Event Summary

Lancashire Development Update | Summary, slides + photos

There is an opportunity for huge inward investment in Lancashire but the region needs to come together to sell itself to both public and private backers, said a panel of experts at Place North West’s Lancashire Development Update.

More than 120 people attended the event at the Hallmark Hotel in Leyland, sponsored by Transport for the North and Cuadrilla.

See below for gallery + slides

The Lancashire Development Update is the latest in Place North West’s development update series, which continues with the Cumbria Development Update at Low Wood Bay Resort in Windermere on Tuesday 27 February.

Speakers at the Lancashire event included Beckie Joyce, project director at Capita Real Estate & Infrastructure; Paul Walton, director of PWA Planning; Jonathan Spruce, interim director for strategy at Transport for the North; Michael Conlon, chairman of Conlon Construction; Alistair Eagles, chief executive of Seatruck; Mark Alexander, partner at BLM; Susan Parsonage, chief executive of Lancaster City Council; Kevin Riley, projects director at Mott MacDonald; Andrew Pexton, director at GVA; and Laura Hughes, head of commercial at Cuadrilla.

Three different approaches

The event began with a presentation by Joyce, who outlined the achievements and the challenges ahead for the region.

- While the Local Enterprise Partnership, councils, and universities in the region had done “a phenomenal job” in promoting Lancashire, the “hard reality” is that the area does not have a homogenous footprint: “No single sector will drive forward growth in Lancashire”, said Joyce.

- Growth was happening all across the region but in “individual places”, she said, emphasising the need for “joined-up conversations” across local government and development bodies to make the most of investment opportunities.

- She outlined the different approaches areas in the region can take to maximise growth opportunities; place-led, planning-led, and deal-led.

- Citing the example of Blackburn with Darwen, a place-led approach in partnership with Capita had helped housing completions to nearly double between 2016/17 and 2017/18, and said using a local framework for development, including partnerships with contractors, was one way of helping to drive growth.

- Lancashire’s new garden village was an example of encouraging planning-led growth: the development will deliver 3,500 to 5,000 new homes once a new local plan is adopted in 2019.

- A deal-led approach, like the City Deal for central Lancashire, had “potential for massive growth”, with government backing helping to unlock a potential 17,400 new homes.

- She concluded there was a danger the region could “revert back to thinking we don’t want or need housing growth” and that partners across the region needed to work more closely together to make the most of upcoming opportunities.

More stock needed

Joyce’s presentation was followed by a summary of the region’s industrial market by GVA director Pexton.

- Nearly two-thirds of industrial stock in the region was less than 10,000 sq ft, highlighting the number of SMEs in the region. He said there would need to be “more churn” to encourage these firms to grow.

- Typical lease terms for industrial properties in the region were between five and 10 years, while land values stood at between £200,000 and £300,000 per acre. Preston is among the highest in the region at £300,000 per acre.

- Build costs were expected to be between £85 and £120/sq ft for a new build, while refreshing an existing building would cost £55 to £90/sq ft.

- Rental values for new build stood at £5.50 to £7.50/sq ft, while for modern existing buildings would cost £4.50 to £6.50/sq ft.

- He argued new build would only be viable by establishing higher rental prices: “Developers aren’t trading land and want to build, or will sell land with a design-and-build deal attached to it”.

- He concluded the market’s focus was now on larger numbers of units of 25,000 sq ft or more, and there was still a need for more stock: “It’s about getting the timeline right for delivery of new sites, and the churn to encourage more companies to grow or downsize”.

Infrastructure investment

Spruce of Transport for the North then outlined the organisation’s strategic transport plan, which is currently out for consultation.

- East Lancashire and the Fylde have “massive opportunities to transform and outperform economic expectations,” backed by transport infrastructure.

- “Transport professionals in Westminster didn’t get some of the strategic transport corridors” TfN has proposed, he said, including a route linking Lancashire and Sheffield, and a freight rail link across the Pennines.

