Companies ‘ready to invest’ in property again

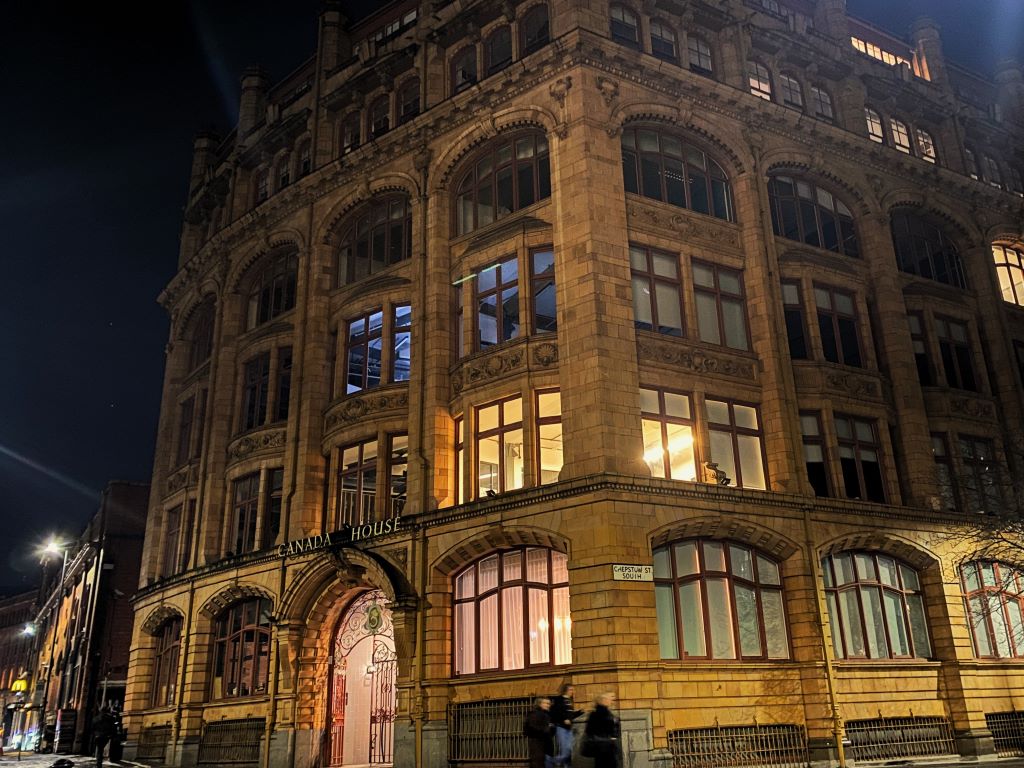

More than 100 people from across the property sector gathered at One St Peter's Square in central Manchester for the latest Invest NW event organised by Place North West.

More than 100 people from across the property sector gathered at One St Peter's Square in central Manchester for the latest Invest NW event organised by Place North West.

Discussion at the event, sponsored by Irwin Mitchell, Lloyds Bank, GVA and One St Peter's Square, covered the current bank lending picture, demand for investment stock in and around Manchester, new forms of development finance and public intervention models.

Trevor Williams, chief economist at Lloyds Bank, led with an overview of the UK's position in the current international economic climate. He described the US as an "unqualified success story" and tipped it for further acceleration in the second half of the year. In less positive news, Williams warned that Europe could experience another recession, or at least a "very weak rebound", while the rapid growth of the emerging BRIC economies – Brazil, Russia, India, China – was likely to slow unless they considered structural reforms.

At home, while Williams touched on the future impact of austerity cuts with only a third implemented so far, he highlighted the "huge amount of liquidity" currently being enjoyed by central banks, with $10 trillion cumulatively across the globe. This, Williams said, had led to "money chasing prime sites everywhere", with risk appetite back to pre-crisis levels.

In the UK, with the sixth consecutive quarter of recovery, companies are running positive balance sheets and have saved through the downturn so are now "ready to invest", according to Williams. While the buoyancy of the housing market is related to pricing rather than supply, consumer confidence is up and saving rates are declining, leading to more spending. Williams described the recovery as "vigorous", but a long time in the making, and predicted steady growth for the next year driven by a flexible labour market and supportive monetary policies.

