The Subplot

The Subplot | New GM plan, Oldham Tesco, Leeds alert

Welcome to The Subplot, your regular slice of commentary on the North West business and property market from Place North West.

THIS WEEK

- It’s that plan again: the latest attempt to agree on a Greater Manchester strategic plan may have a bumpy ride ahead

- Supermarket sweep: why Gulf investors love an Oldham Tesco

- Friends in the North: is Leeds replacing Manchester as the go-to Northern city?

NEVER GIVE UP

The Greater Manchester Spatial Framework has risen again

The Greater Manchester Spatial Framework has risen again

The “Plan of Nine”, created by all Greater Manchester boroughs except freewheeling Stockport, is now embarking on the statutory process that leads to confirmation. Will it get there?

Places for Everyone begins its journey towards statutory approval today with an appearance before a joint committee of the nine (out of 10) Greater Manchester boroughs that support it. The document replaces the Greater Manchester Spatial Framework, the ill-fated but well-meant city region plan for growth up to 2038. After seven years of ups and downs and multiple agonised rethinks, Stockport Council withdrew in December 2020, putting the old, oft-rewritten plan, out of its misery in the process.

Write, rethink, repeat

This time the Nine have chosen a different statutory framework by opting for the legal framework of a joint Development Plan Document. Thus they bypass Stockport and, perhaps not coincidentally, formally exclude Metro Mayor Andy Burnham, whose Green Belt election pledges ensured the original GMSF suffered long and public agonies. He has no place on their joint committee. The Nine, and many in the property business, sincerely hope this is the endgame. They could be disappointed. Here’s why.

Troubled times

There are half a dozen good reasons why the new plan won’t be the final word. Top of the list is that the Nine already admit that the plan will need a rapid review to take into account the effects of the pandemic. Paragraph 1.10 says “the country is still in a state of flux” and as a result, the Nine will use “the process of plan review to monitor the situation and if necessary to undertake a formal review outside of statutory review timetable.” That means Pandora’s box remains firmly open.

M’learned friends

There’s also the risk of judicial review. To use the joint Development Plan Document route the plan has to have “substantially the same effect” as the GMSF it replaces, minus Stockport’s contributions. As the plan itself points out, “substantially the same effect” is not to be read as “the same effect” and in this wrinkle lies a wide field for legal challenges, should Green Belt campaigners feel in the mood.

Taking a risk

The Nine may have made a legal challenge easier by extending their rewrite beyond the simple act of deleting Stockport’s contribution. They also took into account new government guidance on how to calculate housing need, which pushes Manchester’s total up by 15,000, and had a look at new evidence that emerged since October 2020. The Nine say they thought long and hard, took legal advice, and decided that despite the big change in numbers they are within the rules. It will be interesting to see what a judge thinks about the plan overall having “substantially the same effect”, but very much not substantially the same effect in the case of the City of Manchester. Nobody will be surprised if this winds up in the courts, not least because a group in Bury is already fund-raising to do just that.

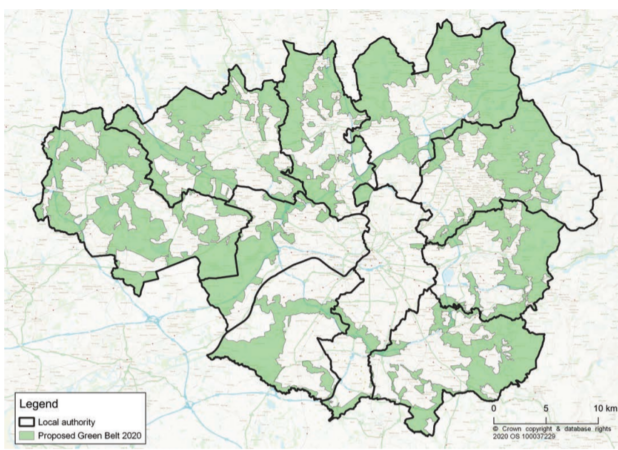

Green Belt

Then there’s politics. Removing 4,300 acres from Green Belt will not be popular with some voters. It figured in May’s local elections, from Bolton to Tameside. The post-2019 cohort of Conservative MPs from Greater Manchester now has some weight with the government, and since they come from areas (Bolton, Bury, Rochdale) with a history of activist local opposition to the GMSF, they could choose to intervene with ministers. This is rated as a real risk by the plan’s supporters.

Blue wall

Suppose hostile MPs intervened, would that be enough for the government to kill the GMSF? The wise heads say that last week’s “Levelling Up” speech by Boris Johnson means the Government has no way back and has to support plans that appear to achieve growth. That the speech was so lame means the Government has even less scope for chucking out other people’s ideas: they need all the content they can find.

