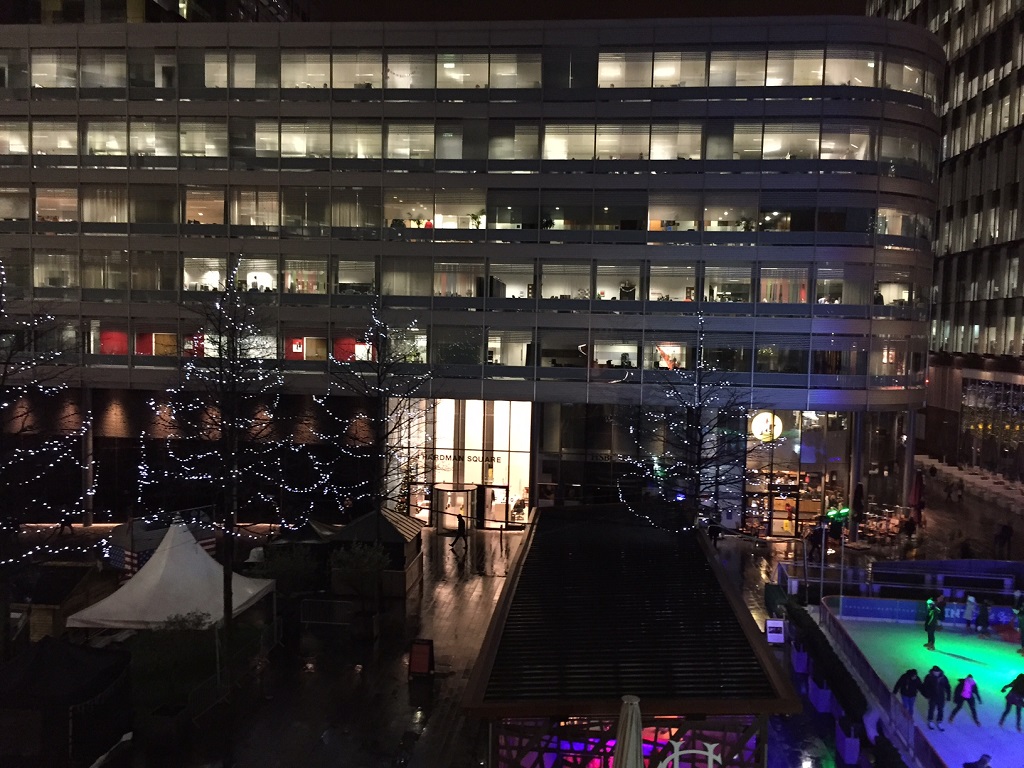

Orchard Street buys 4 Hardman Square for £31m

Orchard Street Investment Management has completed the acquisition at a yield of 4.95% of 4 Hardman Square in Manchester's Spinningfields on behalf of wealth manager St James's Place from a GLL Real Estate Partners fund.

The building is occupied by Grant Thornton and HSBC and contains 54,300 sq ft of office space on five floors above double-height ground floor retail and leisure.

The property is fully let with an average unexpired lease length of seven years. Completed in December 2006, the property was designed by Foster & Partners, along with 3 Hardman Square, and holds a 'very good' BREEAM rating.

Tom Chadwick, investment transactions manager at Orchard Street, said: "This landmark asset holds a prime position in the centre of Manchester's most sought-after office location. Underpinned by growing occupational demand as an increasing number of businesses are attracted to the North West's capital, we believe that 4 Hardman Square presents an exciting opportunity for future income growth."

Tom Chadwick, investment transactions manager at Orchard Street, said: "This landmark asset holds a prime position in the centre of Manchester's most sought-after office location. Underpinned by growing occupational demand as an increasing number of businesses are attracted to the North West's capital, we believe that 4 Hardman Square presents an exciting opportunity for future income growth."

Will Kennon, director at CBRE, representing vendor GLL, said: "4 Hardman Square represents a rare opportunity to acquire a genuine trophy asset in Spinningfields, the leading international business district in Manchester. A direct and targeted marketing strategy helped achieve strong investor interest and we are delighted to have represented our clients, GLL, and deliver this successful outcome."

Orchard Street was advised by DTZ. GLL was advised by CBRE and Norton Rose Fulbright.

In May 2013, Orchard Street acquired the 50,800 sq ft Bauhaus office building in nearby Quay Street.

In August 2014, NFU Mutual bought 106,000 sq ft Chancery Place in Manchester city centre for £57m reflecting a 5.05% yield.