Assura posts strong quarter update

The FTSE 250 Warrington-based primary care developer and investor has seen its share price increase over the past quarter, and confirmed to shareholders they would received a promised dividend payment later this month.

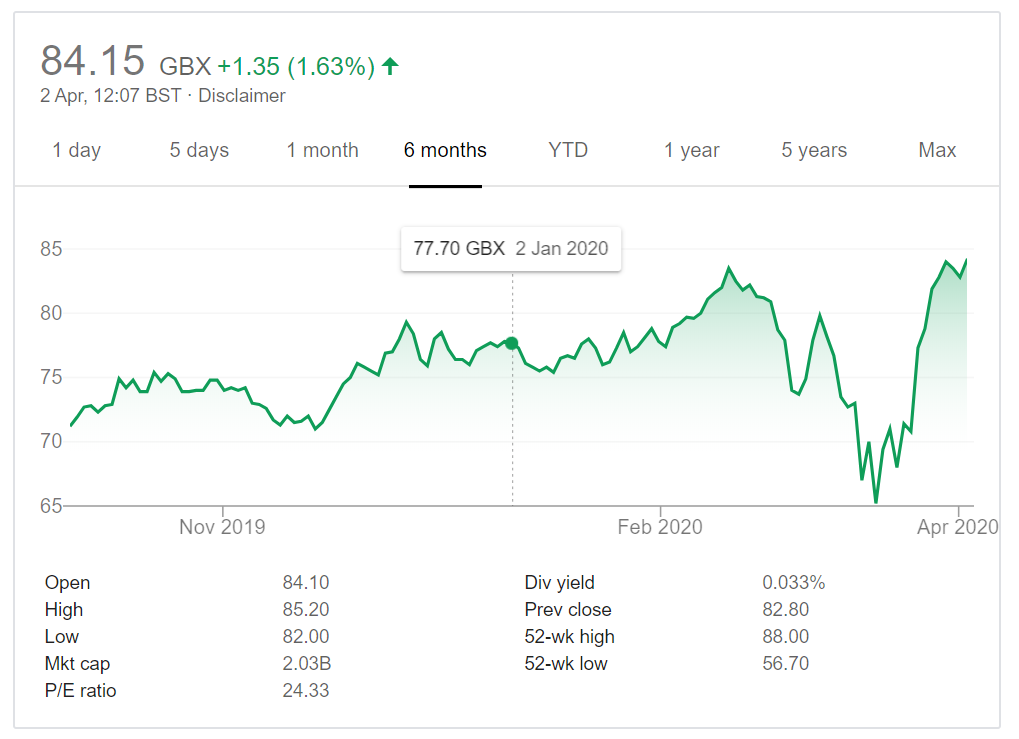

The company is listed on the London Stock Exchange with a capital value of £2bn.

Assura has seen its share price increase steadily over the past year, from 56.8p in April 2019, to 77p at the start of this year, to 83.6p today, its highest price since entering the stock exchange. The value was up 0.8p this morning.

Investment management company BlackRock sold part of its shareholding in Assura in March as the Covid-19 outbreak took hold but the shares have still manage to buck the market.

In a time when many property and construction companies are cancelling dividends in order to preserve funds in the face of the coronavirus crisis, Assura’s statement to the stock market confirmed shareholders would receive their quarterly interim dividend of 0.697p a share on 15 April.

In an update on the fourth quarter of its financial year ending 31 March, Jonathan Murphy, Assura’s chief executive, said: “Assura is working closely with the NHS and our GP partners to make sure we can best support the health service through the Covid-19 crisis.

“We are also assisting occupiers to optimise the use of space in their buildings and offering vacant space to the NHS where we can. We are continuing to follow closely the latest advice of the Government and Public Health England, working with the contractors for our on-site developments.

“Looking at the quarter as a whole, Assura continued to make good operational progress, in particular around our acquisition and development opportunities, as we seek to deliver primary care assets that cater to the needs of the NHS now and for the future.”

While he said Assura’s March quarter rents had been received “in line with normal patterns”, on the development side he predicted “delays to anticipated completion dates for our on-site developments, and start dates of the immediate pipeline”.

Momentum around Assura’s deals pipeline is continuing, with 13 acquisitions completed for a combined £54m in the last quarter, including £41m in March.

Contracts have been exchanged for the disposal of 20 properties totalling £17m, expected to complete in the next few weeks.

Overall, Assura has 576 healthcare properties in its portfolio giving an annual rent of £108m, and 15 developments on site with a cost of £81m. There are £77m of projects due on site in the next year.

Among its schemes, Assura is on site with a £2.1m medical centre at Trafford Housing Trust’s £7m Timperley Library redevelopment, which it will purchase once the wider scheme completes later this year.

The investor owns 56 buildings in the North West valued at £323m on 30 September 2019.

The company’s gross debt stood at £847m with undrawn facilities of £220m.