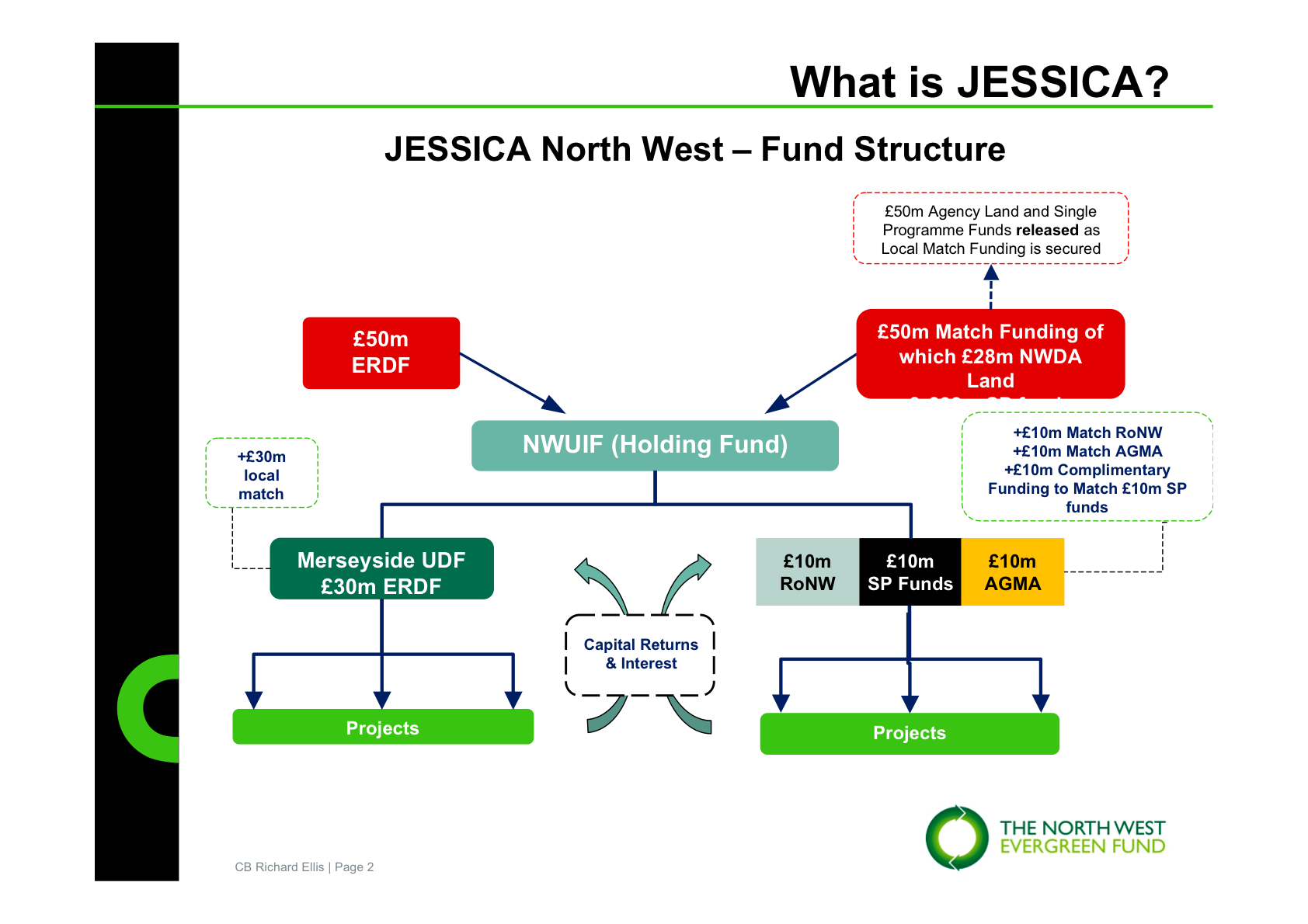

Evergreen fund on course for £500m launch

Local authority pension funds and an undisclosed bank will invest in the forthcoming European-backed Jessica fund for the North West, according to fund manager CB Richard Ellis.

Sarah Whitney, fund manager of Evergreen and director of government and infrastructure at CBRE, outlined the spending allocation progress to 200 delegates at the Lowry hotel in Salford last night for the annual conference of Central Salford, the urban regeneration company.