Row back

The plan isn’t what it once was. “There has been a significant reduction in land proposed for employment use since the original 2016 Draft, which on the face of it could appear contrary to the need identified in the [new plan] to provide a ‘bold, ambitious plan for good quality employment,” said Richard Barton, senior director at Avison Young. To recap, the plan includes 20.5m sq ft of offices, mostly in the city centre, Salford and the airport; 35.8m sq ft of new warehousing, much of it in the northern boroughs, and 165,000 new houses by 2037.

Big shrug

Is the plan worth it? Too focused on housing, too hung up on Green Belt, too compromised by politics and not sufficiently inspired on how to revive communities: Subplot has heard all that, and more, from several property industry sources. John Lafferty, director of development consultancy at JLL, said: “You have to ask about deliverability, the Green Belt issue isn’t going to go away, and can we deliver the housing numbers on brownfield? All good questions, to which we have no answers.”

All a bit ho-hum

Planning consultants are sanguine. Local politicians’ desire to end the muddle and embarrassment of the last seven years will ensure the plan gets over the line, and the Nine have done what they need to for success. “No surprises here, this is a no-surprise plan,” said Savills director Jeremy Hinds. “The big gain from this plan would be delivering more affordable homes, that would be a real win if it can be done,” said Deloitte partner Simon Bedford.

What next

The plan now heads to public consultation, which might result in more changes, then an examination in public to ascertain its soundness. The hard deadline is December 2023, by which time the government said all councils must have plans in place. It will be a squeeze to get approvals by then, and legal actions or rethinks could prove fatal.

Conclusion: miraculous resurrection or dead man walking – we won’t have to wait long to find out.

IN CASE YOU MISSED IT…

The golden shopping trolley

The golden shopping trolley

Oldham’s 149,000 sq ft Tesco supermarket has been sold for £54m. What’s the reasoning behind one of Oldham’s biggest ever international deals?

International money does not often find its way to Oldham, not on this scale. The vendor of the Huddersfield Road Tesco was Qatari, the buyer was the Kuwait Business Town Real Estate Company making its UK debut and the deal was funded by Abu Dhabi Islamic Bank.

Safety first

The mid-decade move to grocery delivery hit supermarket profits hard, but since 2017 the bottom line has been bouncing back. This means overseas investors have had a few years to get their heads round UK supermarket investment, a learning experience that provides the kind of medium-term certainty they like. Neither does it hurt that buying into supermarkets is a Europe-wide phenomenon, one in which the UK lags (UK volume was about £1.7bn in 2020, roughly half of Germany’s), so there’s some catching up to be done. International money notes all this, and feels comforted.

Spread

The odd thing is that supermarkets haven’t done that well out of the pandemic. Sky-high costs dented rising turnover, so in April 2021 Tesco reported profits of £825m, down from £1bn. Investors, however, keep their eye on the big story, which is that supermarkets are still making money at a time when much retail is floundering. Analysis shows that while rents for supermarkets have slipped, rents for other retail have slipped a lot more, and the gap is widening. Savills data shows the spread in 2019 was 2.4%. Today it is more like 5.2%, exactly the kind of movement investors like to see. At the same time, supermarkets are growing their floorspace very slowly – so limited supply now, and into the future, which will help keep prices up and yields keen.

Golden trolleys

But that’s not the end of supermarkets’ charms. They are normally on precious long-dated, upward-only inflation-linked leases. At a time when inflation is beginning to rise – UK inflation surged up to 2.5% last month, and the global picture is iffy – supermarket leases are hugely appealing. Add all this up together and investors feel they are looking at gold-plated shopping trolleys.

So, Oldham?

Gulf investors are super keen on UK real estate (if you lived in a war region run by mad autocrats, you too would be keen on UK real estate). No surprise that they are taking a lead on supermarkets and are now jostling with opportunity-led locals like Supermarket Income REIT plc. Yields averaged 4.35% last year, according to Colliers. The Oldham deal rang all the right bells.

IN CASE YOU ALSO MISSED IT…

Friends in the North

Is Leeds replacing Manchester as Whitehall’s go-to Northern city? A string of relocations – the Bank of England, the UK Investment Bank, Channel 4 and now the British Library – suggests it might be.

Moves last week opened the door to the first £5m of £25m awarded by the Government to support the British Library’s first regional operation. The library opens in Leeds’ gorgeous, but crumbling, Temple Works. Is it the latest sign that Leeds might be the Johnson Government’s Northern city of choice?

Yes, but

There’s a bit more to the British Library move than meets the eye. The library has long had a base up the road at Wetherby Spa – a vast outstation housing the lending stock, and miles of books they can’t fit in the famous London complex. And Temple Works has been an embarrassment for ages (Burberry, the fashion label, was to base its HQ there until they saw the bill for renovations). Even so, it’s a cultural coup for Leeds. Remember, the city beat Manchester and Salford to win the Channel 4 relocation. The broadcaster opened for business last year.

