Event Summary

Industrial + Logistics: a sector on the rise | Summary

Far from being only about big draughty sheds in out-of-the-way locations, the logistics industry is crucial to the region and the country, keeping goods and services moving in uncertain times, a Place North West event heard.

The event sought to examine the biggest issues around industrial property: what is being developed and where, and what can we expect to see in the future.

Industrial + Logistics was sponsored by JMW, Harworth, AEW and Turley.

It was the latest event under Place North West’s new conference format, using a platform called Remo that enables networking on digital ‘tables’, as well as many other features.

A full video recording of the event is available to watch here.

Key questions

- How have the Brexit timeline and Covid pandemic affected the regional logistics market this year?

- Why have several major schemes been called in, and what could help change that?

- Is automation and digital transformation changing industrial development?

Main takeaways

- As their high street presence is reduced, retailers are looking to logistics to reinforce their brand values, and this is also supporting the region’s low-carbon agenda

- Quality industrial supply is at a historically low level, with an estimated nine months of grade A stock available in the North West

- There is growing momentum to push for green space and amenities at ‘big box’ locations, which might help schemes to achieve planning consent

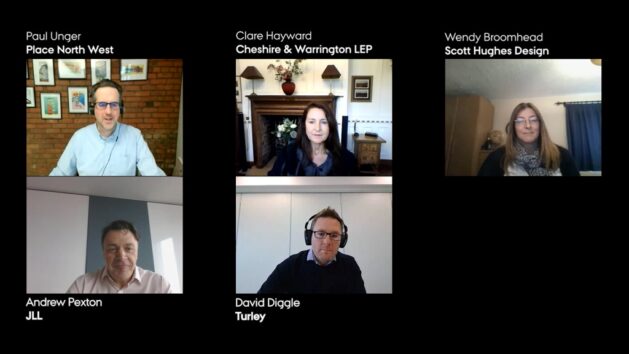

Panel one

Clare Hayward, growth director, Cirrus, and chair of Cheshire & Warrington LEP

Wendy Broomhead, partner, Ridge & Partners

David Diggle, director, Turley

Andrew Pexton, director, JLL

With home working now a full-time reality for many and online retail’s rise against the high street strengthened, has Covid-19 created a boom time for those with warehousing space to promote?

Andrew Pexton said the statement is true to an extent: “Q4 2019 and Q1 2020 saw very strong take-up, companies were positive and taking space, so things looked good heading towards the Brexit deadline.

“From March, perspectives changed and a lot of companies have been firefighting – they’re looking to minimise expenditure and maximise flexibility. There’s obviously been activity among supermarkets, medical companies, and online retail.

“Supply is very low – nine months’ worth based on 10-year average take up,” he added. “We estimate that there is 750,000 sq ft of grade A take-up this year, so demand is still there. I can’t remember a time with supply this low, and the Secretary of State calling in several key regional schemes this year has not helped.

“One lesson learned from Covid is the need for leisure space at major industrial schemes. Another trend is demand for water points and toilets within buildings, and more space to account or distancing. Occupiers are also looking to build resilience, as they remain alert to the risk of further lockdowns or plants being temporarily closed, so they might take space across two locations.”

Wendy Broomhead said: “The zero-carbon agenda is really pushing into logistics now: we’re seeing major players wanting to raise their game, even amid Covid. As brands lose storefronts, they’re concentrating more on logistics to be the face of the brand – Selfridges and Co-op are two retailers branding logistics projects and increasing quality.”

She added: “We’re seeing flexibility in how industrial parks mature, with significant changes from masterplans to delivery. More are looking at on-site power generation. Net biodiversity gain on these sites is a tricky thing to attain, so we’re constantly working to find ways to do that.

“Health and working conditions are starting to be taken into account more: better lighting, gyms, outdoor leisure, access to parks, cycle networks which reduce reliance on public or shared transport. We’ll see more of this.”

Clare Hayward said: “Logistics is huge for Cheshire and Warrington, we have 25,000 people employed in the sector and a number of our projects put forward for the Comprehensive Spending Review would build on that.

“As some sectors struggle, this is an area of jobs growth, and we’ve set up a project to fund training and help employers address skills gaps, it’s about matching local level interventions such as job postings with policy level activity. It needs reinforcing that there are high-quality jobs in the sector, particularly as it embraces digitisation.”

