The Subplot

The Subplot | Flex offices, Russian money laundering?

Welcome to The Subplot, your regular slice of commentary on the North West business and property market from Place North West’s analysis editor, David Thame.

THIS WEEK

- Flexy time: Manchester’s flexible workspace sector prepares for a shake-out

- Elevator pitch: who is going up this week, and who is going down

FLEXY TIME

A growing market faces a big shakeout

The Manchester flex workspace boom isn’t over, though mergers/acquisitions and failures could shake it up. Will fast-growers like Huckletree be disruptors, or a flash in the pan?

The flex workspace sector is a mile wide and an inch deep: dozens of small operators with a handful of hubs jostle for position in London and Manchester. Everybody knows many – maybe most – won’t survive. Expanding the offer in Manchester is for many operators a key part of their plan, making them more attractive to potential buyers-out or merger-minded rivals. What kind of shake-out can we expect this year?

Watch them come

First, we can expect lots more new arrivals and expansions. There’s no let-up in appetite to take Manchester floorspace. X+why is on its way, Huckletree plans to expand, Industrious has a ton of money behind it, and keep your eye on Clockwise. Meanwhile, landlords are stepping up their own offers. Grosvenor has launched a very chi-chi flex office brand called 25EP and Landsec plans to expand its Myo brand from two units to six. Neither landlord is yet talking about Manchester openings, but it’s surely on the way.

For example

Huckletree has its eye on Manchester as part of a plan to expand from just 200,000 sq ft today to 1m sq ft by 2025. The firm’s 30,000 sq ft Manchester outpost opened in 2019 and three new hubs are in view: the far side of Piccadilly Station/Portugal Street, Enterprise City around Quay Street, and Ancoats. “The city is explosive, there are so many innovation pockets around the core, we might get to five or six hubs,” says Gabriela Hersham, founder and chief executive at Huckletree, and absolutely nobody’s fool.

Window of opportunity

If expansionist newcomers don’t act now, they may never get the chance. Today landlords don’t mind (much) cutting a management deal with a flex operator thanks to the uncertain chances of them getting a “normal” office letting instead. But as the office market recovers its nerve, management agreements (which landlords would rather avoid) become less appealing, and generous rent-free periods of capital contributions will plunge. “There are opportunities but we have to jump now,” says Hersham.

How to lose money

Maths is also a problem. If you want some funky floorspace in 2024 you may need to pay £35-£40 per sq ft – cripplingly large numbers for flex operators who remember how WeWork screwed this up, and don’t plan to screw it up themselves. “It is really easy to let your operation costs skyrocket and you end up with buildings that never break even, let alone deliver your margins – we look at 20%-25% margins – but it is amazing how quick and easy it is to turn that into zero or a negative. A few members leaving your hub and you’re there,” says Hersham.

Let’s be friends

This is why mergers and acquisitions will be big news in 2022 (and 2023/4). A heavily fragmented market is ripe for consolidation. “We’ve been approached a few times and we’re treading carefully around some others. I had a conversation this morning with a big operator who wants to scoop up some smaller ones, and it could be how we grow quickly too, because lots of smaller players had a really tough time during the pandemic and maybe want out,” says Hersham.

Cash in hand

Huckletree is relatively well resourced with real lines of credit in a game that some landlords fear is mostly smoke and mirrors. Private backers have helped gift the company £13m in equity and debt. But that funding will soon vanish if office rents rise and management deals get tougher.

Voodoo

Landlords, too, are re-thinking. Like Grosvenor and Landsec, plenty reckon they could run their own flex office brand. Others, having watched WeWork accelerate into the stationery cupboard, and noticing that so much of the flex sector depends on generous terms and capital contributions from landlords, are spooked by the whole darn thing.

Shirt in the game

“Nobody feels too comfortable with management agreements, but landlords know few flex operators are prepared to take a lease,” says Patrick Kennedy, regional head of flex workspace Colliers. “Landlords get more comfortable when they know the operator is taking on some risk, and putting some money into the project.” As well they might.

Survivors

Some will go to the wall. Those with the blandest most commodified looks and offers will go first. Specialist sector-based clusters of like-minded users sharing space under a single branded operator – as Huckletree do in London, but not yet in Manchester – might be one way to survive. Fintech and cybersecurity would make good sectors to trial the idea.

