Place10: A transformational decade for North West logistics

As part of the Place10 series reflecting on the past decade, Jason Print, partner at Gerald Eve, reviews the evolution of the North West logistics market and its adaptation to the internet retail shift.

As part of the Place10 series reflecting on the past decade, Jason Print, partner at Gerald Eve, reviews the evolution of the North West logistics market and its adaptation to the internet retail shift.

We are all buying more goods online. The proportion of internet retail sales as a percentage of all retail sales has grown from 3.1% in Q2 2007 to 15.3% in Q2 2017. Such a growth rate has had a dramatic effect on the supply chains and distribution networks of retailers and consequently, we have seen a dramatic change in the volume and type of requirements for logistics property.

Logistics property is no longer an after-thought for retailers – it is a critical part of the whole operation.

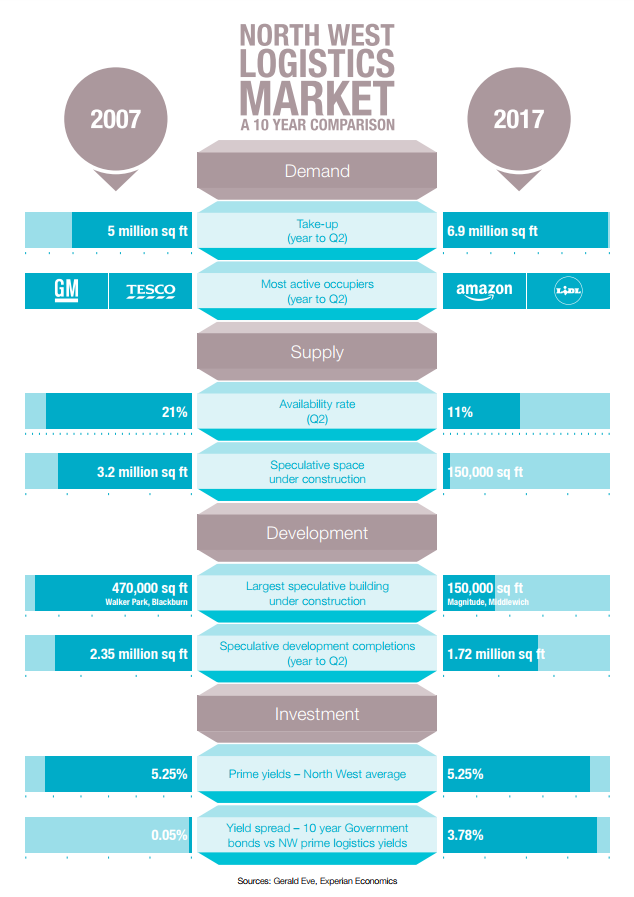

The infographic below illustrates the extent to which the occupier base and the supply situation have changed over the course of the last 10 years.

A comparison of the two single most active occupiers now and 10 years’ ago highlights the ongoing shift from traditional supermarkets to internet and discount retailers. Such a shift has driven demand to levels higher than the previous peak, and take-up for the year to Q2 2017 is 39% above the levels achieved during the same period in 2007.

This comparison also highlights how developers have been more judicious in the developments they have started – with the largest building currently under construction 320,000 sq ft smaller than the same period ten years ago. Whilst we have seen developers respond with speculative developments, this has been a targeted and measured response and we have not to date seen the same volume of space delivered as we saw 10 years ago.

Despite the fact that prime yields have now returned to the levels being achieved a decade ago, the yield spread between logistics and 10-year government bonds is now much wider, making logistics more attractive to investors. As one of the asset classes which is expected to outperform the broader market, there is a significant weight of money targeted at the sector, although when compared to a decade earlier, there is now an acute shortage of investible stock.

The outlook over the next 10 years for the North West logistics market could be equally as transformational as the last. As demand from internet retailers continues to grow and adapt to changing consumer behaviour, we are likely to see the logistics network become an increasingly important part of the operation.

Occupiers and, in turn, developers, will have to continue to be innovative in how they cope with the increased use of technology and automation within logistics properties.

We are likely to see the provision of power become an increasingly important issue and developers are already looking at the concepts of underground and multi-storey warehouses as ways of counteracting the loss of employment land to higher value uses. This loss could be one of the defining features of the next 10 years – as more land is allocated for residential use, sometimes at the expense of employment uses, the supply of industrial land becomes more restricted.

However, ironically, an increase in residential use also brings with it an increased demand for logistics given the need to deliver goods to a greater number of consumers. Protecting the supply of industrial land and factoring in a heightened demand for logistics space in areas of expected population growth will be crucial.

- To take part in the Place10 series reflecting on the decade since Place North West was first published in August 2007, send your stories and memories to news@placenorthwest.co.uk headed ‘10’

Very good Jason. You should try returning my calls sometime.

By Imran Younus.