- “The Westminster-held belief is that Manchester to Leeds connectivity is the most important, but the aim of the transport plan is join the dots across the region more efficiently,” he said.

- He added the Government is “beginning to understand” the proposals as Lancashire’s advanced manufacturing cluster continues to grow, highlighting the importance of linking tech hubs across the country.

- West coast mainline stations in the region “need to be ready for HS2”, he said, including Preston, Wigan North Western, and Lancaster, and this will provide a major opportunity to invest in improving transport infrastructure in and around these stations.

- TfN’s proposed additional investment in transport across the North amounts to around £50 per person per year, he concluded, giving the region the opportunity to deliver 850,000 new jobs and around an additional £100bn to the economy.

A disparate region

Spruce, Pexton and Joyce were joined by Riley of Mott MacDonald for a panel session chaired by Place North West editor Jessica Middleton-Pugh.

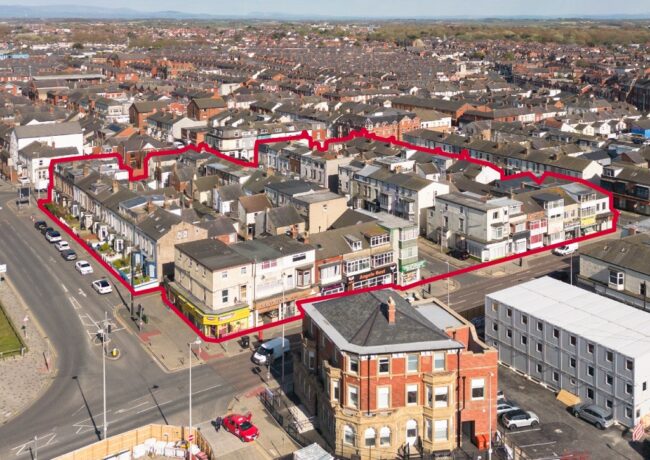

- Riley, who is working on masterplans for Blackpool Airport Enterprise Zone with IBI, said the site had “not been a well-used asset” but the 341-acre site could offer 3,000 jobs in advanced manufacturing, energy, and food.

- He added there was a “real need” to improve capacity at Preston to make the station “a gateway to Lancashire” ahead of the arrival of HS2.

- Spruce said the local road network could benefit from around £330m of funding from upcoming legislation, which will put vehicle excise duty towards road improvements.

- Pexton said businesses would continue to locate themselves next to the motorway network and at transport hubs, and “being blind” to that would exacerbate planning issues including vehicle access and congestion.

- Joyce reiterated the region “was a disparate place with lots of different markets”. “We need to be able to speak with one voice on economic growth, and we can’t have that conversation unless we’re talking to everyone,” she said.

- Riley said “getting the infrastructure right from the outset” would be key to the success of the region’s Enterprise Zones, but that masterplans “were beginning to align” to maximise growth.

- Pexton added that “speeding up the planning process” would help to unlock more developments, but that he had seen “more local authorities working together, not against each other” to help get schemes under way.

- “There are a lot of functionally obsolete buildings in the region, and if we can prove they’re not viable for industrial sites, we can release them for housing”, he said.

- Joyce agreed, concluding: “The worst situation for everyone is that housing and industrial are battling against each other.”

Fracking potential

Following a networking break, Laura Hughes, head of commercial at Cuadrilla, took to the stage to outline the opportunities that fracking could bring to local businesses.

- Hughes began by stating there was the potential for “hundreds of millions of pounds” of investment in Lancashire through fracking, and said shale gas extraction could “fuel our country for decades, if not generations”.

- She said US shale gas extraction “was not a good analogue” for potential fracking in Lancashire, citing differences in geology, topography, regulation, and land ownership, with the potential developments “more akin to gas storage in Cheshire”, which has already begun.

- The company is testing two wells in the region under license, which will establish the commercial viability of the drilling. If successful, each well could deliver £100,000 of contributions to local services, and a potential saving of 2% of gas price for local grid entry.

- There could also be “several hundred million” of capital and operational expenditure per well, much of which will be channelled towards the local supply chain.

