Commentary

Can placemaking and property investment co-exist?

Investors should make placemaking a top priority when considering their next purchase if they want to achieve the maximum possible rental yield, writes Kirsty Jolley of Alliance Investments.

It’s no secret that the UK property investment market has proven itself to be resilient in the face of a series of economic and social crises in recent years. More than £15.1bn was invested in UK residential property over the course of 2022 according to Knight Frank. By 2028, more than 71% of current investors are expected to increase the size of their portfolios.

Rental yields are growing faster than ever too, but especially in our North West regional cities, which offer lower entry prices than London and the South East. As investors continue to turn their backs on the capital, our region is the most viable alternative for short- and long-term investment success.

But what makes it so successful? One important factor is a focus on placemaking that enhances the characteristics, assets, and potential of our cities to provide a residential experience that is both desirable and unique.

Renting was once seen as a short-term solution to changing circumstances by many, or a way of addressing a temporary gap between owning a home. With this mindset, a rented property never felt like a home, and it was less important to ensure that extra comforts, amenities, and services were provided.

Today, however, renters – particularly the younger demographic – have a completely different attitude to their rental properties. The sector is no longer a temporary fix and is instead a long-term prospect, replacing the idea of home ownership for many.

Whether that is because home ownership is less affordable than in previous generations or that renting offers a desirable level of flexibility, the effect is that more people than ever see renting as a permanent lifestyle.

Higher yields and rental incomes

With one in three millennials expected to rent for their entire lives, rental properties that allow them to achieve their desired lifestyle in a central location close to employment opportunities, leisure options, and cultural sites will command a premium.

Outdoor space is more in demand than ever before for both physical and mental health reasons. Within the home, style and aesthetics are key factors for social media savvy millennial and Gen Z renters keen for the perfect snap. Investors should therefore pay attention to architecture, interior design, and the quality of the furniture packs on offer to maximise their returns.

Another key differentiator is whether a property is pet-friendly or not. Almost four in five renters surveyed by SpareRoom have reported difficulties finding homes that will allow them to keep pets – at a time when being a pet owner is more popular than ever. Allowing people to keep pets will set your property apart on the market and renters are increasingly willing to sign a policy that makes them responsible for any damages caused.

The rental lifestyle shift

What is more, Millennials and Gen Z are willing to pay a higher price to secure rental homes in buildings that put placemaking front and centre. A rental home needs to be more than just a place to sleep – it needs to be a home, a community, and a lifestyle destination all in one. Put simply, it needs to be a real place where people can truly live in the long term.

If a building can provide that and make the most out of its placemaking potential, investors are looking at a recipe for not just higher rental yields now, but the foundation for greater than average growth in the future.

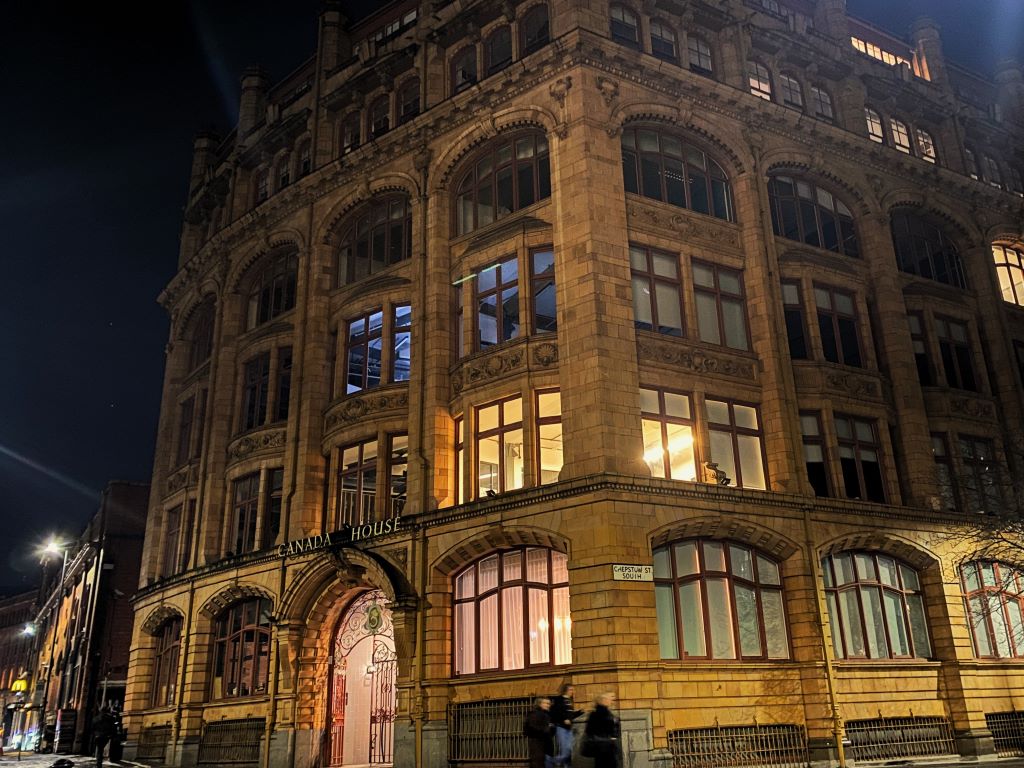

Property developments in the North West are well positioned to make the most of placemaking and provide something unique to renters. We have a wealth of natural assets in our cities and the potential to keep improving the quality of what is on offer to create spaces that are much more than a simple apartment building.

Take Manchester for example. In one city you have:

- Oxygen from Property Alliance Group, which has a gym, swimming pool, spa, and lounge to create a health and wellness hub as an amenity

- Vision from Vision Manchester, which combines luxury living with the heart of the city centre on the doorstep

- Berkeley Square from The Heaton Group, which is centred around a stunning landscaped garden courtyard that combines with the riverfront to create a unique, tranquil home

These residences represent three different types of placemaking that will appeal to a broad range of renters not just now, but for many years to come.

At Alliance Investments, we have had a front-row seat to the power of placemaking in recent years and how it has led to higher returns and lower vacant periods for investors.

It is clear to us that the question is no longer whether placemaking and property investment can co-exist. Placemaking should now be a front and centre concern for any investor. It’s just good business.

- Kirsty Jolley is head of marketing at Alliance Investments