Collapsed Pinnacle developer owed investors £12m

Pinnacle Student Developments Liverpool, the firm behind The Quadrant in the city and a sister company to the developer of Manchester’s failed Angelgate project, owed investors nearly £12m at the time of its collapse in January, according to the company’s director Carl Mills.

Pinnacle was behind the 252-apartment student scheme The Quadrant on Shaw Street, and apartments were sold off-plan to individual investors, many of whom were based overseas.

However, construction work ground to a halt on the site following the administration of main contractor PHD1 in April 2016, and the building remains unfinished.

The special purpose vehicle company for the development, set up by Mills who is also a director at a number of other Pinnacle companies, entered administration in late January.

A statement of affairs prepared by Mills and filed with administrators KPMG at Companies House suggests the company owed buyers £11.6m, along with £20,000 owed to trade creditors and £1.9m owed to another Pinnacle company, MVG Holdings.

Mills is the sole director of this company.

The statement of affairs estimates the value of the land at Shaw Street at £1.9m, while the “works undertaken” at the site are valued at £8.5m.

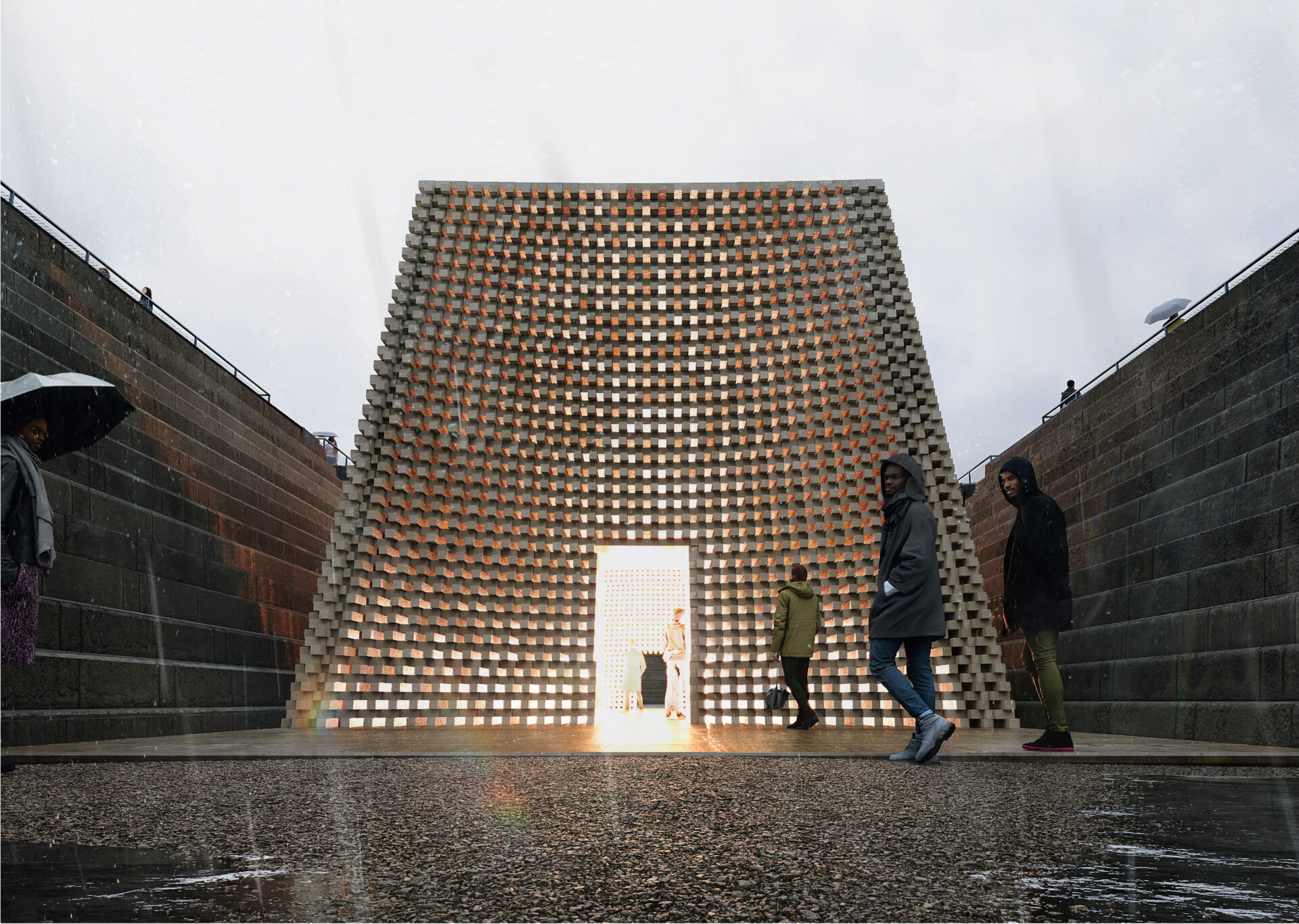

A CGI of how the as-yet-unfinished scheme will look

At the time of the company’s administration, KPMG said: “With work onsite being at a standstill for more than 18 months, and with no development finance options available, the creditors had no alternative but to petition to place the company into administration.

“During the coming days and weeks, we will be exploring the options that are available to maximise the return to the buyers company and other creditors.”

The company is the latest Pinnacle business to collapse owing millions to investors, following the developer behind Manchester’s Angelgate site.

Pinnacle’s SPV for that site, Pinnacle (Angelgate) entered administration in September last year. The £77m development was slated to include 344 apartments over two blocks, but much like The Quadrant, work ground to a halt after the collapse of PHD1.

Following the administration, Mills prepared a statement of affairs which claimed creditors were owed £29.7m.

This included £17.8m owed to 196 creditors who paid a deposit for apartments in the development’s Block A, and £12.8m owed to 148 investors for Block B.

Mills also claimed the land at Dantzic Street had a book value of £7m, which could potentially have risen to £9m.

However, Pinnacle (Angelgate)’s administrators Moore Stephens stated they did not know how Mills had calculated the book value of the development site, or whether the £9m value of the land “was based upon any agent’s valuation”.

Other unsecured creditors, including Goodwin Construction, which was lined up to complete the scheme, have come forward claiming to be owed money by Pinnacle, despite not being listed as a creditor by Mills’ statement of affairs.