The Subplot

The Subplot | Rishi’s shy rabbit, Liverpool Waters, Sunlight

Welcome to The Subplot, your regular slice of commentary on the North West business and property market from Place North West’s analysis editor, David Thame.

THIS WEEK

- Rishi’s shy rabbit: how the Chancellor’s spring statement flirts with a big plan to boost regional investment

- Elevator pitch: your weekly rundown of who and what is going up, and who is heading the other way

THE BIG PRIZE

Rishi Sunak’s multi-billion pound conjuring

The North West property industry wasn’t expecting much from the Chancellor’s spring statement. Could a multi-billion pound regional investment pot be the rabbit he eventually pulls from his hat?

Market watchers were not exactly on tenterhooks ahead of yesterday’s spring statement by Rishi Sunak. “There isn’t expected to be much in the way of direct property intervention,” said JLL on Monday, while noting higher borrowing and energy costs won’t help developers. Faced by cost of living issues, a European war and enormous Covid-related debts, Sunak hasn’t much space for the kind of issues the real estate sector wants to talk about.

Rishi’s hat

Yet behind the understandable shrugging sits a potential multi-hundred billion pound pot for regional levelling-up, one that might (if it works) be genuinely transformational. It could be the rabbit-from-the-hat to end all rabbits. And like so many momentous things, it’s been hiding in plain sight.

John who?

In politics there’s always a story behind the story, and in this case the thread you have to pull to find our rabbit is the official list of the speeches of the city minister, John Glen. Glen has been laying out plans to reform the way the financial sector is regulated, post-Brexit, for the last six months, but his speech to the Association of British Insurers on 22 February took things a stage further. You can find it here.

Loadsamoney

So why does this matter? The meat of the speech was Solvency II, the set of rules that prevent insurers and pension funds from going bust, agreed by the European Union in 2016 and ripe for review since the UK left the EU. If government allows pension funds and insurers to take a more relaxed view of risk, and to keep smaller cash buffers, then it could release billions of pounds for investment. In Glen’s words it “allows the release of meaningful amounts of capital for productive investment.” A consultation by the Prudential Regulation Authority began in July 2021, and proposals were expected next month.

Listen to Walter

Walter Boettcher, the affable Texan who serves as chief economist at Colliers (and still manages to look like he could, if required, wrestle a cow to the floor), has been watching the evolving debate about Solvency II’s replacement. “What we’re seeing is the preparation for changes that could be in the Autumn Budget. If they make the changes now being discussed with the Prudential Regulation Authority and the Bank of England it could free up hundreds of billions for investment in UK large-scale regeneration and infrastructure. This is potentially transformative, potentially staggering.”

We love bunnies

In other words, this is simultaneously the biggest possible post-Brexit dividend, and the largest possible gesture towards levelling up, that the government could hope to make. Politically, it has to be appealing. What well-connected folk like Boettcher were looking for in yesterday’s statement was a sign that the government was firmly behind it because the last budget was positive but not quite the full banana.

The shy rabbit

And they got it, though it was hard to spot. Buried deep in the official text of the Spring Statement (page 39 of 52) were the words “efforts to reform Solvency II and the pensions charge cap to unlock institutional capital into illiquid assets are ongoing”. Which isn’t quite the full-throttled green-for-go some hoped for, but it keeps the pot boiling nicely. A rabbit from the hat goes into the pot, if you like.

Carpe diem

Happily, the Solvency II relaxation coincides with a huge investor appetite for alternative property sectors, mixed-use developments, schemes with residential, leisure, retail and offices in funky combinations. “Suddenly you have the potential for major regeneration projects in the £500m-£1bn range, plus infrastructure opportunity to support it of the same kind of values. And if it is handled right, the risk for investment remains fairly light,” Boettcher tells Subplot. “This could open up a new range of regional public-private partnerships and could be an excellent source for things like social housing,” Boettcher adds.

That rail project?

And what else? Nobody Subplot spoke to uttered the magic words “Northern Powerhouse Rail” but the idea that the Solvency II rethink could unlock it is hanging around. It could also unlock half a dozen other North West mega-schemes.

Wrinkles

There will be bumps ahead. The insurers and pension funds have some serious quibbles about detail. The sheer complexity of these kinds of issues could slow progress to a snail’s pace.

