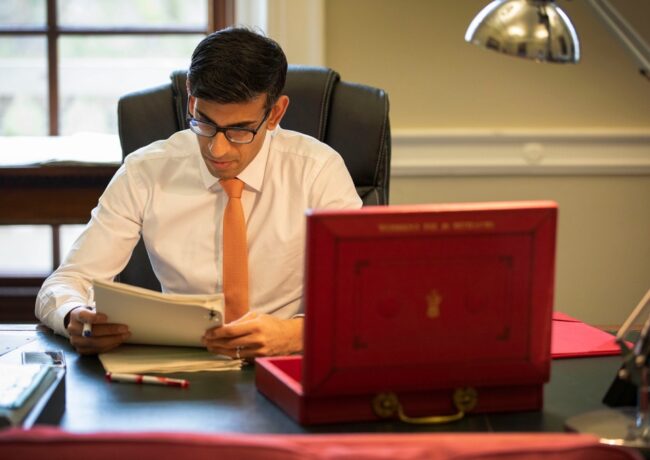

Sunak’s stimulus to help housing and hospitality

Chancellor Rishi Sunak unveiled measures to boost the economy, including raising the stamp duty threshold to stimulate the residential market, offering £2bn to retrofit homes, and reducing VAT for bars and restaurants as they reopen after lockdown.

Sunak on Wednesday promised to leave “no one without hope” as he unveiled his Summer Statement package to help the country’s recovery from the coronavirus pandemic.

The measures in detail include:

Hospitality support

A reduction in VAT for bars, hotels and restaurant services, from 20% to 5% for the six months ending January 2021 aims to boost the hospitality industry and lure consumers back to bars and restaurants. The cut in VAT also applies to attractions such as cinemas and theme parks.

“This is a £4bn catalyst for the hospitality and tourism sectors helping to protect 2.4 million jobs,” Sunak said.

To further support bars and restaurants, 80% of which were said to have ceased trading during lockdown, the Government is to give diners a 50% discount on meals eaten in participating restaurants from Monday to Wednesday throughout August, an initiative Sunak called an “Eat Out to Help Out” discount.

“This moment is unique, we need to be creative,” he added.

Bill Addy, chief executive of Liverpool BID Company and chair of Liverpool Visitor Economy Network, said: “Our retail and hospitality sectors have been among some of the hardest hit in the economic shock caused by coronavirus and the Eat Out to Help Out scheme is an added incentive for those who want help reactivate the sector.”

He added: “Cutting VAT to 5% will help people enjoy the city for less and alleviate pressure on our visitor economy. The road to recovery isn’t going to have any shortcuts so we’ll need to continue to work together to encourage confidence, support businesses and rebuild our city.”

Housing

Following a 50% fall in property transactions in May, according to Government statistics, the chancellor cut stamp duty land tax to “catalyse the housing market and boost confidence”.

He increased the stamp duty threshold, the minimum property price for which it must be paid, to £500,000 from £125,000 until 31 March 2021.

The average stamp duty bill will fall by £4,500, the chancellor said. However, units in purpose built build-to-rent and PRS schemes are exempt from the changes.

Melanie Leech, chief executive of the British Property Federation, welcomed the cut in stamp duty but said Sunak had “missed a trick” by not giving BTR investors an exemption from the 3% stamp duty surcharge, which could have boosted the delivery of homes.

Anthony Stankard, founder of the Manchester estate agency Reside, praised the immediate introduction of the stamp duty cut. “It’s a great idea and only logical to introduce immediately as otherwise it would have stalled everything for three months.

“To run it to next April, rather than the end of this year, gives it longevity and will help people plan and make sensible decisions.”

He added: “The current system of a tiered transactional tax has always seemed unfair to me and a barrier to moving. Stamp duty should not apply to anyone buying a house to live in. It should be a tax on second properties and investments.”

Green Homes Grant

Government is making £2bn available to increase the energy efficiency of residential properties.

Homeowners and landlords can apply for up to £5,000 each to retrofit homes, while low-income households can apply for a grant of up to £10,000.

Sunak said that the funding could make up to 650,000 homes more energy efficient and save households up to £300 a year on bills.

A total of 140,000 ‘green jobs’ could be created as a result of the initiative.

The chancellor also pledged £1bn to making public sector buildings more energy efficient and an additional £50m towards a pilot scheme to research the “correct approach to decarbonised social housing”.

Brian Berry, chief executive of the Federation of Master Builders, said: “Grant-funded vouchers are a step in the right direction to launching the retrofitting market, and supporting consumers to build with confidence after the pandemic.

“We hope at the autumn budget the chancellor will bring forward the rest of the £9.2bn [green] manifesto , and support the development of private finance initiatives that will ensure the market grows in a sustainable way.”

Construction

Much of the chancellor’s so-called ‘mini-budget’ centred around creating and retaining jobs in various sectors and the launch of the Construction Talent Retention Scheme has been welcomed by industry professionals.

The scheme will aim to redeploy furloughed staff at risk of redundancy, matching them with employers seeking additional staff.

Diane Bourne, managing director of Eric Wright Civil Engineering and member of the Civil Engineering Contractors’ Association, said: “As a major employer in the North West, we support this scheme.

“Covid-19 has had a major impact with long-lasting effects on the construction sector and now, more than ever, it will be imperative that we work together to retain our best talent while protecting skills and experience across the sector.”