The Subplot

The Subplot | BTR winter warmer, normality returns

Welcome to The Subplot, your regular slice of commentary on the North West business and property market from Place North West.

THIS WEEK

- Winter warmer: are Londoners driving the North West’s BTR rents up?

- What kind of office: the new normal turns out to be like the old normal

WINTER WARMER

Some like it hot

Rents seems to be rising at ridiculous rates in the North West private rented sector (PRS), driven by students and new arrivals from London. Can the pace be maintained, and will the narrower build-to-rent sector also warm up?

Down on Chapel Street, Salford, the queues are metaphorically forming at Grainger’s 376-unit Filaments BTR scheme (pictured). Viewing figures tripled over the summer, and reservations jumped by 188% compared to the spring. This is what a bounce back looks like, say ardent BTR fans. Fears that the BTR sector would make a sluggish return to post-pandemic life have been banished.

No flats left

The background is an almighty surge in demand for (and collapse in the supply of) PRS accommodation in central Manchester. Over summer rents surged, and in some sub-sectors they went crazy: for instance, according to Urbanbubble a three-bed flat will cost you 27% more to rent this year than it did last year. Supply fell sharply leaving just under 700 rental properties at the start of August, 76% down on August 2020. With overseas students now returning to the North West ready for the start of term, figures will almost certainly become more exaggerated.

Surging rents

The BTR sector is a sub-set of PRS. The trends are the same, but the effect more muted because new supply has entered the market at a steadier (and proportionately slightly higher) rate than PRS. Back-of-the-envelope calculations suggest about 1,400 new BTR units became available this year. Rents for BTR one-beds are now at record levels, with the average rent a shade under £960/month, that’s up 2.7% in the summer quarter. That’s slower growth than the PRS sector overall, which scored about 3.3% in the last quarter, says Urbanbubble.

Busy summer

The striking thing about this growth is it happened all at once, in one crazy burst of activity over the summer. For instance, two-bed BTR apartment rents are up 4.4% over the year. But drill down and you see that they grew by £53/month since last August, with £46 of that growth registered between May and August this year. The numbers look even more bonkers for desirable, lockdown-friendly, three-bed BTR apartments, up 14.5% in just three months. Urbanbubble analyst Ed Howe wonders if this pace of growth is sustainable.

Trend clear, numbers less clear

There’s lots of market uncertainty about numbers: plenty of agents would pitch the rental growth rate lower and slower. That said, there’s definitely something happening. “There’s not enough stock to keep the market fed. Growth, judged over two years, might be 10% but that’s serious growth, and if we can’t let a three-bed flat in 24 hours then we’re doing something wrong,” says Anthony Stankard, managing director of Reside Manchester. So what’s going on? Strong local demand is undoubtedly the backbone of the market, but it is reinforced by three other trends.

Blame Londoners

New arrivals from London are a key part of the explanation, albeit one that’s hard to measure. With their higher rental expectations and London salaries, it is easy for London arrivals to distort pricing. Subplot has heard of schemes scoring up to 30% Londoners, and at that rate, the effect on pricing would be considerable. “We’ve had tenants relocating from London saying they can get twice as much for half the rent they paid in Hoxton,” one agent told Subplot. Generally, though, the proportion of Londoners in the market is not thought to be high.

Or overseas students…

London inward migration is the exception, not the rule says Grainger’s Jon Pitt. “I guess it is single-digit percentages of new arrivals from London, but anecdotes say it is definitely happening. We’re finding a surprising number of tenants in our London properties who want to renew the lease in Manchester properties,” he says. Pitt says overseas students and corporate relocations are the big drivers, with numbers perhaps double what they might normally be.

…especially Chinese students

“I was surprised to see Chinese students return in the numbers they have, given how much online teaching is still going on, but they’re increasingly important,” says Stankard, adding that the Manchester buzz, plus being in the same timezone as your lecturer, is proving to be a significant draw.

Or pent-up demand

Pent-up demand is the explanation, according to Adam Higgins, co-founder of Capital&Centric, whose 533-unit Kampus joint venture with HBD is now letting. “We’re well over half full and we’re renting our homes twice as quickly as we’d projected, even before the pandemic. I think there’s huge pent-up demand as people are desperate to get back to pre-Covid normality, and that means going to bars and restaurants, something that’s on their doorstep at Kampus,” he says.

The other story

Things aren’t so sunny in Liverpool. The PRS market has improved but supply is still fairly generous, with overseas student demand still a shade suppressed, so rental growth hasn’t been amazing. Maybe 2%-4% with the emphasis on the smaller, cheaper bread-and-butter apartments (not the three-beds, as in Manchester). Encouragingly things picked up in August, so maybe the market’s on the turn?

Supply-side shock

Liverpool BTR is struggling to digest around 1,000 new units delivered in the past few months into a market that only had 3,150 units to start with. Nobody in their right mind would have planned to add 30% of new stock to the market this year – it’s an unhappy accident – and it poses a challenge for landlords. City Residential’s Alan Bevan says: “There have to be some concerns about so much stock entering a market that isn’t strong at the higher price points. It’s going to take 12 months to let, and some landlords might do deals, fill the space up, and come back to firm up the rents another day.”

What next?

Not a week goes by without the announcement that an investor or developer plans a £1bn+ UK BTR portfolio – Hammerson, Macquarie, John Lewis, the list goes on. Next week Subplot is due to talk to one of the new megabucks entrants to see how their sums add up.

DRIVING THE WEEK

Back to what kind of office?

Back to what kind of office?

