IN FOCUS | Developers await return of project finance

Funding for property development is likely to remain scarce throughout 2020 as banks adopt a cautious approach amid Covid-19. However, build-to-rent and other schemes with strong fundamentals could still pique backers’ interest, reports Sarah Townsend.

“We have entered a cycle of constrained liquidity in a market that was already quite dry and fewer deals are happening,” said Andrew Antoniades, executive director and head of lending at CBRE Capital Advisors, which manages the £140m North West Evergreen Fund, among other portfolios.

“Still, good schemes with good sponsors [investors] will always hold up, and the region’s proactive and well-capitalised developer community will help the market here to bounce back quicker than in other parts of the country.”

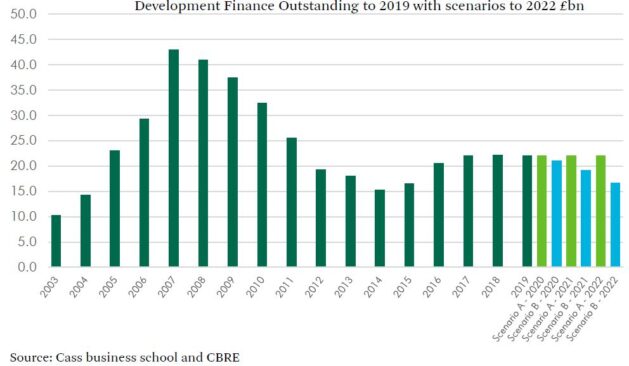

Many bank lenders retreated from the real estate finance market after the global financial crisis in 2008/9 and never returned, which caused availability of development finance in the UK to decline to an estimated £20bn in 2019, from a high of £44bn in 2008, according to research by CBRE and Cass Business School (graph, below).

In a briefing note to clients in May, CBRE forecast that development finance would either remain flat at this new lower norm, or, worst case scenario, continue to dip in the years to 2022 on the back of the pandemic.

The picture looks similar for both debt and equity financing, with equity backers including high-net-worth individuals, institutional investors such as pension funds, and local authorities, all adopting a generally cautious approach in the near term.

‘Pause and reflect’

“Traditional lenders are pausing on new deals and focussing on servicing existing borrowers, while alternative lenders may be unable to take advantage of opportunities for a range of reasons, from low liquidity and weak funding lines, to problem assets on their books,” Antoniades explained.

The lockdown since March has brought about a period of “hesitation and reflection” for most industries and development is no different, said his colleague Colin Thomasson, executive director of investment properties at CBRE Capital Markets.

“Covid-19 has come very quickly and changed the market,” Thomasson said. “While there hasn’t been outright panic like there was in 2008, developers are using the time to pause and reflect on how they might need to change their business model and projects in the short-to-medium term.

“They realise now is not the time to chase funders for solutions.”

Securing development finance is not something that is typically wrapped up and signed in a matter of weeks – it can take 6-12 months to progress discussions and structure the right deal.

Developers are therefore resisting the urge to start fresh funding discussions and are doing what they can in the interim instead, such as drawing up designs, submitting planning applications and carrying out site preparation and enabling works. “I don’t think you could describe the picture as bleak,” Thomasson said.

Thomasson, left, and Antoniades from CBRE

In fact, surprisingly few deals that were in the pipeline, or had been agreed in principle before lockdown, have been scuppered, according to commentators that spoke with Place North West.

Muse Developments, which is building the £142m Time Square retail and leisure scheme in Warrington in partnership with the council, and Salford’s mixed-use New Bailey as part of the English Cities Fund, expects to announce two forward-funding deals within the next month, each valued at more than £50m.

Both deals were agreed prior to Covid-19 but negotiated during lockdown, and all indications are that they will go ahead as planned, said the company’s regional director Phil Mayall.

“I’d love to compartmentalise, but actually it’s not lot size, or sector, or any one thing that will make a scheme more attractive to funders, but a combination of its underlying fundamentals,” he said.

“Would you get development finance for a speculative build office with no pre-let right now? Possibly not, but a phased mixed-use scheme with the right tenants in the right location might make an easier pitch.”

Another regional developer, Capital & Centric, completed a £24m agreement with the Greater Manchester Pension Fund to finance its Adair Street hotel in Manchester in April.

Again, the deal had been struck prior to the Covid-19 outbreak, but Capital & Centric’s co-founder Tim Heatley said it shows that if you can find a backer, especially an equity investor, with a vested interest in the scheme’s long-term fundamentals rather than in making a quick buck, you can secure development finance in the current climate.

“The ability to articulate the deeper, regenerative nature of projects is key,” Heatley said. “Because it’s in times like these that councils and other long-term funding partners look for solutions to economic challenges, like job creation and better housing, rather than solely financial returns.”

Capital & Centric secured £24m from the Greater Manchester Pension Fund for its Adair Street ‘Jenga’ hotel. c.Our Studio

Dan Batterton, head of build-to-rent at asset manager Legal & General Investment Management, agreed that even traditional lenders have shown a willingness to help customers out at a difficult time.

“We have been negotiating a debt facility for a residential scheme and the bank told us, ‘provided the building site’s open, we’re happy to lend’. So, there was an initial pause in the first few weeks of lockdown but once construction resumed mid-way through, the deal completed with zero amendments to our pre-agreed terms.”

Beds-and-sheds

Residential schemes, especially build-to-rent and PRS, are among the most attractive and low-risk propositions for debt and equity funders at present, Batterton added. He forecast “a very busy third quarter” for development finance in this sector.

“People still need somewhere to live, even if shops, bars and restaurants are closed and the future of office space is uncertain. People may have put plans to buy homes on hold, which has helped rental prices hold up.”

Industrial and logistics has also seen an uptick in demand during the pandemic. “Its all about beds and sheds,” said Guy Butler, co-founder of developer and asset manager Glenbrook.

However, aside from those sectors and small-scale deals, funders are cautious of entering new project finance negotiations and are preferring to tie up deals already on the table, he added.

“Most of the activity taking place is in the sub-£10m category, and many banks seem to be deliberately pricing themselves out of the market by offering finance on less favourable terms with interest rates of 3% and upwards.”

Another observation is that some banks’ relationship managers are being moved over to form NPL (non-performing loans) teams, in preparation for an anticipated rise in financial distress in 2021. This is both alarming and frustrating for developers as their usual banking contacts are working on something other than project finance.

Mayall is regional director at Muse

Similarly, the willingness to help that Batterton spoke of may also be falling short. In supporting existing property clients and commercial occupiers by offering a range of incentives and waivers at an uncertain time, lenders may lack the time or inclination to start up conversations about future developments.

Heath Thomas, regional director of real estate finance for the North at NatWest bank, said: “We are proactively supporting our customers in the commercial real estate sector, through access to government schemes and measures such as capital repayment holidays, covenant waivers and extension facilities for a set period.

“We are reviewing this support on an ongoing basis to…help customers through the disruption caused by Covid-19.”

Right finance for right scheme

Across the board, there is greater scrutiny of funding transactions and this will continue in the months ahead. Pipeline deals are being called back to investment committees for more due diligence, said Thomasson, while other deals are taking longer to complete or may have to be restructured or renegotiated due to lower valuations.

This in turn could put pressure on developers to revise business models and increase equity-to-debt ratios.

The key difference between the health-driven economic disruption now and the credit crunch-provoked financial crisis in 2008 is that there is money available, but the cautious approach adopted by the industry is making it harder to get hold of.

Development finance could be muted for some time yet and there will be intense scrutiny of deals. But, as Mayall said, for the right projects, the money is there.