Avison Young: Shed take-up falls to five-year low

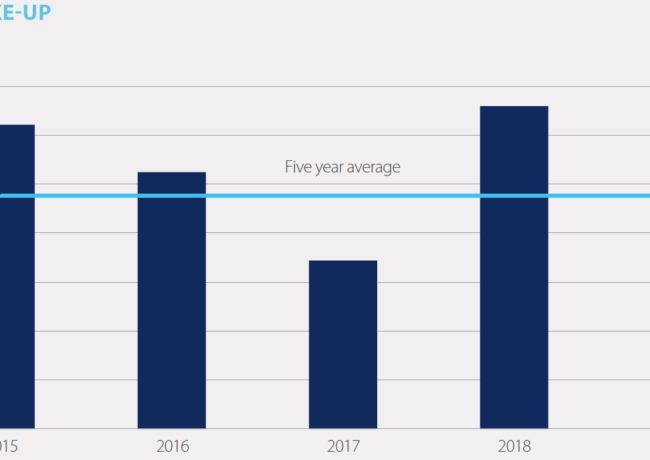

Political uncertainty dragged down the market for large warehouses in the region last year, resulting in a total take-up equivalent to half the five-year average.

Avison Young’s annual ‘Big Box Bulletin’ round-up of the market found “subdued” market in the first of the year held back the annual statistics.

Mike Rooney, principal in the Manchester office, said: “The North West reported 909,000 sq ft of take-up for the second half of 2019, which is a marked improvement from the low take-up observed in H1. Among the six transactions which occurred in H2, the 238,000 sq ft taken by Boughey Logisitics at 240 Jack Mills Way, Crewe, was the largest and represented the strong demand from the third party logistics sector, followed by Honeywell which acquired 211,000 sq ft at Ellesmere Port.”

Mike Rooney, principal in the Manchester office, said: “The North West reported 909,000 sq ft of take-up for the second half of 2019, which is a marked improvement from the low take-up observed in H1. Among the six transactions which occurred in H2, the 238,000 sq ft taken by Boughey Logisitics at 240 Jack Mills Way, Crewe, was the largest and represented the strong demand from the third party logistics sector, followed by Honeywell which acquired 211,000 sq ft at Ellesmere Port.”

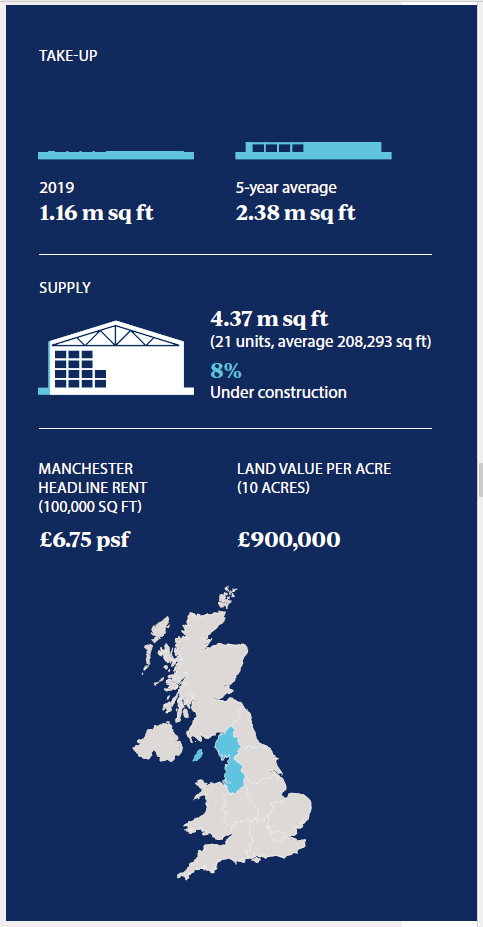

Rooney added: “Due to the subdued H1 activity, total take-up for the North West in 2019 was just 1.2 million from eight deals. This is half of the five year average, with the subdued performance being attributed to the political uncertainty that has characterised the year. Many businesses held off committing to large spaces in 2019, but with the strong finish to the year, we expect this release in pent up demand to prolong into 2020 as the election and Brexit progress have provided some clarity for the future.”

The clear general election result at the end of the year appears to have lifted confidence – the so-called Boris bounce – across all sectors. Rooney urged caution, however: “It remains to be seen how much this [political clarity] is tempered by continuing uncertainty as to what a Brexit deal will look like. Significant requirements additional to those already being sought are likely to come to the market early this year, bringing expectations for further rental growth, with rents currently headlining at £6.75/sq ft.

“The substantial speculative completions which came to the market in 2018 lifted availability to 5.7m sq ft in June last year. However, the limited recent development pipeline meant this figure fell 24% by the end of 2019. This is forecast to fuel greater growth in land values in the North West over the next year particularly as the availability of new stock declines.”

Looking nationally, Avison Young said the forecast 1.1% GDP growth in 2020 is unlikely to change materially, yet a short-term boost to economic activity can be expected, which in turn drives improved sentiment and transactional activity. But with the focus shifting to debate over the UK’s future trading arrangements with the EU, considerable uncertainty still remains.

Deals in the pipeline in the distribution sector indicate a robust level of activity for 2020. The strong growth in e-commerce and requirement for last mile delivery has generally insulated the sector from political and economic headwinds that have affected other sectors. With demand levels remaining robust, the increase in supply coming to the market will likely be absorbed and there remains a strong appetite from developers and funds for speculative development to meet requirements.