Finding fair value

According to Michael King, senior director in valuations at GVA, all-property capital values are still 29% below 2007 peak, but are 26% above the 2009 low. In the North West, institutions are back in the investment market. King highlighted recent deals, such as NFU Mutual's acquisition of Chancery Place at a 5.05% yield earlier this year, as a sign that strong values had returned. However, he predicted that with the development pipeline looking to bring more property to the market, office rental growth would level out.

King said that development activity had fallen more dramatically in the last recession than the previous two, leading to a gap between prime and secondary property yields that had widened significantly to 562 base points in June. While investment in Manchester is led by "value for money", King highlighted the lack of available quality office stock to satisfy demand. The industrial market was still lagging behind the UK average, while the retail sector had also fared worse than in other regions.

The presenters were joined on the panel by Patrick Duffy, real estate partner at Irwin Mitchell, Angela Fielding, senior projects director at developer Argent, and Sean Davies, head of finance at Manchester City Council.

One St Peter's Square

The event took place at the newly completed One St Peter's Square landmark office development in central Manchester, developed by a joint venture between Argent and the Greater Manchester Property Venture Fund.

Fielding said: "Argent was appointed back in 2008 after a competitive process, and were selected on our experience. Planning permission was granted in 2009, we achieved the prelet KPMG agreement in November 2011, and had the first spade in the ground by May 2012.

"In my view One St Peter's Square is the best building Argent has ever developed in Manchester and possibly the best in our portfolio nationally. We are very confident that we have the first-mover advantage now, and One St Peter's Square is the perfect place to secure some of that demand that we're seeing around the market at the moment."

With the 273,000 sq ft building 22% let, Argent is still actively seeking occupiers to take space alongside KPMG. On the subject of leases, Fielding said: "There will hopefully be a series of announcements over the coming months."

The letting agents on One St Peter's Square are GVA and Savills.

Rating game

Questions from the floor touched on the benefit of being in the European Union for investment, the overheating London market, bank lending and investment in the region outside of Manchester.

On interest rates, Lloyds Bank economist Williams said that he expected a move but stressed that it was very difficult to predict timings. Based on trends in the economy expected in the market early next year rates could be raised by a quarter of a point in February said Williams, "if conditions warrant it".

Asked about public sector initiatives, Manchester City Council's Davies gave an overview of the Evergreen and Growing Places funds. "The Evergreen fund has been very successful, as has Growing Places. There's a new round of ERDF money working its way through the system, and we'll be looking to establish an Evergreen 2 fund at the start of next year, pending EU sign off. In projects, we tend to look for the most viable outline business case, we care about job creation, and the GVA impact story to go with that scheme."

Duffy agreed with King in terms of the return of property funds to the investment scene. He said: "We have seen an influx of property funds back into the market over the past six months, while in the past 18 months, a lot of the acquisitions have been from individuals in the Far East and New York investors. Manchester is seen as a viable alternative to London, particularly compared to areas such as East London and Shoreditch which investors are now getting priced out of."

Speaking about the Invest NW event, Anita Weightman, partner and head of real estate at Irwin Mitchell in Manchester, said: "This event followed on from the inaugural Invest NW earlier this year and again it provided a unique opportunity within a unique setting for the industry to come together, network and discuss some of the key issues that are affecting the sector. Both our real estate and banking teams were keen to support the event and we hope attendees found the session valuable."

See gallery below

Click here to view and download Michael King's presentation

Trevor Williams' presentation was not made available outside the event

- The Invest NW panel

- Invest NW attendees

- King, Williams and Place North West editor Paul Unger

- Angela Fielding with Patrick Duffy and Mike King

- Trevor Williams of Lloyds

- Williams of Lloyds Bank

- Mike King of GVA

- Trevor Williams and Mike King

- The Invest NW panel, from left: Patrick Duffy, Sean Davies, Mike King, Angela Fielding and Trevor Williams

- Mike King and Angela Fielding

- Sean Davies with Mike King

- Patrick Duffy and Sean Davies

- Patrick Duffy and Sean Davies

- Angela Fielding of Argent with Trevor Williams of Lloyds

- Architectural model of One St Peters Square