Legacie receives £500m boost from RWinvest

The Liverpool-based developer will continue to work with the international investment firm on a number of projects across the city over the next four years.

Legacie and RWinvest have previously worked together on a variety of big residential and commercial projects in region.

The money will be invested in a number of developments including One Park Lane, and see the redevelopment of the historic Heap’s Mill Rice Factory into one and two-bed luxury apartments.

Legacie is also pushing on with plans to build a 656-unit apartment development known as The Gateway on Leeds Street, which will include a mix of apartments will include an onsite café and spa.

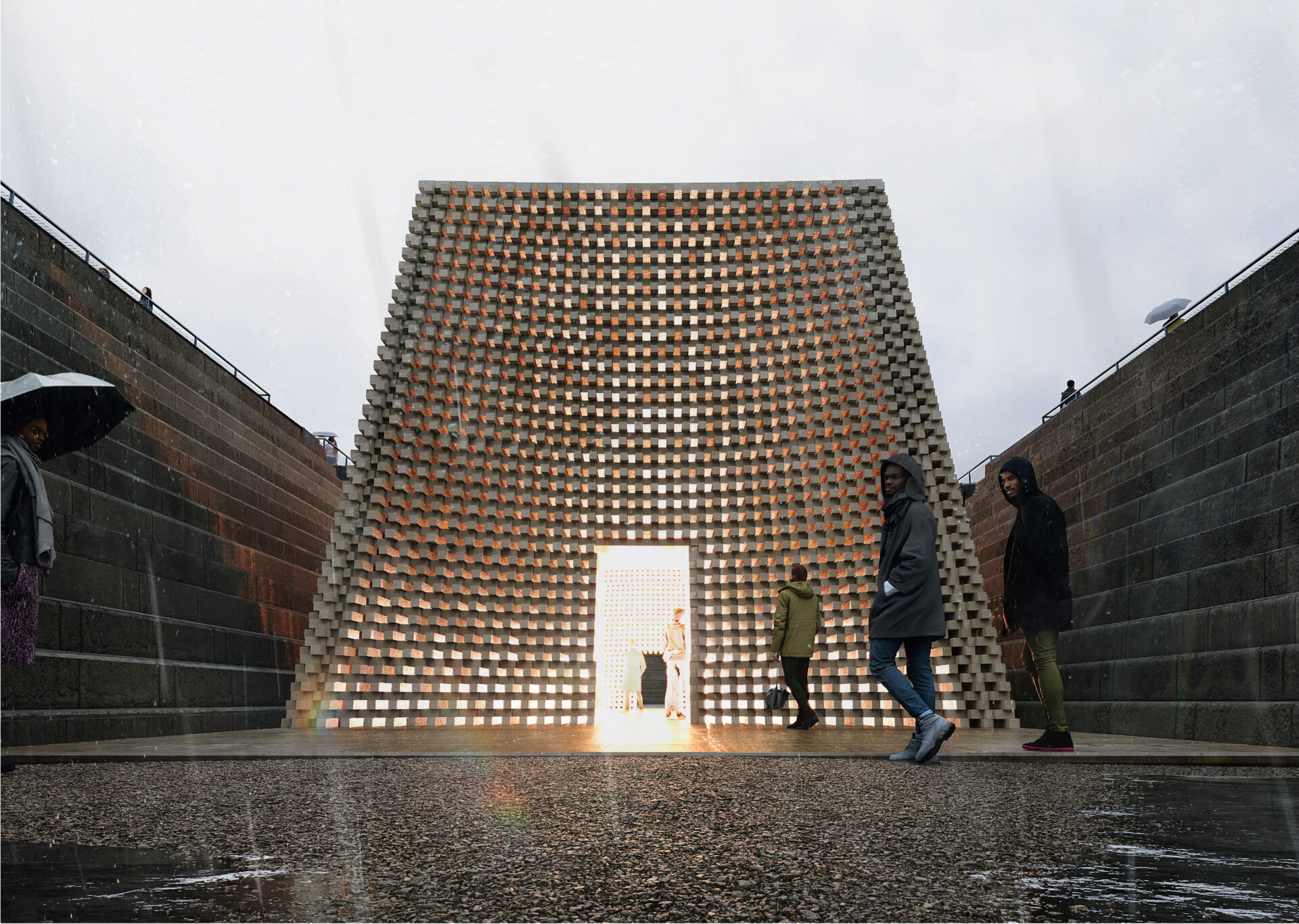

The developer currently has seven live sites in the city following on from the first phase completion of its flagship Parliament Square in the Baltic Triangle.

RWinvest promotes Legacie’s developments to international investors, which they say are attracting first-time buyers from outside the city into the area, due to affordability compared with other regions.

John Morley, chief executive of Legacie, said: “We have a huge development pipeline coming forward and are proud to be investing so significantly in the city.

“If you look at our most flagship schemes in Liverpool, they are being delivered in areas that, in many cases, stood as wasteland for decades.

“Now, we are delivering quality homes and building communities that are driving regeneration and economic prosperity. One Park Lane and The Gateway projects are particularly good examples of that.”

Michael Gledhill, director of RWinvest, added: “Our partnership with Legacie has meant that we have been able to match international investors with exciting residential projects across Liverpool.

“We are working at pace on some pretty groundbreaking development sites, with Heap’s Rice Mill in particular likely to become the economic engine in terms of driving further growth of the thriving Baltic Triangle.

“Our developments have not only attracted overseas buyers but there has been an increase in buyers at home who all want to tap into what the city has to offer. It feels very positive.

“We are all invested in growing the city and helping it flourish over the next few years.”

More investment for Liverpool, long may it continue.

By Liverpool4Progress

Great news keep the investment coming

By Anonymous

More good news for Liverpool, important historic building preserved . This type of building regeneration ensures the character of the city is retained so it just doesn’t become just an anywhere city . . Seems outside investment starting to come back to Liverpool, perhaps the sensible council is having a positive impact. Some way to go but signs of hope

By George

Legacie doing their best to get the place looking like a proper city again with some impressive projects. John Morley seems to have the vision our planners and councillors lack, and the work being done may make the big developers take note that Liverpool has a future, and that the City and City Region is a place that people want to come and live and work in.

By Anonymous

Sales agent continues to sell investment properties…wow.

By Derek

If I’ve read this correctly, Legacie and RW have aggregated the value of their future sales to private overseas buyers, come up with a figure and badged it as ‘investment.’ Or am I missing something?

By Anonymous

Yet more positive news for Liverpool! Someone pass me the smelling salts!

By Roy

Legacie are doing an incredible job. 👏

By Anonymous