- Cuadrilla has also formally entered into a local agreement, which includes a quarterly report of its spend in the local area, including number of employees, apprenticeships, the contractors used, and both direct and indirect spend. So far, the Preston New Road site has contributed £7m to the local economy since tests started.

- “We want to show people we can do this well, in compliance with environmental controls, and we want to be transparent,” she concluded.

Brexit opportunities

A panel discussion, featuring Alexander of BLM, Lancaster City Council leader Parsonage, Eagles of Seatruck, Conlon, and Walton then followed.

- Parsonage said Lancaster was “at a pivotal moment” having been opened up to more investment by the M6 and the Heysham Gateway, and there were “great opportunities” across the region supported by the port, the city’s historical centre, and its university.

- Eagles, who has supported a €400m investment in Heysham Port, described the area as “a long-forgotten uncle that you didn’t send a Christmas card to, that’s about to transform into the trendy cousin”.

- “We don’t sell the region enough as a whole,” he argued. “With the right investment we could act almost as a suburb of Dublin and Belfast.”

- Alexander said “huge strides” had been made to promote Lancashire on the global stage, but projects like the Penwortham Bypass would help to benefit the region and raise its profile further.

- Conlon called for “joined-up thinking” by local stakeholders particularly around the social infrastructure needed to support housing, arguing for the need for new schools alongside housing projects.

- Walton said his company was submitting around 400 planning applications a year, with the geography of these spreading more widely across the region in the last 12 to 18 months. He also called for infrastructure investment to enable potential garden village developments.

- However, he added that completely joining up planning across the region into one homogenous system “was a challenge beyond many of us”, saying there were still differing responses to development from different planning departments across Lancashire.

- Eagles said that while Brexit had added to uncertainty, it provided an opportunity to “leap out of its seat while others are sitting back”. “Our fastest growing route is between Heysham and Dublin; if there’s more investment in both it’ll be a catalyst for further growth,” he said.

- Conlon concluded that local authorities should acknowledge that private businesses did not see political boundaries: “I can’t see how any of the cities in towns and Lancashire doing well is detrimental to the rest of us.”

- Parsonage said Lancaster Council wanted to make “a statement of intent” and invest in the Morecambe Bay area to attract business and finance to the region. “We have seen a lot of real interest will result in multi-million-pound inward investment,” she concluded.

Slides from the event can be found on our SlideShare page using the below links:

Jonathan Spruce, Transport for the North

Place North West is also hosting a special event, in partnership with the Preston, South Ribble and Lancashire Councils, to outline progress three years into the £400m City Deal, and examine Central Lancashire as a place to live, work and do business.

The event on Thursday 1 March at The Villa at Preston North End is free to attend, and all refreshments are included, but registration must be made in advance.

Click here to book your ticket

Click any image to launch gallery

- Panel, from left: Beckie Joyce, Capita Real Estate & Infrastructure; Jonathan Spruce, Transport for the North; Andrew Pexton, GVA; Kevin Riley, Mott MacDonald

- Laura Hughes, Cuadrilla

- Beckie Joyce, Capita Real Estate & Infrastructure

- Laura Hughes, Cuadrilla

- Beckie Joyce, Capita Real Estate & Infrastructure

- Jonathan Spruce, Transport for the North

- Jonathan Spruce, Transport for the North presents on the Strategic Transport Plan

- Jonathan Spruce, Transport for the North

- Pexton previously spent 26 years at Avison Young. Credit: Place North West

- Beckie Joyce, Capita Real Estate & Infrastructure

- Panel, from left: Michael Conlon, Conlon Construction; Susan Parsonage, Lancaster City Council; Alistair Eagles, Seatruck; Mark Alexander, BLM; Paul Walton, PWA Planning

- Panel, from left: Michael Conlon, Conlon Construction; Susan Parsonage, Lancaster City Council; Alistair Eagles, Seatruck; Mark Alexander, BLM; Paul Walton, PWA Planning