David Diggle said he believes it is time logistics made its voice heard as a key part of the economy: “Covid opened the public’s eyes to the importance of logistics in getting goods to them, and it’s time for the industry to gain a stronger footing in planning policy.

“Some local authorities are supportive, but with others it’s a challenge explaining the value it brings, especially with politicians who regard the Green Belt as sacrosanct – and motorway locations are usually green belt.

“Not enough is made of the significant number of office-based, technology and management jobs in the larger logistics buildings. A 10,000 sq ft office in a city centre context would be considered significant.

“If development can be low- or even zero-carbon, that would play well with planning officers, as will schemes blending with wider green infrastructure: country parks and active travel. We’re yet to see the consequence of all those white vans buzzing round: there’ll surely be rising demand for urban area last-mile logistics.”

Panel Two

Sally Duggleby, head of industrial occupier advisory, Savills

Alan Lamb, director, AEW Architects

Matt Whiteley, development manager, Harworth

Anna-Jane Hunter, group member, Chartered Institute of Logistics & Transport Rail Policy

We constantly hear of the need for big thinking – that multimodal development can free up road space and help green targets. Is it happening, panellists asked.

Anna Jane Hunter said: “Rail is definitely becoming a bigger part of the conversation again, as people have seen the role it plays, for example in getting supplies around and helping to build the Nightingale hospitals.

“The low-carbon agenda is also massive for making rail’s case. What rail needs is really challenging targets on carbon and getting lorries off the road.

“If ambitious targets are to be met, the only way to do that is more linking of transport modes: rail, ports, even air. Although perceived widely as being about journey times, HS2 actually has huge potential for rail freight– along with reopening old routes – because of the capacity it would unlock. We also need more electrification as soon as possible.”

The levelling-up agenda is in the national news at present – but Government decisions do not necessarily reflect it, said Matt Whiteley. “We’re keen to be a part of [the levelling up agenda], but need a supportive policy framework. We’re keen to get on with more than 1m sq ft-plus at Wingates.

“Logistics is one of the glimmers of hope for a way out [of the Covid-enforced slowdown], and the development industry isn’t looking for a free ride – we see our responsibility to develop holistically. The country park at Logistics North in Bolton is a critical part of the offer, and we look at a full range of ancillary uses: scale is important, because schemes as large as ours are attractive to coffee shops, for example.

“We expect to see more tailored development due to Covid – where people want space, or more facilities – but at a time when speculative building is prevalent, the opportunity to shape your property is challenging.

“A good proportion of our investors are attracted by the ESG credentials we’ve established by regenerating brownfield sites and it’s important to occupiers too: many won’t look at buildings that aren’t rated as BREEAM ‘Good’ at least.”

Sally Duggleby said that the market nationally is going through the roof, with take-up levels higher than in the record year of 2016.

She joined the call for more human-scale aspects at industrial locations: “I’m sick and tired of big box developers telling me that on-site amenities are not possible or desirable. People need to leave work for breaks, they need access to shops and exercise – very few are doing well when it comes to health on-site. It can be a differentiator.

“If we regard Amazon as a trailblazer, the North West’s lack of supply has definitely held it back – in my time as Amazon’s head of UK real estate, I wanted to do more here but couldn’t find the sites. Doncaster, on the other hand, now has every type of Amazon building type.

“Around London, we’re already seeing some repurposing of former retail parks, or stores within ore of this. The last-mile sector is an area I expect to see move on a lot over the next year as companies catch up with leaders like John Lewis on customer service.”

Alan Lamb said: “There need to be sensible conversations around Green Belt release, and taking a strategic approach to masterplanning and layouts, using whole sites. People can’t work from home in these jobs, they need to be given amenities, the better operators have been doing this for a while and it helps staff retention.

“Within buildings themselves, design changes post-Covid include larger café spaces and bathroom areas that five years ago would have been seen as a luxury. The importance of having flexibility and distinctiveness has been accelerated.”

He added: “We’re moving to a more mature view of making a building work long term, for it to be recyclable over time. In a buoyant market, with a lot of investment money, if we can’t do it now than when can we? ‘Is our investment resilient?’ is a question I expect to hear a lot more often.”