Empty properties costing North West LAs millions in lost business rates

Empty businesses cost UK taxpayers £1bn a year, with the North West being one of the worst affected regions, according to new research out today.

The data is once again prompting calls for urgent reform of the system as some councils lose out on millions of pounds of potential business rates income through the tax relief that’s currently available on empty properties.

At the moment Councils keep around 50% of business rates in their area but this is to rise to 75%, as from 2021, through a revised scheme that sees LA’s taking on more of the rewards of attracting businesses into their areas – as well as the risks of a decline.

However, in a slump, landlords of vacated properties don’t have to pay businesses rates for three months. Currently business rates generate some £25bn a year for local government to spend so any promised Government overhaul or review could threaten that vital income stream. That has to be balanced against the pain businesses feel in paying business rates they believe don’t reflect either a true value of their premises or take into account changes in trading or circumstances.

Elsewhere, the collapse of larger businesses can significantly reduce local authorities’ income through empty premises relief. The collapse of the SSI steelworks in Redcar and Cleveland in 2015, for instance, led to a loss in business rates of around £10m.

Rules around business rates are different in Scotland and Wales but empty premises cost an estimated £26m in Wales, say the BBC. North of the border, up to one in 10 business premises receive empty premises relief, which totals £82m across Scotland.

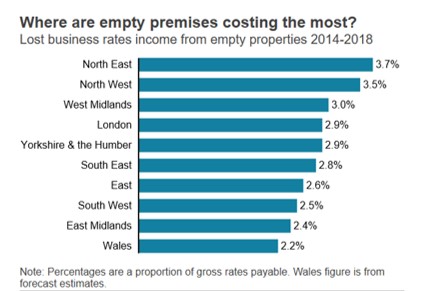

Looking at the chart below, the North West lost around 3.5% of business rate income Percentage (%) between 2014-2018, beaten only regionally by the North East at 3.7%.

Selected industry experts bring you insight and expert advice, across a range of sectors.

Subscribe for free to receive our fortnightly round-up of property tips and expertise

Selected industry experts bring you insight and expert advice, across a range of sectors.

Subscribe for free to receive our fortnightly round-up of property tips and expertise