Forrest looks to sell social housing and energy arms

Forrest is understood to be exploring the sale of its social housing and energy businesses with a refinancing deal now looking increasingly unlikely as the company tries to stay afloat.

The Bolton-based contractor was last week forced to deny rumours it was close to appointing administrators, and instead said it was looking to refinance after being hit by a series of problem jobs.

However, it is now understood that a refinancing deal with its banks is looking increasingly unlikely, with the contractor now looking to offload its social housing and energy businesses to generate enough cash to stay afloat.

According to the most recent accounts filed by its parent company, Ensco 996, at Companies House covering the period to 1 March 2017, the “refurbish and respond” social housing arm accounted for nearly 60% of the business’s turnover, while the energy business accounted for around 12%.

While Forrest’s focus has shifted away from social housing towards new-build residential projects, which make up 31% of its revenue, the refurbish and respond business still had a turnover of £47.2m, more than half of the firm’s total of £83m.

Any move to sell off the energy and social housing businesses could provide a welcome boost to the business, which needs to raise cash before next Wednesday’s payroll.

The company is understood to be struggling with three problem jobs: Citu NQ in Manchester’s Northern Quarter for client Salboy, where the contractor is believed to be losing around £2m; and two projects for X1, the Plaza and the Gateway.

Financial director Keith Reid last week admitted the company had made “a series of incorrect pre-construction estimates” on some of its projects, and at Citu NQ, the contractor is now likely to be replaced by Domis, the firm set up by former Forrest chief executive Lee McCarren.

Reid added the company was continuing to work with FRP Advisory to find a way forward for the business: “Our main priority is to find a solution that works best for our customers, employees and suppliers, and we are doing all that we can to secure the long-term future of the business.”

As a result of Forrest’s troubles, clients have now taken steps to safeguard schemes if the contractor does eventually call in administrators, with a decision on the company’s future expected this week.

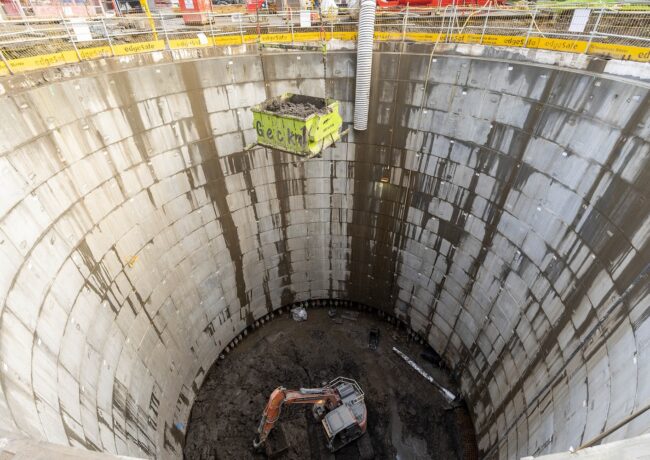

Among these is Elliot Group, for whom Forrest is delivering a contract haul worth £170m and including nearly 1,500 homes and student beds. The contractor is on site at Aura, a £100m project on the former Erskine Industrial Estate featuring 142 homes and more than 1,000 student beds.

Forrest has found itself in difficulty after it last year unearthed a pre-tax loss of £26m, which it said was down to accounting “errors”.

The company had previously reported a pre-tax profit of £3.6m in 2015 but this was revised heavily downwards to a pre-tax loss of £19.2m. This was followed by a £6.8m loss for the year to 29 February 2016.

Following this, the Greater Manchester Combined Authority agreed to step in with a £2m finance package to keep the contractor afloat. The GMCA was a new lender to the group replacing the Royal Bank of Scotland. At the time, Palatine Private Equity remained as majority shareholder, alongside Lloyds Development Capital.

Mark Nicholson, Carillion’s former managing director of building for the North, Midlands, South West, and Scotland, took over as chief executive in September 2017, following the exit of McCarren.

The company’s former finance director, Matthew Farrimond, was also jailed this summer for siphoning off nearly £370,000 from the company during his time in charge.

He was jailed for four years at a Bolton Crown Court hearing in June this year.

I am not sure who would want to buy the energy arm or the social housing arm….do they have any value??? Probably not. It’s also not worth studying the accounts for any Jewels either, as we all know now, they were, and probably are a work of fiction….and with Forrest’s poor name for paying…..I’d let them sink…..not worth throwing good money after bad.

By Anonymous

the contractor is now likely to be replaced by Domis, the firm set up by former Forrest chief executive Lee McCarren.

Maddness

By TBC

they need to pay all the subbies they have left hanging !!!

By Anonymous

Both those arms are the most profitable

By Nonny

Sad to see this happen, so many contractors have gone bust due to rapid expansion ie Sustainability Inc, Globe, Carillion etc I feel for clients and the sub contractors here

By Paul Smith

Accounting errors of £26 million surely the former ceo and md should be accountable and how they can just walk away and start new companies is wrong

By Dubious

Get the sub-contractors paid before this turns into another Carillion

By Anonymous

If i had the money readily available id buy the refurb/energy arm of the business in a heartbeat. Straightforward contracts with good fast turnover. Best outcome all round for staff, contractors and suppliers. New build? No thanks!

By Colin