subject to planning approval, the council and its private sector partner Langtree in the Parkside Regeneration joint venture are to invest £50m in the first phase, which could create more than 1,600 jobs, according to Harris.

Glass Futures, another key project in St Helens, is a £54m global centre of R&D for the glass industry. Planning consent is due to be given in May and Harris said the centre is expected to open in 2023.

Panel One – Unprecedented growth and demand

Joe Burnett, development director, Network Space

Karen Hirst, managing director, Maple Grove Developments

Rob Taylor, partner, national logistics & industrial, Cushman & Wakefield

Lisa Harris, executive director of place, St Helens Council

Taylor said the “groundbreaking” take-up of industrial space in excess of 50,000 sq ft seen in 2020 is set to continue.

Last year, more than 5m sq ft of industrial and logistics accommodation was transacted in the North West and Taylor said he anticipates that when figures for the first quarter of 2021 are released, a further 2m sq ft will have been signed for – representing phenomenal growth even in the first part of this year.

Headline rents are continuing to creep upwards, and Taylor predicts that rents of £7/ sq ft for units larger than 100,000 sq ft will soon become the norm.

He added that, though, that planning delays impacting various large-scale industrial schemes across the North West, including Tritax’s Symmetry Park and Parkside Colliery, could negatively affect future supply.

“We wait and see what the outcome is. Had they been allowed last year there would have been stuff up, built and let on all three of those schemes. That is going to have an impact on supply moving forward.”

Burnett said Network Space has delivered 580,000 sq ft across five sites in the region over the last three years but Covid has caused some deals to fall through as occupiers paused requirements amid the pandemic.

However, he claimed there has been a recent “surge of confidence and interest [in the market] buoyed by the vaccine roll-out”.

Competition to acquire sites is high, and Network Space has seen its land supply dwindle and is having to work very hard to “restock its pipeline”, Burnett added.

Recent acquisitions by Network Space in Altrincham and Huyton totalling around 650,000 sq ft will see an element of repurposing existing buildings, rather than demolishing and building new stock, he said.

“Our approach is to retain and repurpose some of, if not most of, the space. There are sometimes greater margins to be made when repurposing.”

“Industrial has never been so hot,” according to Hirst.

Like Burnett, Hirst, 30% of whose company’s portfolio comprises industrial assets, said a lack of supply is driving up land prices, making it hard to compete.

“The key challenge of the industrial market is land price,” she said. “We are on the reserve list when competing with other developers in the open market.”

Hirst predicted that the next phase of Artis Park in Winsford, 120,000 sq ft of mid-box units, should let well given current demand. She added that existing trade counter units delivered in the first phase, and let to Toolstation and ScrewFix, achieved rents of £8/ sq ft.

Harris, meanwhile, said that Liverpool’s freeport status could “jumpstart the Liverpool City Region’s needs” in terms of industrial development.

“There are a wide variety of sites and opportunities that will be unlocked by the freeport and tax incentives will give those sites an edge.”

She added that the freeport allocation was a positive sign that large schemes in the city region, such as Parkside Colliery, would be approved by the planning inspectorate.

“We are confident we will get right decision,” she said. “If we can get over that planning hurdle, we will be well placed.”

Panel two – Future growth and evolving products

Hannah Richardson, associate director, Spawforths

Deborah Faithfull, estates manager, Hermes

Paul Martin, development director, Firethorn Trust

Steve Widdowson, director, Caddick Developments

Richardson said an increase in automation requirements means that occupiers are seeking taller units – up to 40 metres instead of around 15 to 22 – which presents planning difficulties. “In terms of visual impact, it is a challenge,” she said.

Larger developers are paying more attention to the issue of sustainability than midsize firms that are “lagging behind”, Richardson added.

“The sector has an important role to play. Some [developers] are embracing sustainability and making an increased commitment to it. [Others] don’t see the value.”

On Green Belt release, Richardson and the other panellists agreed that more needs to be done to educate the public about the benefits of the industrial and logistics sector, such as the creation of skilled jobs.

“There is a misconception that these sheds are empty apart from one man and a forklift,” she noted.

Faithfull said that the Covid-19 pandemic period had resulted in Hermes achieving five years’ worth of growth in five months, in terms of acquisition of new depots, as it moves to keep pace with changes in e-commerce consumer behaviour and demand.

“It has been an amazing year,” she said. “The number of parcels [dispatched] went through the roof.” In 2019, Hermes’ peak week saw 1.9m parcels pass through its depots; last year that increased to 3.4m as the company tripled its profits.

However, Hermes’ specific list of demands, including large yards and two-three sides of loading elevations, makes finding sites challenging, Faithfull added. The possibility of repurposing retail parks to accommodate logistics is unlikely to work for Hermes given the amount of space the company needs.

“We have been approached, but at the moment I don’t see it working unless it is a big retail estate with land at the back,” she said.

“Unless they can keep us away from the public in an enclosed yard we don’t want it. We need to be away from residential as lorries come through night.”

Widdowson said the level of occupier demand “has surprised everybody” and that the process of buying sites is definitely becoming more difficult in a rapidly growing market.

“It is challenging to acquire at the moment – pricing is difficult,” he said. “If you are trying to use today’s numbers you are probably behind the curve so you have to get ahead of the curve to transact.”

He added that industrial accommodation is becoming more “sophisticated” and that occupiers are getting involved in the development process at an earlier stage to “avoid the rush” of potential tenants vying for multiple high-quality units.

“There is a real cocktail of moving parts that makes the sector far more sophisticated and complex now than it ever has been,” Widdowson noted.

He compared the issue of Green Belt to the first amendment in the US constitution – “It is that emotive,” he said.

Developers need to “find answers against a difficult political backdrop” in order to advance projects in the Green Belt, or even on greenfield land, according to Widdowson. “We want to be part of the solution rather than part of the problem.”

Martin echoed the thoughts of other panellists when he said that identifying and acquiring sites is proving difficult.

“We are finding it more and more challenging to identify sites that stack up,” he said. “Logistics is one of the few sectors with tailwinds so there is a lot of money fleeing other sectors looking for a place to hide and that is affecting completion for sites and driving up land prices.”

He added that the office component of large logistics schemes is another element of the industrial landscape that is evolving.

“Companies are using big logistics developments as head offices so they need bigger and better offices. It’s not an ancillary warehouse office [anymore], they want a high-quality finish to wow clients,” he said.

Martin also agreed that more needs to be done to convince the public that not all Green Belt development is bad.

“[Green Belt] was allocated to prevent urban sprawl. In terms of logistics, you are looking at motorway junctions. If you use common sense that is not valuable green space.

“The public needs educating but politicians fear public reaction and are worried about votes,” he said.