The old relationship

This matters because during the Nineties and Noughties Manchester City Council’s stock-in-trade was to be the Government’s best friend in the North. Whenever the Government wanted a pal, a trial location, or a sounding board, Manchester stepped forward. Westminster politicians liked the big-city all-embracing feel that a partnership with Manchester conveyed, and Whitehall civil servants liked the fact that if the city council said it would do something, it generally did. That the city has always attracted disproportionately wide media attention helped, too. After all, you want the voters to notice what you’re doing. And it was no coincidence that the Blair, Brown and Cameron governments all had senior figures with seats around Greater Manchester. The happy result was that Manchester got a lot of what it wanted.

The rival

Suddenly Leeds thinks it is the go-to location. Chancellor of the exchequer Rishi Sunak is MP for a Yorkshire seat, and the county has a lot of red-to-blue marginal constituencies (Leeds East, Keighley, Huddersfield and Yvette Cooper’s seat in Pontefract are all on the Tory hit list). Moreover, the Government knows that however much some people love Manchester, plenty more in the regions think it is as bad as, or worse than, London. It looks good to spread the love around.

Do not be lazy

A serious threat? Speak to Leeds agents and developers privately and they chuckle, and admit that Leeds is never going to rival Manchester, it’s just too small, but it may have a political tail-wind. It could also have a commercial edge, of a kind, appealing to those priced out of Manchester but fancying some regional weight in their portfolio. Commercially, Leeds is doing well. The prospects for growth are strongly rated in an office market with Grade A vacancy rates of just 2.9%, roughly half that of Manchester according to Savills data. Speculative development is about to drop 482,450 sq ft of new Grade A-space onto the market.

Best fit

Atam Verdi, chairman of property regeneration consultants AspinallVerdi, has a Leeds office looking out on a raft of speculative office and build-to-rent schemes. “It is over-simplistic to say one is in favour, and the other is not. It would make more sense to say investment is going to the city to which it is better suited,” he said. “I don’t think for a moment Manchester is worried – jobs growth and investment there is strong, and they are at the centre of a city region operating on a different economic scale.”

Conclusion: Leeds is not a rival to Manchester, but if it syphons off some of the political goodwill and some of the chunky requirements, it could give Manchester pause for thought.

The Subplot is brought to you in association with Cratus and Bruntwood Works.

Good luck to Leeds, they are in the process of getting shafted over HS2.

By Rich X

Just to add an additional pause for thought on that Leeds competitive note: over the years much concern has been expressed in Liverpool about being competitively undermined both locally and by government.

These concerns were, without exception, ridiculed and dismissed as paranoia despite any evidence or effect.

To hear concern expressed about emerging competition from Leeds may suggest this wasn’t so paranoid after all. Especially given Liverpool being far closer to Manchester’s scale than Leeds.

The net effect of government effectively withdrawing from Liverpool in terms of serious interest has been devastating.

By Jeff

Just to build on what Jeff said. I don’t think there’s any mystery to the fact that agglomeration effects mean the big get bigger, and Manchester among Northern cities has that as a tailwind, but no room for complacency.. Government baubles are all well and good, but its commercial vitality that will drive longer term prosperity, and frankly that will always start at home. If we can’t create businesses that thrive and want to stay in our cities we are not going to attract outside investment. You might add that the very existence of green belt locks in the size ratios of the UK cities, that’s why the benighted Northern Powerhouse Rail is important.

By Rich X

Whether it’s Leeds, Liverpool, Manchester or Hull etc. Northern cities should not have to rely on tidbits from central Government which are designed to pit us against one another in needless rivalry. We all know that the Northern regions need massive investment in the rail infrastructure linking Liverpool in the West and Hull and Newcastle in East and true devolution with real revenue-raising powers. Without radical change, London and the South East will continue to outstrip us all. Leeds getting a few million pounds for an offshoot of a London based institution is a smokescreen.

By Monty

Leeds is already ahead in terms of housing, retail, F&B, education and has a bigger population, it’s the most successful city in the north

By YS

YS, Leeds does not have a bigger population than ‘Manchester’, please don’t peddle that mis-information that ignores Salford, Tameside, Trafford and chunks of Cheshire. Similarly, education, it’s got a good University (i went there) but it is still lower ranked that Manchester. Having lived in both places for a considerable period of time i can say that Leeds does have advantages over Manchester, it is a far better looking city center and the social problems that blight both cities seem to be less visable than in Manchester. It has certainly been a success story no doubt, but think you might be over egging it slightly.

By Loganberry