Henry Boot JV with Capital & Centric wins Aytoun Street

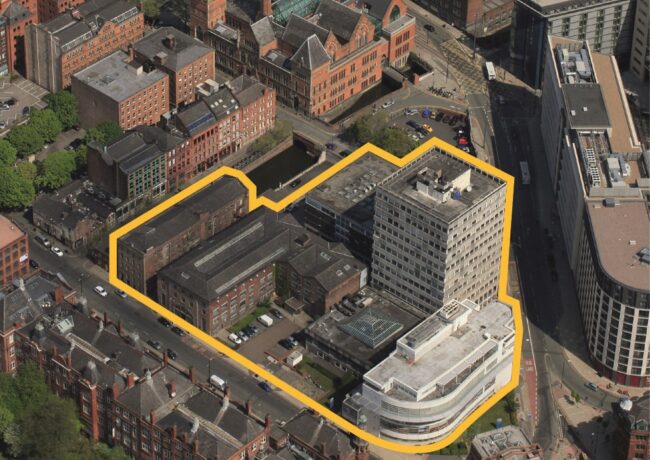

A joint venture between Capital & Centric and Henry Boot has been selected as preferred purchaser of Manchester Metropolitan University's Aytoun Street campus in the city centre.

The scheme will comprise 450,000 sq ft with a mix of residential, leisure and hotel uses. The current buildings on the 2.3-acre site total 250,000 sq ft.

The two Victorian listed buildings, Minto & Turner and Minshull House, will be retained and used for a residential and restaurant offering. The current library building is set to be converted into offices.

The 1960s tower building will be used to house a hotel and apartments, while a linked amenity building next door will be demolished and the plot used for a new residential development. The former lecture building will be demolished to make way for a public realm space.

In total the scheme could deliver up to 500 new homes across the site.

The Aytoun Street site was home to the MMU business school until 2012 but is now largely vacant. MMU's business school moved to a new £75m building at the All Saints campus off Oxford Road.

The shortlist of contenders bidding for the site included CTP, Bruntwood, Ask Developments, and Ikea's property investment arm LandProp.

The winning JV is understood to be lining up equity investment from a group of five Premier League footballers.

John Cunningham, director of finance at Manchester Metropolitan University, said: "We were impressed by the approach to the development of the site taken by Henry Boot Capital & Centric and are confident that they will show the necessary application and persistence to work through the various challenges necessary to undertake a successful redevelopment of the site. The final scheme will make a positive contribution to this part of the Manchester city centre."

DTZ is advising MMU.

Looking forward to this taking shape, been empty for ages, needed sorting out.

By HighyLikely