Developer looks to complete Fox Street

Developer SGL1 is seeking to finish off the part-built final block of an apartment complex north of Liverpool city centre, originally developed by Primesite.

Plans have now been submitted by advisor Zerum to establish a fresh consent for 138 flats and 2,065 sq ft of commercial space at block D.

According to documents now filed with Liverpool City Council, SGL1 – headed up by Fortis Group directors Darren McClellan and Keiran Moore – will then seek to gain retrospective planning consent for the completed blocks A, B, C and E – block A being a redevelopment of the former Swainbanks warehouse.

In an updated design and access statement, architect Keith Davidson Partnership said that there has been a shift in thinking for block D sine 2015 when Primesite was granted planning consent.

Under Primesote’s approved plans, block D was earmarked for 180 apartments, while later plans saw a desire to get 250 apartments in, using studios and cluster-style flats. However, SGL1 now feels this part of the market has been adequately covered in the earlier blocks.

Subsequently, the developer is proposing larger studios and apartments, resulting in a scaled-back 138 apartment scheme.

Block D sits between the Swainbanks building and the listed St Mary of the Angels church. The site as a whole is close to Great Homer Street, adjacent to the City Point student accommodation development delivered by Caro.

The Fox Street project team also includes Eddisons, AA Projects, Soundtesting, Indigo Surveys, CC Geotechnical, ADS Structural, RSK, Altair and FIRE Consultancy.

The background

In 2015, Liverpool City Council granted Primesite permission for five blocks comprising 400 apartments across two separate consents.

However, Primesite had then sought to refresh those consents in a combined planning application, which made some minor changes and removed basement parking.

Work had started under the terms of the original consent when this fresh application went to committee in April 2017. Liverpool City Council’s planning committee resolved to approve the combined plans, but a decision notice was never issued, a state of affairs that has proven problematic given issues that later emerged (detailed below).

As Zerum outlines in its planning statement dated May 2022, “this application seeks to address the outstanding matters and consolidate the work that has already been undertaken on the site”.

As the planning statement further notes, this is “an unusual situation” with Zerum adding that “we have to acknowledge that we now have a situation where that development does not have an appropriate planning permission in place”.

Block D aside, the buildings have been completed and are all occupied to various extents. According to documents filed, there has been constructive dialogue with the city council as the new applications have been progressed.

Block D is the largest individual component of the Fox Street scheme. The Swainbanks building houses 54 apartments, block B – to Swainbanks’ rear – 96, and blocks C and E 30 and 40 homes respectively.

An “unusual situation”

The Primesite vehicle responsible for the original development, Fox Street Village Ltd, went into administration in June 2019, with secured creditor PH Invest owed £1m.

Linmari Construction, which had also been involved in the project, with its name on the site hoardings, was liquidated in May of that year.

By that point, the original sole director of Fox Street Village, Kerry Tomlinson, had resigned, leaving in February 2017.

According to one of various administrator’s reports filed with Companies House by David Rubin & Partners – and later Begbies Traynor following Begbies’ acquisition of the former – the site had been acquired by Fox Street Village for £1.35m in late 2015, funded by off-plan sales.

The administrator’s proposal from August 2019 states that following consent in 2015, work started the following year, and by the end of 2017, 90% of units had been sold, with four of the blocks completed.

That report stated that the Swainbanks building, converted to studio flats, was being used as an aparthotel, with the other blocks mostly let to “students and young professionals with a few owner-occupiers”.

It was also noted that the development had been subject to two separate prohibition orders issued by Liverpool City Council due to safety concerns on Blocks C and E, necessitating remedial works, and that the council had also issued an enforcement notice for the whole scheme, which could have led to demolition were the authorities not satisfied with the quality of the building work.

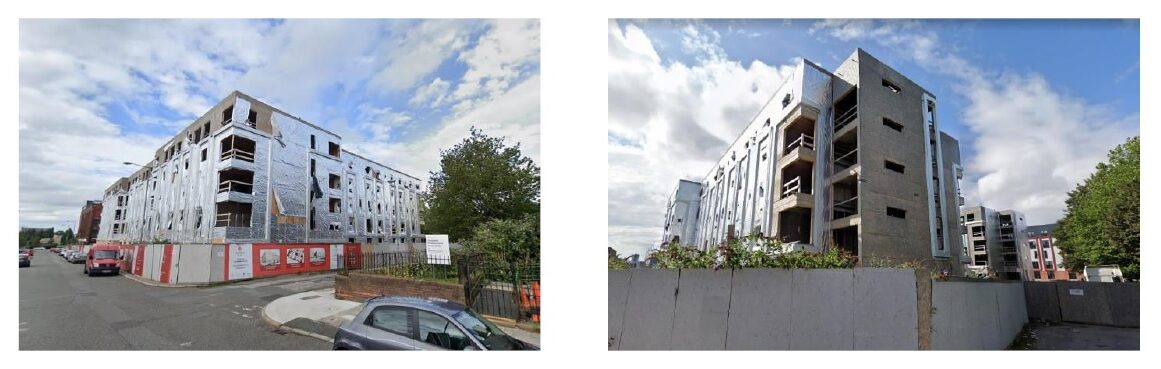

The exterior of Block D was completed before the original developer’s administration. Credit: planning documents

Over the course of the first year of administration, David Rubin & Partners worked with Lambert Smith Hampton and Hill Dickinson in order to try and secure a sale of the scheme that would allow it to be built out and issues resolved. Landwood Group also advised on the sale process.

During the first half of 2020, LSH approached 25 potential buyers for the project, and although a deal with MCR was close – reaching an exclusivity period – it never got over the line.

According to the administrator’s update of summer 2020, SGL1, described as “a company operated by the Fortis Group” was then reengaged, leading to a sale at £1.6m, completed in November 2020.

Since that time, as the developer pulled its plans together, legal and financial wranglings have continued in the background. According to the administrator’s progress report from July 2021, PH Invest was paid £450,000 to part-satisfy its fixed and floating charge.

The administrator has also been taking steps to recover money owed to Fox Street Village, while in November 2021 a creditor and member of the Fox Street Village Investors Association (which had earlier challenged the sale process itself) challenged in court the valuation of the scheme and how sale proceeds were divided, with the court ruling in favour of the administrators.

Those investors with security by way of a buyer’s lien are entitled to a proportionate share of the proceeds of the sale, Begbies Traynor said.

So many half built projects in the city, if this developer can bring this one home then that`s a plus.

By Anonymous

The design of this one is horrendous. I’m amazed at how many of these ugly buildings et the green light to be built. Look at the quality of the beautiful red brick building next to it. This is a disgrace. Isn’t Liverpool capable doing better than this?

By Steve

If’ rather they didn’t even start this if this is the quality of design we can expect.

By Anonymous

Another half thought through cut price design in Liverpool. Not good enough.

By Floyd