City Residential: Liverpool boosts build-to-rent opportunities

The agent’s latest report highlights ongoing challenges around the viability of delivering build-to-rent projects in Liverpool but argues the city should remain “extremely confident” in its future pipeline, which is approaching 4,000 BTR apartments.

City Residential had previously flagged a slowdown in fractional sales, and in its latest report covering the second quarter of this year, pointed to the build-to-rent sector as the main beneficiary.

With a number of stalled sites now being resurrected – including Herculaneum Quay, Victoria House, Heap’s Rice Mill, and the Paramount – the city’s pipeline has seen an increase with an increasing appetite for institutionally-backed build-to-rent projects predicted.

Liverpool’s build-to-rent pipeline now stands at 3,958 apartments, with 1,002 under construction and a further 1,645 with planning approval and 650 awaiting planning. Combined, these have a gross development value of £671m.

City Residential managing director Alan Bevan said: “Our focus on the Built to Rent sector this quarter is a logical one given the influence it is likely to have on the rental market in the city over the coming years. Whilst some other UK cities have seen a greater take up of BTR development than Liverpool, the continued strength [and] steady growth of the Liverpool’s rental market is exactly the type of performance that many BTR investors are looking for.”

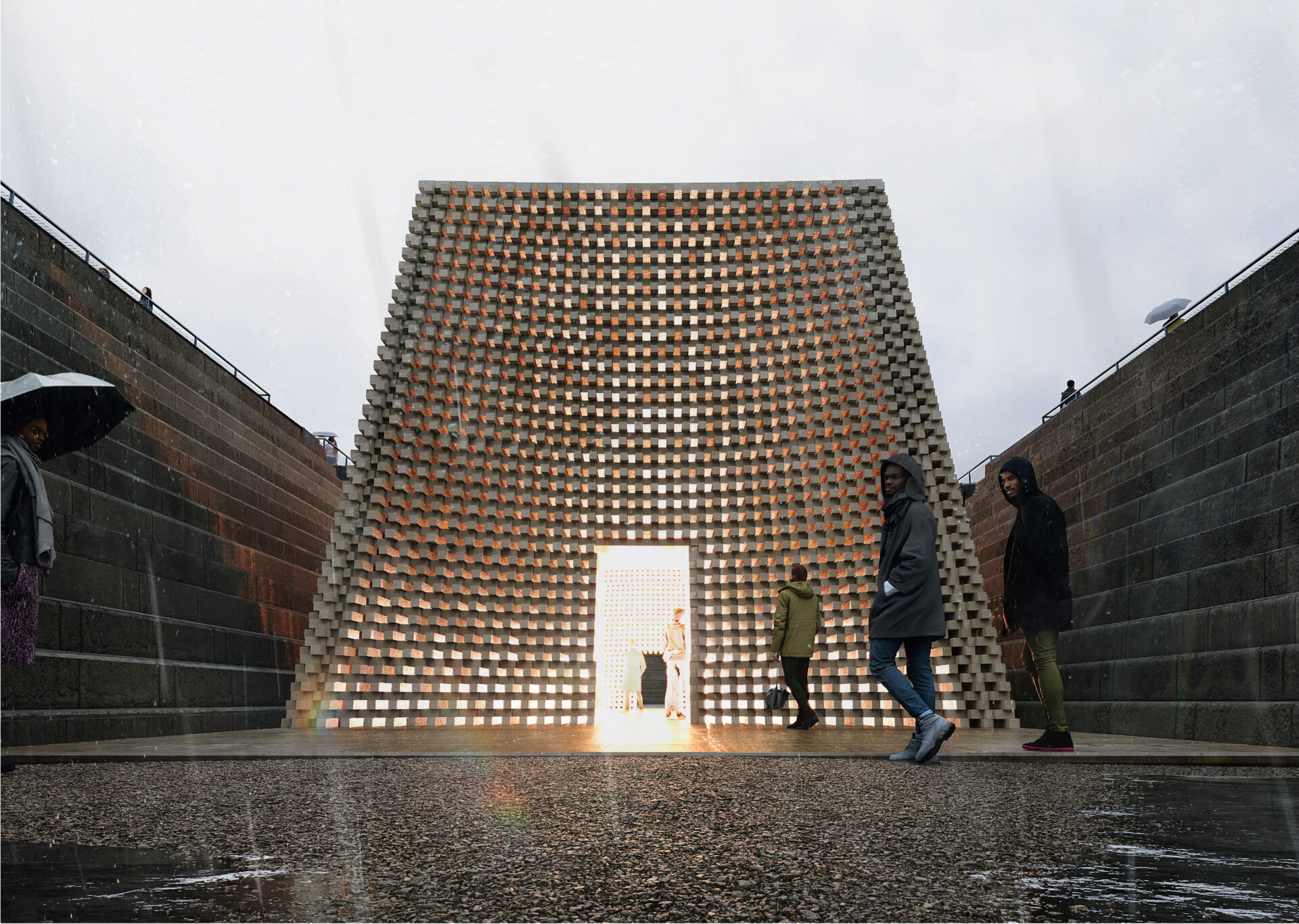

Schemes backed by institutional investors that are coming forward in the city include at Blundell Street, where Brickland is working with backer Heitman to deliver 200 apartments in the Baltic Triangle. ISG is the contractor, and the scheme, pictured above, is on course to complete next summer.

However, Bevan warned that viability of build-to-rent would continue to be an issue: “Although the ongoing strength of the rental market in the city has been pleasing, financial viability for BTR schemes in the city continues to prove challenging.

“With build costs not dissimilar to that of other cities such as Manchester, Leeds, and Birmingham the lower rental prices in Liverpool prove extremely challenging in making potential developments stack up.

However, Bevan added: The positive that comes out of this issue however is that we are highly unlikely not to see a surge in BTR developments in the city which in the medium/long term will result in a more stable, better performing sector that the institutions backing BTR schemes are wanting to deliver [or] invest in.”

All very good, but lets not forget Clayton square, central station and the evil hulk of St John’s are the biggest blights on Liverpool right now.

We need a master plan far bigger bigger than Liverpool one.

By Hissy McPrissy