The Subplot

The Subplot | Office investment, spa days, bad luck

Welcome to The Subplot, your regular slice of commentary on the business and property market from across the North of England and North Wales.

THIS WEEK

- Early birds: there are some juicy bargains to be had in regional office markets

- Elevator pitch: your weekly rundown of who is going up, and who is heading the other way

RETURN OF OFFICE INVESTMENT

Bargains to be had, deals to be done

By the time you read this, it may already be too late: early bird investors are tugging at the worms. Even nine-figure deals, like the sale of the Co-op HQ, are back in play.

One Angel Square, Manchester is back on the market, in a second attempt after last year’s effort to unload the 330,000 sq ft block ended in disappointment. The owner – a vehicle controlled by RREEF Investment, part of Deutsche Bank, and Bedell Corporate Trustees, a Jersey Property Unit Trust – repriced at £165m, down from £210m. The owner paid £142m in 2013.

There’s no guarantee they will get the new lower price – there’s empty floorspace and that will spook some potential buyers – but the renewed sale effort comes at a super-interesting time for regional offices.

But this

Why so interesting? Two reasons. First, the big funds spot a yield gap. We’ll come back to that in a moment. Second, because smaller funds spot a once-in-a-generation opportunity to turn some of the office market’s sow’s ears into silk purses. Here’s how it works.

We’re going shopping

Dan Green is a partner at investment and asset manager Tri7 and he’s recently been spending a lot of time in the North looking at small floorplate, multi-let office blocks in city centres – the kind of property many would regard as far from the heart of the action. He’s about to buy one close to us (Subplot gives you two guesses on location) and another in the South. More will follow. The Big Six regional cities are his target in what he reckons is a three-to-five-year play – buy now and sell around 2027.

Bargains

“Pricing on regional offices has drifted too far,” Green tells Subplot. He believes the sub-£20m blocks he’s after are typically 10%-20% underpriced. “There’s an opportunity because the funds are looking to dispose of these offices, buildings at the lower end of the EPC ratings that need capital expenditure to bring them up to scratch. But if they are well located, these smaller floorplate, multi-let offices offer a diverse income stream.”

Buy, improve, sell

The play is to buy these blocks off the big funds today – because the funds don’t want them – to improve them, grow income, and sell them back to the funds who, by the second half of the decade, will have come around to the idea of shorter leases and multiple lets. After all, the build-to-rent sector and student housing depend on exactly that – lots of short leases – and investors think that’s the Holy Grail. Why not in the office sector?

Nice little earner

If this works, Tri7 can grow a £50m-£60m portfolio in the next year or so, nurse it gently, and turn a handsome profit come the day. “Once the big funds get their heads around shorter leases, the yields will come back, and then these blocks will appeal to investors once again,” says Green. Obviously, current gloomy expectations about interest rates might interfere with the timetable – 2025 has been scrubbed off the wall planner – but hang on a bit longer, and bingo?

Getting competitive

The proof that this is an actionable plan, not just a strategy brainstorm, comes from the sale market for these poorly regarded office blocks. Earlier this year, serious bidders came in ones and twos. Today Tri7 is meeting three or four competitors. The normal rule of thumb is that by the time you read about plans like this, in places like this, the hot properties have already been snapped up by early bird investors. Fortune favours the brave.

You do the maths

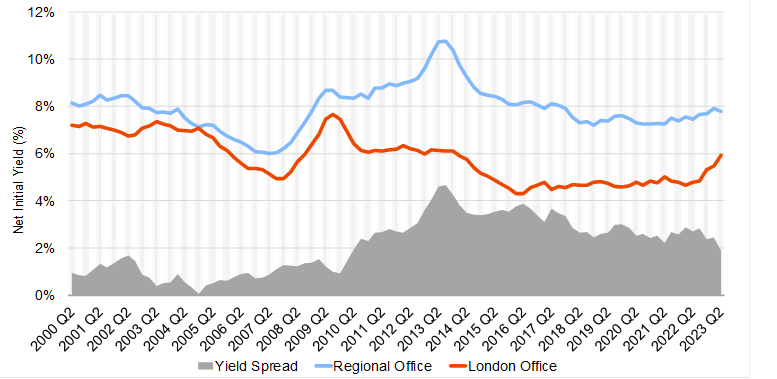

While the smaller-but-ambitious investors are on manoeuvres, the bigger funds are also studying regional offices with care. Why? Because the yield gap between London and the regions has narrowed dramatically and is now at a 13-year low. This is a fancy capital markets way of saying that the regions look a lot better value than they did.

Data from CoStar makes the point: see the way the red and blue lines converge, partly because the regions get sharper, partly because London gets blunter? Big money knows this, and thinks it’s interesting, not least because the big regional office markets – Manchester and Leeds high on the list – have consistent demand and a strictly limited supply of new offices. In short, the maths look good if (big if) the price is right.

So, back to One Angel Square. The yield is about 7%, sky high compared to the 4%-4.25% yields of the recent past. But for buyers, it’s all good: a sufficiently modern building with income. And for that reason, an opportunity for those who wish to offload, and might have done so earlier if it hadn’t been for the wild ride we’ve all been on, to sell into a relatively competitive market. Make no mistake, the regional office investment scene is back in business.

ELEVATOR PITCH

ELEVATOR PITCH

Going up, or going down? This week’s movers

A bit of bad luck for the Liverpool office market, and a slow-moving spa day in Trafford Park. Doors closing, going down.

Liverpool offices

Liverpool offices

Liverpool’s office market has been grim, but to the surprise and delight of many, it began to look like things were improving: 2022 take-up figures ended feeling okay. But no, the gods must have their sport, and now the law firm behind one of the largest lettings is in administration.

In February 2022, High Street Solicitors took 14,875 sq ft at No 1 Tithebarn, in a relocation from Cotton Exchange around the corner in Old Hall Street. The firm signed a 10-year lease at £16/sq ft, the largest deal for about a year. In April 2023, Doncaster-based CM MediCall Aid petitioned for winding up, following a failed attempt by Bury Council the year before, and last week administrators were appointed.

Spa days

Spa days

Therme has announced that its £250m wellbeing resort at Trafford Park is to be re-thought, as Place North West reported. Consultation ahead of a new planning application is now underway.

The latest announcement comes after a steady stream of announcements since summer 2019. And yes, it hasn’t been an easy world in which to develop anything, but assuming the latest rethink is approved by October, and assuming the two-year construction begins immediately, it won’t open until 2025. It was supposed to open in 2023, despite Covid delays.

Therme does quite a lot of announcing: recent disclosures include new schemes in Washington DC, Toronto and South Korea. Subplot hasn’t been able to find quite so many announcements about openings. According to the project map on the spa operator’s website, nothing has opened since Bucharest in 2016.

Therme’s spokespeople say: “Therme Manchester will be funded with a typical mix of third-party construction financing, alongside funding provided by Therme Group. Whilst we cannot disclose the details of our financing arrangements, we will release more information about our development programme as soon as the details become available.

“As a privately held group, Therme Group does not publicly share its financial statements. However, certain information about the group can be found at the Austrian Company Register: justizonline.gv.at.”

Therme’s UK holding company recently changed its controlling party from an Austrian joint stock company to Therme founder, Romanian citizen (and resident) Dr Robert Hanea.

Therme spokespeople tell Subplot: “Dr Hanea acquired last year an additional share of Therme Group RHTG AG, therefore he is listed as the ultimate person with significant control. However, we can confirm that Therme Group Holding UK Ltd continues to be wholly owned by Therme Group RHTG AG.”

Get in touch with David Thame: david.thame@placenorth.co.uk