The Subplot

The Subplot | Eviction ban, co-living questions, funny numbers

Welcome to The Subplot, your regular slice of commentary on the North West business and property market from Place North West.

THIS WEEK

- You have been warned: the continued ban on commercial tenant evictions could cause trouble in the North West

- The co-living sector is on the brink of consolidation. Is this a sign of a sector under stress?

- ‘Top city’ lists to drive you crazy

THE OTHER PANDEMIC EXIT WAVE

Bad things are coming

Lifting lockdown on 19 July inevitably creates an ‘exit wave’ of infections. But a second, more serious, exit wave will hit the North West property market when the commercial tenant eviction ban ends on 25 March 2022.

Last week, the Government announced it was extending the moratorium on commercial property evictions to 25 March 2022, by which time a new binding arbitration mechanism would be in place. That means landlords will not be able to enforce rent collection for a full two years. The result is £6bn of accumulated rent arrears, according to Remit Consulting, pushed up each quarter by roughly another £1bn, so by next spring the total will be close to £10bn. Landlords are furious and two-thirds of retailers are said by the British Retail Consortium to be facing legal action.

North West debts

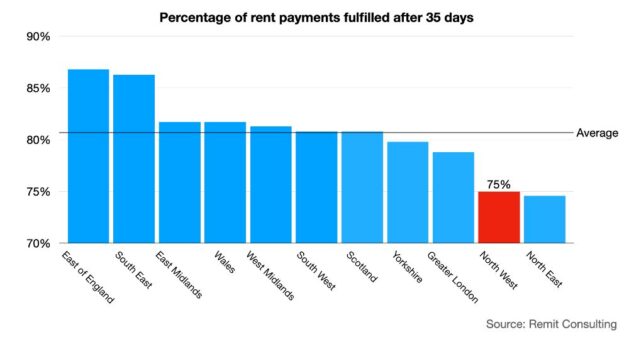

A worringly large proportion of that £6bn comes from the North West. Data that Remit shared exclusively with Subplot shows the region’s tenants are among the UK’s slowest payers. The North West is second from the bottom in terms of the proportion of rent paid by the 35th day after it is due, with just 75% of rent paid. Only North East tenants are more reluctant to cough up.

Office headaches

Don’t forget that while the bulk of the problem is in the retail sector (£3.5bn) the next largest chunk of unpaid rent comes from the office sector (£1.3bn). Rent collection is a little better here because landlords have been more generous, or under less pressure from their lenders, or both. Data from rental software firm Re-Leased shows landlords are about 50% more likely to forgive late rent from office tenants than retail. So there’s a problem in offices too, but it is slow burning.

Winning there

While landlords fume, tenants and city centre cheerleaders are smiling. Their campaign to persuade the Government to continue the eviction moratorium has been a stonking success. Chris Brown, director of Marketing Liverpool, says: “Clearly we welcome the eviction moratorium on commercial properties, which will provide some relief in the short term to businesses, especially in sectors such as hospitality and events, which have been prevented from reopening. However, this is not a panacea, and there is the risk that it just piles up more debt that businesses can’t pay back.”

Losing here

The consequences are hard to predict, but £6bn-10bn of rent foregone is sure to hurt someone. Tom Wallace, chief executive of Re-Leased, says: “The true impact of this has not been fully appreciated by the Government and it will only deepen as rent collection figures continue to plateau.” The best guess is that we’re about to face a shake-up among retail and office landlords to mirror the shake-up among tenants. How will this work?

North West commercial tenants are, by national standards, reluctant payers, according to Remit Consulting data

Time’s up

For most landlords, particularly the names you’re likely to have heard of, cashflow is adequate, leverage is fine, and they don’t want to look like monsters by chasing distressed tenants. These landlords will compromise. Among the rest, the theory is that two groups of landlords are going to find themselves abruptly confronting their grizzly Darwinian destiny.

Dead in the water

The first group are heavily indebted, or over-leveraged, or under-cashed. Whatever the combination, they need income and cannot afford to be forbearing. They will press for full repayment, and will either get nothing or not enough. Their loans will sink underwater as valuations reveal plunging asset values. Squeezed between these two hard places they might have hoped simply to replace the non-paying tenant with another better one and, fingers crossed, the show goes on. Unhappily for them, replacing tenants is not easy these days. Receivership or some kind of corporate recycling followed by exploring their site’s residual value seems the likely outcome.

Good riddance

The second group are the habitual meanies. Landlords that play tough like it was 1996 are, amazingly, still playing tough. David Fox, head of retail agency at Colliers, tells Subplot: “There were always some landlords that were inflexible, and continue to be, and their short-term gain will be their long-term risk, because tenants don’t need to go to landlords like that anymore.”

Nixed

But these two problem groups – the hard-cases and hard-nuts – are few in number, marginal to the market, and don’t matter, do they? Well, yes and no. As Fox explains: “It is a small proportion of landlords who are itching to start proceedings for non-payment and have been making noises throughout the pandemic. And it is a small group who will be handing back the keys themselves if they don’t secure rental income to pay their own debts. But it is a terrifying amount of money due overall, and it is vital to get this resolved.”