But for now…

John Keyes is chair of the UK public sector business at Cushman & Wakefield. He’s also been watching the Solvency II debate, and is expecting something interesting one day soon. But Keyes’ concern is that while the long-medium-term might get transformed, the short-medium-term is going to be tough for property.

No bunnies

“The reality is that public spending is going to get hit, so investment is going to get squeezed, medium-term. And what growth there is may get sucked into wage inflation. I’d like to see lots of public sector capital projects go ahead, not least in the NHS, but I wonder,” he says.

…and maybe some pain

For the construction sector – fragile at the best of times – the current volatility and inflationary mood is poison. Stuart Stead, property and construction partner at Cowgills, warns: “We’ve already seen high-profile North West contractors go bust, and anyone on fixed-price contracts could find themselves pushed into trouble.” Mark Connor, chief executive of contractor Vermont, adds: “Supply chain costs and energy costs are going up daily, and that’s the biggest challenge for the next 18 months, because if they keep going up things don’t work for me anymore. So we have to engage more with supply chains.”

The immediate short-term issues facing the construction sector need to be taken seriously. And there’s going to be a squeeze on other public sector spending. Even so, if the Solvency II rethink works as intended, there could be a pot of regional gold at the end of the rainbow.

ELEVATOR PITCH

ELEVATOR PITCH

Going up, or going down? This week’s movers

The doors open and whoosh, it’s like a hairdryer in your face – this week’s elevator is full of the heated talk over at Liverpool Waters. Next to step inside, Sunlight House. Going down.

Peel’s optimistic noises

Peel L&P has taken back control of the 278-apartment scheme at Liverpool Waters. Your Housing Group decided last year not to press on with plans for the 31-storey Patagonia Place tower. Peel said it plans to build the scheme and is in talks with a development partner.

Peel is upbeat. The firm is talking about a new 10-acre park at Liverpool Waters, but not talking about snails-pace progress on speculative office space or a long list of other promised outputs.

Haunted offices

Haunted offices

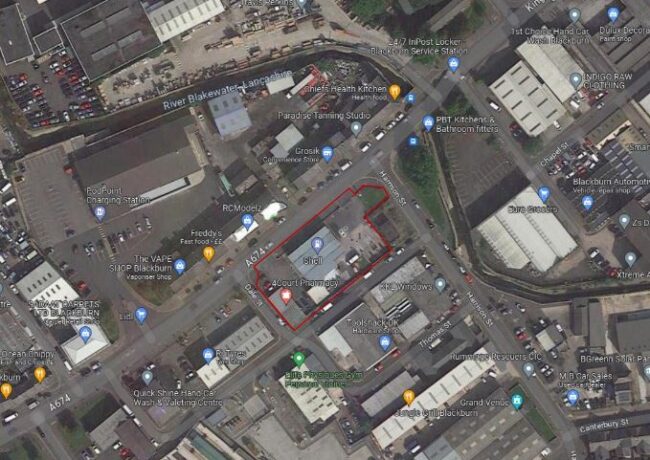

Sunlight House is back on the market for £38m. Abrdn is selling in the wake of a 2018 refurbishment and eight years after the 215,000 sq ft block was bought by Scottish Widows Investment Partners’ Property Trust. The modest uplift in values since the £35m purchase in 2014 from Aviva doesn’t look like it covers the £4m refurbishment cost.

Abrdn will have its own internal impulsions (funds must do what funds must do), and it’s enjoyed an income in the meantime, but the block has yet to recover to the value of its 2005 sale to Warner Estates. Back then it sold for £40m, give or take.

The block is said to be haunted, and it certainly comes with the ghosts of big plans gone wrong. The original idea was to stick a skyscraper on top of the existing plinth, but despite a few attempts that never happened.

Let’s not get silly – a £38m regional office sale is a big deal, and almost anywhere else in the UK the response would be all party-poppers and balloons. But unless the price edges up, or there’s some maths in there that Subplot cannot see, it shows an asset appreciating in value on a very shallow curve. If it’s a wider trend, not a localised phenomenon, this has consequences.

Get in touch with David Thame: david.thame@placenorthwest.co.uk | 01544 262127

The Subplot is brought to you in association with Oppidan Life.