And so it begins

This year will see a rash of mergers, acquisitions and collapses among the well-publicised, but still lightweight, minnows of flex office provision. Giants like IWG – famously but perhaps not lovingly described as the Ryanair of flex office space – will continue to siphon off the more profitable business. WeWork (the Virgin Atlantic of flex space?) will play the same game. Manchester landlords trying to distinguish the future star performers from the looming disasters have a hard job ahead of them.

ELEVATOR PITCH

ELEVATOR PITCH

Going up, or going down? This week’s movers

Could the North West property market be a focus for Russian money laundering? New data suggests this is one story taking a ride to the top in 2022.

Manchestergrad

Manchestergrad

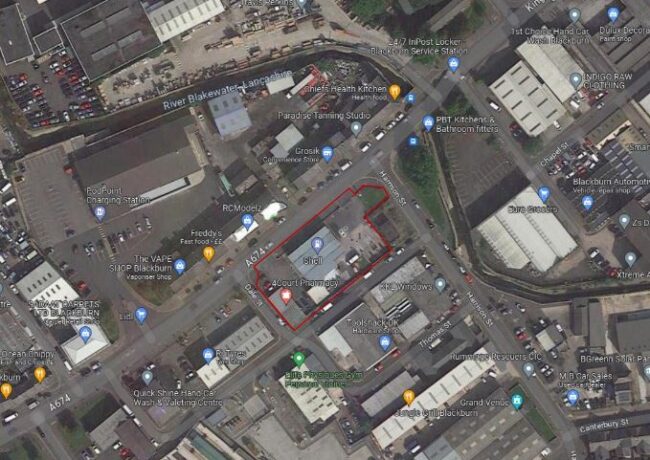

This week’s Russian military threats to Ukraine focused minds on money laundering in the UK property business. London – Londongrad these days – has a long-established reputation for drycleaning oligarchs’ millions through real estate. But how about the North West? The main vehicle of choice is to vest property in companies registered in tax havens. So, what does the February 2020 HM Land Registry overseas company ownership data reveal? The answer: there’s certainly no reason to be smug. Manchestergrad or Moscow on the Mersey could be things, too.

A glance shows all kinds of fascinating nuggets, like the flat on Regent Road, Salford, registered to a company in the British Virgin Islands, whilst a popular Manchester student drinking haunt is owned by a company based in the Cayman Islands. There are houses in Royton registered to owners in Belize and the Cook Islands (where?), and this is tip of the iceberg stuff. Subplot strongly recommends a browse. Of course, it is perfectly legitimate to use a shell company in a tax haven – most do not conceal dirty money, still less Russian oligarchs, and Subplot does not mean to imply otherwise.

The City of Manchester scored 1,622 properties owned by tax haven corporations on the February 2022 list, suggesting the city’s steady appeal (in 2017 it was 1,569, in 2018 it was 1,736). Liverpool is not far behind with 1,473. For comparison, Leeds is lagging behind Manchester at 1,452. Indeed, Greater Manchester is quite the focus: it has 5,282 titles owned by tax haven corporations, compared to just 2,147 in the West Midlands, and 2,714 in West Yorkshire. For the record, Merseyside scores 2,825. Even in Oldham, where the Cook Islanders take such an interest in real estate, no less than 271 properties are owned by tax haven companies.

If Greater Manchester is a focus – and those numbers make it look like it is – the proposed Economic Crime Bill, delayed since 2018 but now looking imminent – might shake things up. A key provision is to reveal the beneficial owners of tax haven companies.

Meanwhile the eight English freeports – including the Liverpool Freeport – also open money laundering opportunities, according to campaigners at Transparency International. “Without proper protections in place, the secrecy and security offered by freeports pose a major money laundering risk,” says Ben Cowdock, investigations lead at Transparency International UK. “Failing to properly monitor and inspect the flow of goods passing through these zones effectively turns them into onshore secrecy havens and magnets for dirty money and illicit assets.” Some modest, probably doomed, attempts are being made to tighten the legislation.

Get in touch with David Thame: david.thame@placenorthwest.co.uk | 01544 262127

The Subplot is brought to you in association with Oppidan Life.

The real asset holders of Liverpool’s long-standing offshores are well known. If we have worries there, they aren’t of a soviet nature thankfully.

Manchester and, to a lesser extent Leeds, where the returns have been higher, realised, and much more connected with growth agenda policies, however strike me as much more likely candidates.

While that might feel concerning, if the outcome is large scale asset seizures, might that not be a good thing?

By Jeff