Habit forming

Something similar goes for the office market. One Manchester landlord told Subplot that tenants can get addicted to non-payment, and once they do it is all but impossible to recover the situation. Those landlords that haven’t got it right so far, and whose delinquent tenants are getting comfortable in their delinquency, may struggle to turn things round. Don’t assume the sector is safe.

Not listening

By March 2022, we will have a clearer picture of how much debt is in play, and how much of it landlords can prudently afford to forgive. Compromises will be necessary on both sides. Yet behind this stands another problem: how on earth did the commercial property sector get into a situation in which landlords were forbidden, by law, from exercising their contractual rights? Or, put it another way, why does the Government not listen to property?

Fumbled

Throughout the crisis the Government could have given property an easier ride. It feels like Government thinking goes like this: retailers (and other tenants) want a moratorium that goes on for two years, long after the initial crisis has ended. Fine, let them have it. Shall we frame the moratorium so that big well-funded retailers can exploit it to avoid their obligations? Yeah, why not! How about sucking £6bn out of the property industry, and all the pensions and insurance it funds, and expecting everything to be ok? Absolutely! Meanwhile, the Government’s hyper-caution about working from home versus working from the office is another big defeat for landlords, sealed by last week’s leak of post-19 July guidance. Without office workers back at their desks, swathes of the economy cannot function.

You had one job

The common factor is that on every significant campaigning issue during the pandemic, property failed to be persuasive. It begins to look like when Boris Johnson famously said “F**k business” – the business he had in mind was property. The next fight will be over the terms of the binding arbitration bill that will replace the eviction ban. It is due before parliament this autumn. Who bets property will come out the winner? Don’t bother. You already know.

Conclusion: if property industry leaders don’t develop their public affairs skills fast, this is going to end very badly for real estate.

DRIVING THE WEEK

Co-living question time

Co-living pioneer The Collective is reported to have asked Credit Suisse to advise it on options, including a full or partial sale, merger or acquisition. Does this show the UK co-living sector has reached a moment of truth?

The co-living (flat share) sector had a difficult pandemic. Occupancy levels in the sector are said to have slumped from above 90% to 50-60%, and despite recovering are still running appreciably below the pre-pandemic trend. Covid-related pressure comes as the sector endures a shakeout, particularly in the US where the sector has grown faster than in the UK. The Collective’s reported move suggests that shakeout has now reached this side of the Atlantic. For Manchester, where co-living has been taken up with enthusiasm as (Subplot, 23 March), this raises some interesting questions.

Numbers don’t lie

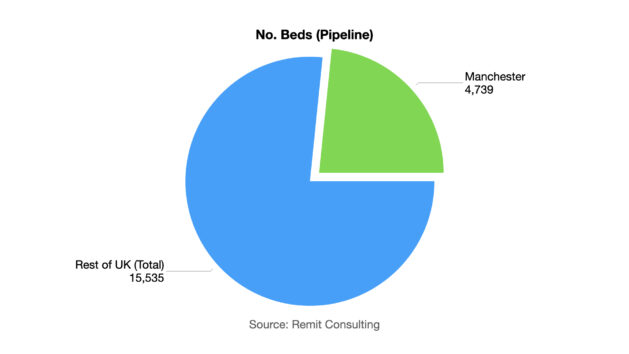

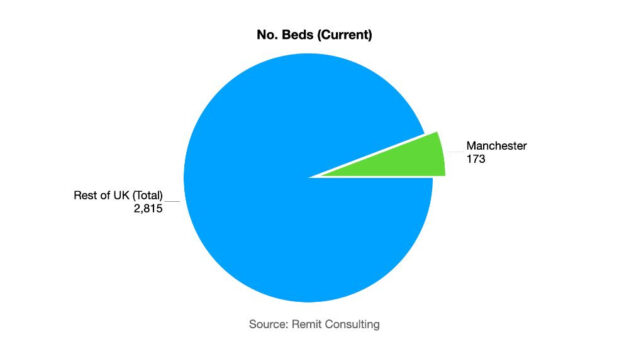

JLL data shared exclusively with Subplot shows just how rapidly co-living has caught on in Manchester. Although today the Manchester scene is a nanoscopic part of a microscopic market (173 beds out of a UK total of 2,988), it is likely to grow fast. Pipeline consents show Manchester accounting for about a quarter of the UK total, thanks to a small number of large schemes. In 2019, JLL calculated that Manchester accounted for 10% of all Europe’s co-living bed pipeline. The figure is sure to be higher today.

Manchester is disproportionately popular with co-living developers: around a quarter of the UK development pipeline is in the city, according to JLL data

Consolidation

The changes in the US co-living sector might be no more than an early-days consolidation in a chaotic startup-dominated sector, something that is about to happen here. Examples include Ollie, taken over by Starcity, which was itself taken over by Common. But there’s also evidence that some business models just aren’t working. Quarters, a subsidiary of a German business, fell into bankruptcy earlier this year, despite a $300m fundraising. Others have failed to flourish, including WeWork’s nascent co-living operation.

