Café Piccolino format ‘must wait two years’

Steven Walker, chief executive of the Individual Restaurant Company, said plans for the group's newest concept had been put on hold due to the economic climate.

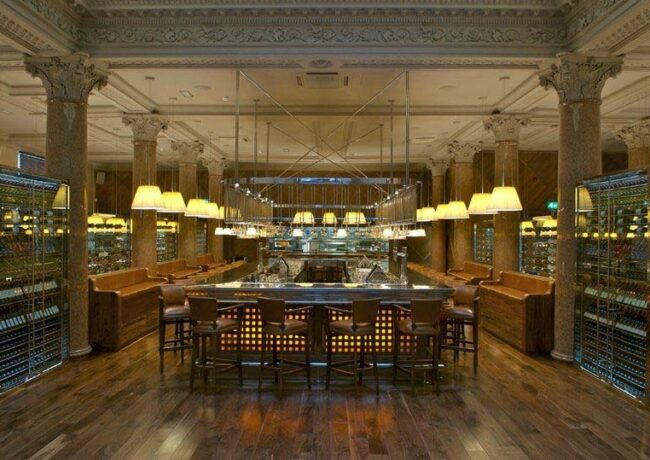

A mid-market offer, under the brand Café Piccolino, was due to be introduced alongside the 31 established Piccolino and Restaurant Bar & Grill formats in the coming year but will now have to wait.

The Manchester-based group recently ceased talks with Grosvenor over opening a Café Piccolino on the leisure terrace of Liverpool One.

"We wanted to stick to our knitting in these more challenging times," Walker explained. "And focus on running the business well. We have a great concept that is more mainstream than our current offers but I certainly think it will be a couple of years before we entertain new concepts."

He added: "It was a fairly easy decision for us at Liverpool One because we haven't traded next to all the mainstream brands in the past and now is not the time for IRC to start innovating."

Walker, speaking as the group announced solid interim results for the six months to July, said the group remained on track with its policy of at least six new openings a year. So far in 2008 four new Piccolino restaurants have opened in Birmingham, York, Hale, Bristol and two restaurants are in build, Piccolino in Clitheroe and Restaurant Bar & Grill in Harrogate. Aberdeen will see a Piccolino open at the end of the year.

Walker declined to name the locations for openings in 2009, saying talks were ongoing with local authority planners and landlords. A Piccolino in West Didsbury and a Restaurant Bar & Grill in Liverpool were among six new site openings during 2007.

Group revenues increased by £4.1m, or 21%, to £24.0m, compared to £19.9m for the same period in 2007.

Restaurant gross profits increased by £400,000 to £4.0m. Margins were down due to "cost pressures on food and beverage supplies". Central costs for the period were £2.1m (2007: £1.8m). After pre-opening and central costs, gross profit was up £400,000 (30%) to £1.7m (2007: £1.3m) in the period.

IRC has net debt of £14.4m with £4.1m available under the group's banking facility. Gearing is 35%. Interest costs in the period of £0.4m (2006: £0.2m) were four times covered by EBITDA.

Shares in IRC were down 1p at 57.5p, valuing the business at £23.11m.