Greater Manchester second in Help to Buy take-up

The city region was behind only London in completed Help to Buy property purchases, with Cheshire also among the top five, according to research based on statistics released by the Ministry for Housing, Communities & Local Government.

Fast Homes – Family Accommodation Support Team – has complied the research from the MHCLG’s Help to Buy equity loan and Help to Buy Newbuy figures, released in August for the period up to 31 March 2018 from the scheme’s launch in 2013.

According to the statistics, 169,102 properties have been bought with an equity loan since the launch of Help to Buy in 2013, with 81% of total purchases made by first-time buyers.

Although Help to Buy has been criticised from various quarters for boosting housebuilders’ profits rather than doing what it purports to, the Government regards it as a success, and it is currently set to run until 2021 – housing minister Kit Malthouse just this week observed that it is a policy that chimes with young voters, a constituency the Tories are desperate to win over.

Balanced against that, homelessness charity Shelter said that it had analysed the increased amount of mortgage lending in correlation to the scheme and concluded that Help to Buy has increased the average home price by £8,250.

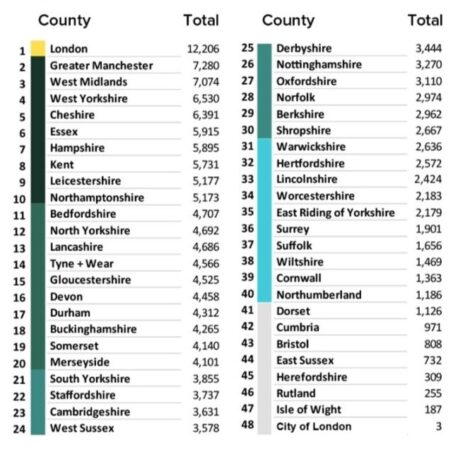

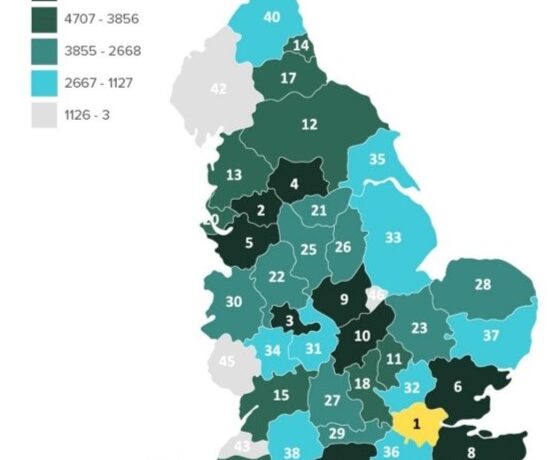

Fast Homes has collated data from the MHCLG’s Help to Buy statistics in order to assess which parts of the country have had the most and least completed Help to Buy equity loan purchases.

Most sales with Help to Buy equity loans, 2013 – March 2018

- London, 12,206 purchases

- Greater Manchester, 7,280

- West Midlands, 7,074

- West Yorkshire, 6,530

- Cheshire, 6,391

No parts of the North West were in the bottom six of Help to Buy take-up.

Fast Homes also analysed the percentage increase each area has displayed since the start of the scheme, a ranking in which Cumbria was placed fifth, with a 766% increase in take-up between the initial period and the most recent year.

Rather exposes how few city centre office to residential conversions and new build flats in Liverpool have been either completed, or completed and sold to people to live in. These would be prime candidates for help to buy, hence the big cities dominating. But even one development in Liverpool that tried has still not had decent take up.

Liverpool has utterly tanked under Anderson’s council, and stat after stat shows it.

By Mike