See slides from CBRE’s Jessica presentation below

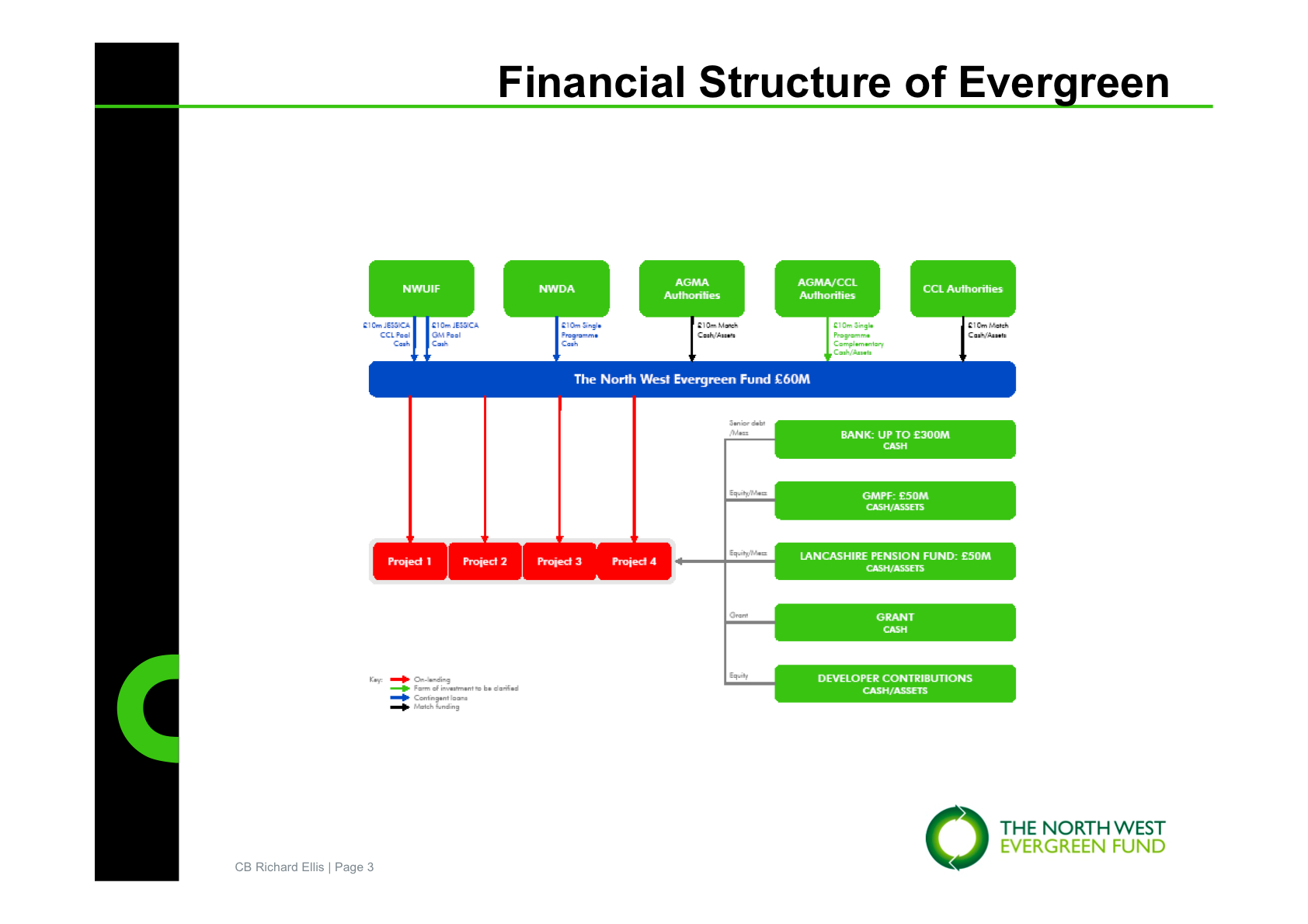

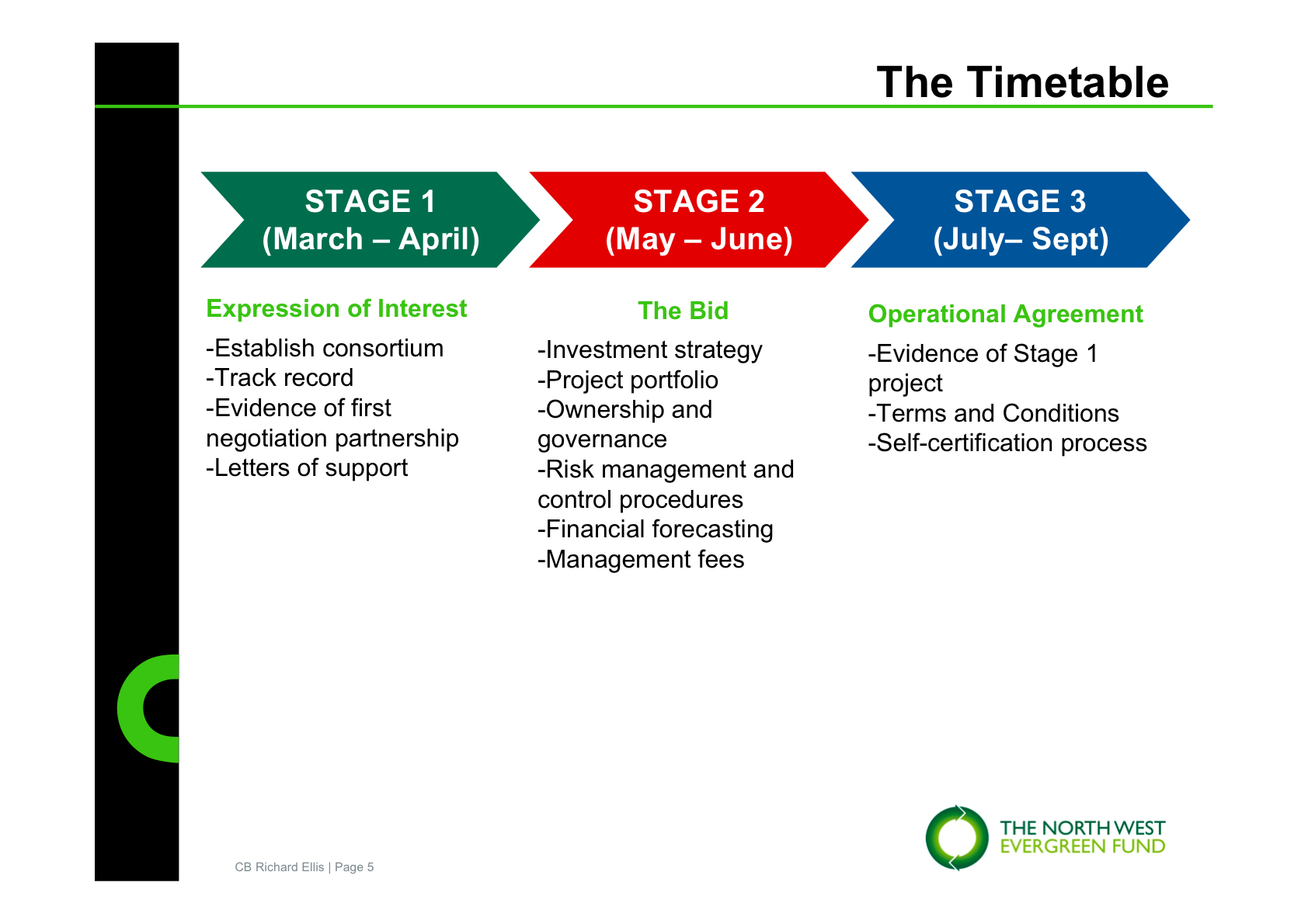

The fund is due to become operational by the end of the year and make its first investments in the first three months of 2011. Investors in the Evergreen fund, which will make loans for commercial property developments in areas of the North West outside Merseyside, so far include:

- European Regional Development Fund, £30m

- Greater Manchester Property Venture Fund, £50m invested as equity rather than debt

- Lancashire Pension Fund, £50m

- An as yet undisclosed bank is close to agreeing a lending facility of between £200m and £300m available on a case-by-case basis

- North West Development Agency, £28m in the form of land and £22m funding from UK Single Programme regeneration budget

Whitney said she hoped Evergreen would be able to secure grants from the European Regional Development Fund to overcome viability gaps on difficult schemes. Developers will also be required to put in cash or debt to make up project costs. The rules of the fund mean it must make a return rather than simply give money in the form of grants as in previous European regimes. The claw-back will begin ten years after the launch.