Deloitte’s November 2020 decision to swap 67,000 sq ft of conventional Manchester offices for 35,000 sq ft with WeWork spooked the UK office market. But the mood is changing, as a real live office market comes back to life. All that pandemic chit-chat about the new normal turns out to be more wrong than right.

Last year’s Deloitte deal looked like the first solid sign that professionals might be bailing out of the traditional leasing market. The best part of a year later that fear is receding. Whilst it is still early days, evidence suggests occupiers are shaving their floor space requirements by no more than 10%-20%, and not the 30%-50% many feared.

Numbers look good

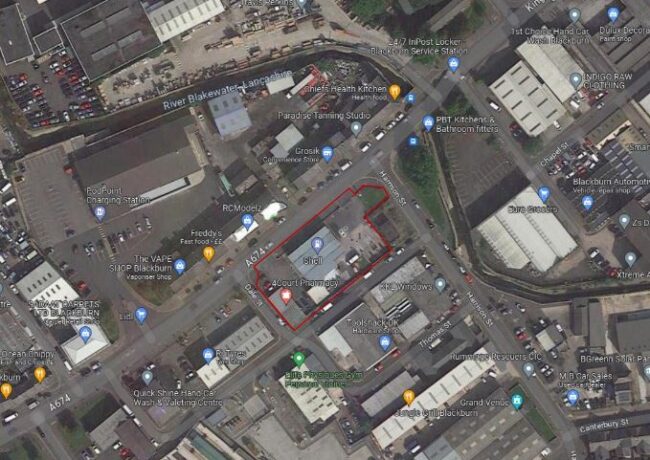

Q3 take-up data is expected to show the Manchester office market returning to something close to the 10-year average. Developers are encouraged: Aegon Asset Management is resubmitting its 135,000 sq ft plans for Speakers House in Deansgate. City planners will decide on HBD’s 100,000 sq ft plans for the Island site, Ridgefield, later this month. According to HBD director Lee Treanor, the scheme reflects new thinking and more optimistic assumptions about floorspace needs.

Conjuring tricks

There’s a bit of smoke-and-mirrors here. Several big Manchester financial sector deals (Deloitte, Grant Thornton, HSBC) showed a significant drop in requirements (30%-40%). But the deals – grabbed at an uncertain time – show these firms are great at protecting their interests in the short-term, not that they have given up on long-term plans for larger floorplates. “They’re trying out hybrid working, which might work for them or might not, and kicking the can down the road on their longer-term needs,” one helpful insider explained to Subplot. Tech and creative firms, generally much clearer about the need for teams to get together, are not cutting floor space in anything like the same opportunistic way.

Hello hybrid

“The mood seems to be that employers need to assume everyone will be in the office for a few days a week, rather than that everyone will be in the office at some point in the week. So they are planning for maximum capacity, not average capacity,” says Treanor. Amenities will change too: at the Island development common areas will be crafted as potential workplaces, the emphasis will be on pleasure and leisure, and the food and beverage offer will be expanded.

No crap offices allowed

Fresh from the reconfiguration of Liverpool’s India Buildings for HMRC, TFT partner David Ashley says developers and landlords risk misjudging this pivotal moment. “Investors and developers making decisions based on regulations, or even to a slightly higher spec than regulations, will therefore not meet occupier needs. Too often these newer concerns are seen as good strategy but have yet to widely inform property investment decisions which unlock value and improve asset resilience,” he says.

Same, only louder

M&G Real Estate, now completing The Lincoln, the 102,000 sq ft office redevelopment of the Brazennose House site between Deansgate and Albert Square, undertaken with CDP, says now is a good time to bring forward amenity-rich, ESG-friendly office space. “Occupiers are increasingly focused on amenities which give staff a compelling reason to come into the office,” M&G asset management director Aaron Pope explains. “Environmental considerations, unsurprisingly, also figure highly within occupier search criteria. We have seen a growing emphasis on ESG in recent times among larger occupiers, who recognise the need for their office space to reflect their commitment to responsible investment principles.”

Fresh air

The same powerful trend has struck CBRE occupational services director Joe Rigby. “Occupiers now have really strict ESG targets, and they also want fresh air. It’s key. That means opening windows, circulation spaces, de-densification and increased lift capacity,” he says. It is still early days, the market has barely three months of real-life activity under its belt. But the tone of lettings so far suggest the old normal and the new normal have more in common than we expected 12 months ago.

The Subplot is brought to you in association with Cratus and Oppidan Life.

Liverpool is a basket case now. The city council have waved though so many poor quality developments, 1 beds, studios, that people with money are far less inclined to look centrally anymore. And that’s before you take into account there has been no effort to stimulate the commercial market, to provide jobs as a pull.

The councillors have hidden behind planning officer recommendations (and how trustworthy are those???) when as seen elsewhere they could actually have said No.

It’s criminal what’s happened here. Time will tell if I’m only speaking metaphorically!!!

By Jeff

Great to see such proven demand for central living in Manchester. The city’s attractions and eating/drinking scene will help it defy the working from home era. I hope Liverpool can recover.

By Manchester Demand

No real surprise that the Manchester Market is so strong, that’s where the investment attracting jobs has been and a lot of big companies have moved there. Liverpool will need long term and significant sustained to even turn a corner

By Anonymous

Liverpool has to do something other than Waterfront and Beatle tours. Must more decades go by before the city council sees this.

By Tufty

Have to say I was surprised that Manchester hasn’t yet reached saturation on apartments never mind office developments with the number of skyscrapers and new business districts that have and are continuing to be built. Impressive performance in light of where we’ve been.

By Simon

Interesting figures on 3 beds. Could we be reaching the point where there is serious demand from larger households to live in the city centre?

By City living