Morgan Sindall posts 29% profit rise

Morgan Sindall, the multi-disciplinary contractor with offices in Manchester, Liverpool, and Whitehaven, has reported increased profits in its construction arm along with an increase in group revenue in its latest half-year results.

For the six months to 30 June 2018, the company reported a revenue of £1.4bn, up from £1.3bn for the same period a year earlier, while group pre-tax profit increased 29% to £29.9m, up from £23.1m.

Its construction arm, which is delivering a series of high-profile projects in the North West, saw its operating margin rise to 1.7%, up from 1.1% a year earlier; revenue dropped by 5% to £662m but operating profit rose by 49% to £11.3m.

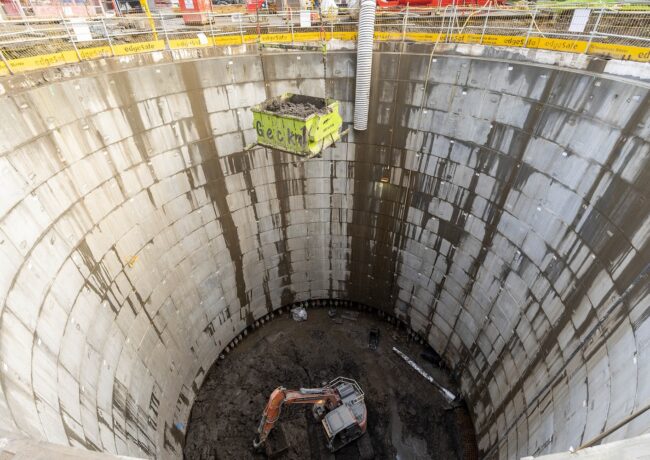

Projects the company’s construction arm is working on in the region include Manchester Metropolitan University’s £45m Mabel Tylecote Building; a multi-storey car park at New Bailey in Salford, pictured above; and Liverpool’s £1bn Paddington Village.

It is also set to deliver the £35m headquarters for the Royal College of Physicians, also in Liverpool, and the first building on the University of Salford’s £800m masterplan.

The Northern division of the group’s construction arm is headed up by Barry Roberts, who was promoted to the role earlier this year. The group added it expected to see “further margin progression” in the second half of the year, achieved through “contract selectivity and operational delivery”.

Fit-out was a stand-out performer in terms of margin and profitability, reporting revenue of £426m, up from £339m, and operating profit of £18.8m, reflecting an operating margin of 4.4%. Around four-fifths of the group’s fit-out business comes out of the London market.

The group reported a £3.6bn order book as of June 30 2018, of which £1.76bn was in construction and infrastructure; £528m through its fit-out arm; £777m through property services; £418m in partnership housing through its Lovell brand; and £115m in urban regeneration.

Muse, the group’s regeneration arm, reported a 3% increase in its development pipeline to £2.13bn, up from £2.06bn a year earlier.

In the first half of the year, Muse generated profits through the sale of a 23.5-acre site in Crewe to Homes England, and also generated development management fees on New Bailey in Salford, and from its development of Time Square in Warrington.

Lovell, the group’s partnership housing arm with offices in Altrincham, saw revenue increase to £231m, up from £200m, although operating profit dropped slightly to £4.6m.

Morgan Sindall group chief executive John Morgan said: “I am pleased to report another strong set of results, which demonstrate the considerable operational and strategic progress made across the group. Fit out and construction & infrastructure have both continued to deliver margin and profit growth, which has been complemented by a good performance from urban regeneration.

“There remain a significant number of opportunities in regeneration and our strong balance sheet and cash position leave us well-placed to invest further in this key strategic area.

“Based upon its current trading patterns and order book visibility, the second half outlook for fit out is very positive and as a result of this, the group is on track to deliver a result for the year which is slightly ahead of its previous expectations.”

The group’s share price opened at 1,458p and at the time of writing stood at 1,500p.