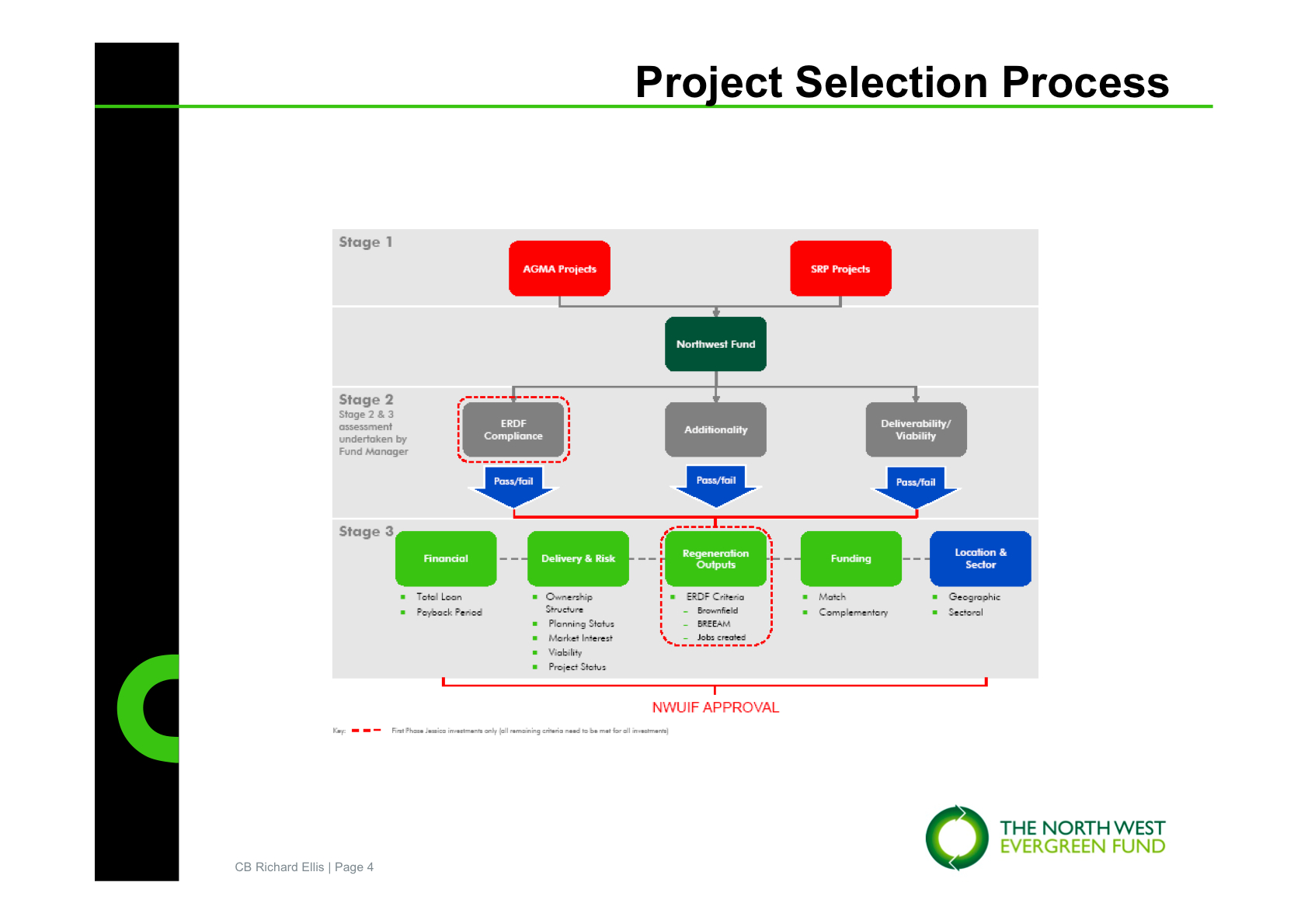

Projects that will be eligible for Jessica support include site remediation and infrastructure work such as roads and utilities for office schemes on brownfield land, university projects, mixed-use town centre schemes although a “high element of residential or retail” would be a problem, Whitney added.

Whitney also said the newly announced tax increment financing powers for local authorities to raise bank debt against future business rates could also be a powerful regeneration tool in the future.

She said the level of consensus and cooperation between the local authorities involved in the North West Evergreen Fund was “unprecedented” in her experience of working with UK and European public private partnerships.

Jessica stands for Joint European Support for Sustainable Investment in City Areas. Several versions are being established around the country, though Evergreen is ahead of most. Evergreen is managed by the Association of Greater Manchester Authorities and its advisor CB Richard Ellis.

The initial plan from the European Investment Bank, guarantor for the funds, was that Jessica would take equity and offer development guarantees for projects. However, Whitney said, state aid competition rules meant that senior and mezzanine debt would be the initial form of finance while Brussels decided if other forms were permissible.

Click to launch images