The Subplot

The Subplot | What the Budget didn’t say about Northern regeneration

Welcome to The Subplot, your regular slice of commentary on the business and property market from across the North of England.

THIS WEEK

- Was the Budget good for the North? The fate of planned A5036 improvements might be a clue

- Elevator pitch: your weekly rundown of who is going up, and who is heading the other way

HE GIVETH AND TAKETH AWAY

A single Liverpool road project might tell you everything

Some Budgets unravel slowly, some quickly. The Achilles Heel of yesterday’s speech by Chancellor Jeremy Hunt could turn out to be infrastructure.

More competition

Investment zones are back again and yes, there’s another competition to determine who gets them. You can read the methodological guidance note which includes a two-stage process linked to metrics such as average GDP per head, extent of local skills, and proportion of labour force in the knowledge industries. There will be one each in Greater Manchester, Liverpool, West Yorkshire, South Yorkshire and the North East and Tees Valley. The property industry will be pleased the zones will be focused on “place led” regeneration.

Small incentives

The Chancellor promised that each zone will get £16m a year in government investment, a sum insufficient to move the dial on regeneration. The policy background is that the Treasury, which hates the idea of tax-exempt zones, fearing it amounts to a multi-billion open-ended tax loss for no very easily identifiable benefits, won a Whitehall stand-off with the Levelling Up Department, which loves them.

Remember freeports?

Meantime, anyone who expects investment zones to yield results rapidly needs to look at freeports, a not dissimilar idea. Liverpool’s took two years to set up, opened in January, and the city region awaits the 7.2m sq ft of commercial floorspace over 10 years the promoters anticipate. It’s not a quick fix. The Chancellor hailed the new zones as “12 Canary Wharfs” but Canary Wharf took decades and wouldn’t have worked at all without complete change in the UK financial services sector. London Docklands’ success is not easy to replicate.

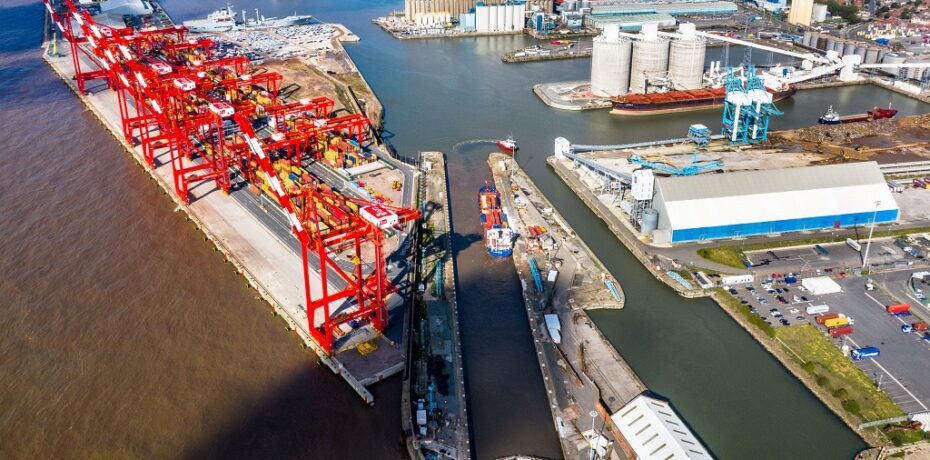

That Liverpool road

Remember too that Canary Wharf got the Jubilee Line extension and the Docklands Light Railway, a reminder that without infrastructure these ideas don’t fly. On the subject of which, last week’s statement on HS2 also disclosed that improvements to Liverpool’s A5036 Princess Way will be postponed to the 2025-2030 roads programme. The scheme, which could cost up to £335m, is intended to provide improved access to – you guessed it – the Port of Liverpool by creating a new road link to Switch Island. Is this likely to be good news for the Liverpool Freeport? No need to answer, because it is a warning that without coherent infrastructure add-ons investment zones will be of limited significance.

Fingers crossed

But maybe the government thought of this? The Chancellor’s statement included the line “I can announce a second round of the City Region Sustainable Transport Settlements, allocating £8.8bn over the next five-year funding period.” You can read about the Northern region’s July 2022 allocations here. As Subplot shipped, useful paperwork on the latest allocation had yet to appear. If it helped fulfil Mayor Tracy Brabin’s pledge for spades in the ground on a £2bn Leeds tram network before 2028, that’d be a massive win. But we don’t yet know. For now, confidence that transport policy can align with regeneration policy is not high.

- Read Place North West Budget takeaways and industry reactions

ELEVATOR PITCH

ELEVATOR PITCH

Going up, or going down? This week’s movers

The Chancellor found £400m for some Northern towns, but seems less keen on the £14bn regeneration pot offered by changing UK solvency rules.

Special pots

Special pots

Another round of Levelling Up Funding will be coming – £1bn is promised later this year – but £400m has also been found for new “Levelling Up Partnerships” of various kinds for some worthy Northern causes.

Colne Valley’s Marsden New Mills have been empty since 2002 and lined up for redevelopment more or less ever since. Apartments, a gym and an 18,000 sq ft business centre were trailled by the local Conservative MP late last year. The Chancellor has now confirmed this (or repeated it – your choice).

According to the Chancellor other areas to benefit include Redcar and Cleveland, Blackburn, Oldham, Rochdale, and South Tyneside. A tweet from the Treasury added there would be 20 of these schemes. Given the Marsden New Mills example, whether this is all new commitments, or a repeat of previous announcements is not yet clear.

Dogs that did not bark

Dogs that did not bark

You’ll search the Budget paperwork in vain for references for Northern Powerhouse Rail, but that was expected. The government clearly lost interest in this long ago. The much bigger dog that did not bark was Solvency II. As regular readers will recall this is the so-called Big Bang 2.0 rethink of the post-2008 rules on pension and insurance fund solvency. The idea is that instead of billions sitting in emergency kitties waiting for the next Great Financial Crash, it could be out there building things.

The government – both Johnson and Truss versions – saw Solvency II as a monster source of funding for their levelling up agenda (see Subplot March and September 2022). The Sunak government appears to think something similar, but in a less aggressive idiom, judging by thoughts published in November 2022.

Here’s the important bit: if the aim of Solvency II was still a levelling-up big bang we would have heard about it yesterday and we didn’t. Maybe reality triumphed over rhetoric, because there’ll be a long wait for the money to filter out of funds, even if rules change fast – and they won’t. Or maybe the explanation was provided last week in an appearance by the Bank of England governor Andrew George before the Commons Treasury Select Committee.

George said that reducing the solvency barriers to release £14bn would increase the risk of insurance firms going bust. “The annual risk of a failure will rise from 0.5% to 0.6% if the changes are implemented, a “relative increase in the probability of failure of around 20%,” he said. Unless and until the Bank of England comes enthusiastically on board, Solvency II may not be going anywhere fast.

Get in touch with David Thame: david.thame@placenorth.co.uk

Important to note that an additional factor in the delay to the Rimrose Wrecker Highway is the city wide objection. It’s an offensive underspend to not tunnel the road and no decent options were ever put forward. Our city was determined to not be worthy of not being wrecked by Highways England.

If the government is serious about making a success of this area, it needs a proper set of solutions not a budget, least effort possible option.

If that comes forward they are serious. If it doesn’t then they are not.

By Jeff