Gamblers

Reza Merchant’s The Collective is the mummy and daddy of UK co-living operators. It is also busy in the US and Dublin. Nobody suggests it is heading into oblivion. But questions are being asked about a model that is hugely popular with venture capital and family office investors, but still largely untested. There are just 2,889 co-living beds in the UK, remember, yet before the pandemic JLL calculated that, globally, the sector had soaked up $3bn in startup funding: that is one hell of a bet.

Today Manchester’s coliving sector is a very small porportion of a microscopic market, according to JLL data. But that will change fast

Big question

At the root of the debate is a version of the same fork-in-the-road that has played out in the co-working/serviced office sectors. Do operators rent prime space from landlords or do they own and operate their own space? We saw with WeWork how the first model can run into trouble in co-working. Simultaneously, there are those who question the co-living business model for anything much beyond cheap-and-cheerful space and say the pandemic proved their point.

Overpriced

This argument goes that management and build costs can only be met by equally high rents the market cannot stomach. Cheap competition from alternatives like hotels, Airbnb and a breed of increasingly clever hostels undermines pricing. So losses are made, costing venture capitalists who hope one day the market will rescue them. The VCs hope their story ends when they exit, and they turn a thumping profit. Critics say that day will never come because co-living is not scalable in the same way that, say, restaurant chains are, and that one day venture capital will realise its error and stop throwing good money after bad.

Deep pockets

Investors show no sign of doing this. Andrew Purdon, head of co-living transactions at CBRE, tells Subplot: “We have experienced a significant increase in enquiries from investors targeting co-living during the past six months. The typical investors seeking co-living opportunities are private equity, but we are also receiving interest from pension funds too. For both types of investor, an experienced operating partner is critical.” Faith in Manchester is still high because of the strong 20-34 age group population, healthy graduate retention and the city’s leading status in creative, digital, and tech industries.

No comparison

Stephen Beech, chief executive and founder of Beech Holdings, is even more upbeat. “If you look at our first co-living scheme of over 300 units, and the fact that it is currently 100% occupied with a sizable waiting list, it speaks for itself,” he says. He rejects the idea that cheaper accommodation will undercut co-living. “I personally do not see any correlation between co-living, hotel beds, nor short-term Airbnb. This new asset class has only just started its journey, and it has an incredibly solid future, as it is an asset class that has become extremely attractive to institutional investors. There is also heavy competition between investors to be involved on these schemes,” he says.

Conclusion: Remember the business plan scene from TV show South Park? (Phase one, collect underpants; Phase two, ?; phase three, profit!). Co-living sometimes seems a bit like this, only instead of “collect underpants” read “have large graduate population.” Turning flat-shares into a scalable business proposition was never going to be as easy as some investors believed. But it shouldn’t be impossible, either.

IN CASE YOU MISSED IT…

‘Top city’ lists to make you mad

‘Top city’ lists to make you mad

Creating ranked lists of cities is a cheap way to get publicity, and it helps boost flagging local egos. But should you take it seriously?

Salford and Chester are among the top five chicest cities in the UK, apparently. Both easily beat London, which is merely listed as ‘having potential’. This is according to research released last week by an interior design business. Meanwhile, it emerges that Manchester is one of the world’s most stressful cities, a shade below Houston, and a smidgen above Stuttgart. London is rated considerably more relaxing. This information reaches us thanks to a ranking of stressful/relaxing cities produced by a German wellbeing brand.

This is scientific

Each survey makes an ostentatious show of “scoring” cities on various criteria. Chicness, for instance, depends on a count of your boutique hotels, listed buildings and museums, online searches related to interior design, and the number of interior design courses on offer. Strangely, London’s several hundred theatres and museums scored just five cultural points out of 100, while Chester’s handful of museums and two theatres scored the city a thumping 48. The publicists, who had taken several opportunities to ask whether this outlet would be using the survey, fell oddly silent when asked to explain.

Stress test

The stressful/restful cities list comes with an even greater panoply of mathematical rigour. The researchers “compared how stressful each city’s urban environment is by looking at population density statistics in addition to air, light, and noise pollution levels, the amount of traffic congestion and weather”, then moved on to unemployment levels, local purchasing power and healthcare, along with a score to measure their response to Covid. Having lived in both, Subplot still can’t quite understand why Manchester is at number 26 (high up in the stressful cities) and London is at 69 (heading down the league, towards relaxing).

Hey look at us

If you wanted to be generous, you could call this qualitative research. However, the fact that London comes out in such counterintuitive positions in both surveys maybe tells you something significant. In particular, it suggests you are meant to talk about the research and name check the people who produced it, which is why Subplot is choosing not to reward this kind of flim-flam by mentioning the providers’ names (though by all means Google them if you’ve nothing better to do).

The Subplot is brought to you in association with Cratus and Bruntwood Works.