Commentary

COMMENT | How does Warrington cope in a downturn?

With the launch of the Warrington Annual Property Review postponed until later in the year, we looked at historic data from the past 22 years to explore how resilient the town’s economy is to economic shock, writes Vince Sandwell, managing director of BE Group.

The end of April is when BE Group would usually have presented its annual market review to around 200 business leaders, property professionals, investors and developers.

In lieu of the event, this article examines activity in Warrington across the office, industrial, retail, leisure, housing and property investment sectors, based on our compiled data, and compares the current situation with whole sectors temporarily shutting down with the financial downturn that began in 2008.

Offices and industrial set the scene

If we look at just these two sectors in Warrington since 1999, the combined take-up of floorspace recorded in the industrial and office sectors exceeded 25m sq ft, of which around 21m sq ft of industrial and warehouse space, and 5m sq ft of office space, was let or sold.

Annual take-up of industrial and warehouse floorspace averages around 1m sq ft, while a quarter of a million sq ft of office space on average is let or sold each year.

Warrington continues to be a place where businesses want to locate, expand and do business, but how does that compare with Warrington’s stock today, and the performance of that stock?

There is currently just less than 20m sq ft of industrial floorspace in Warrington, and less than 5% of that was vacant when BE Group last carried out an assessment. For offices, there is around 5.5m sq ft of built stock. Four years ago, the vacancy rate was running at just over 10%, but that level has fallen progressively in the past few years.

On the face of it, it is a healthy position to have less than 10% of stock vacant. However, the reducing stock will mean less choice if development does not keep pace with demand, and industrial in particular could suffer.

The effect of a downturn

With the outbreak of Covid-19, the trend seen by those long-term take-up figures is unlikely to continue, at least in the short turn. We have never seen the town centre and certain business sectors effectively close down, and the effect cannot be predicted at present.

To try to understand Warrington’s resilience to such crises, we can, however, look back to the recession in 2008/9 and see the local economy responded in the office and industrial sectors.

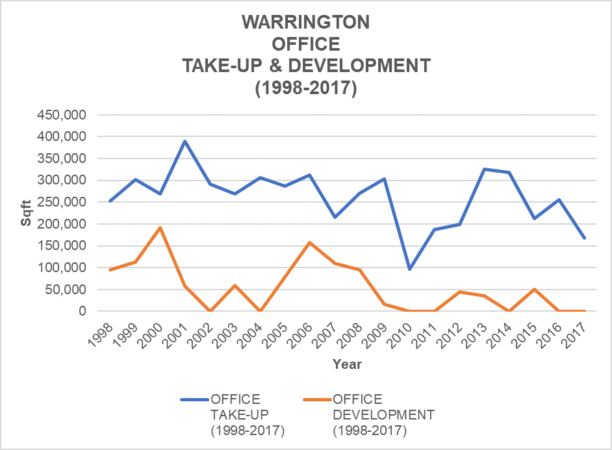

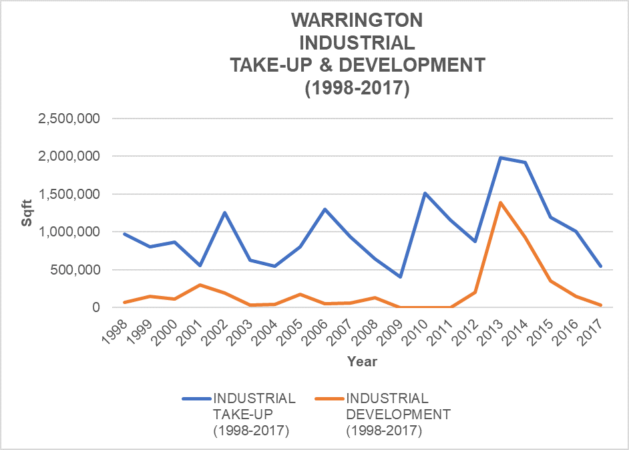

The following graphs show the transactional activity in both sectors since we started recording deals, set against development activity over the same period.

Source: BE Group

The volume of office floorspace transacted fell in a single year from over 300,000 sq ft to under 100,000 sq ft from 2008 to 2009 – a direct result of the downturn. Prime rental levels tumbled by up to 30% and office vacancies rose to around 800,000 sq ft, the highest in several years.

At the same time, new office development stopped completely and has remained at a low level until the present day – the exception being years that saw the construction of customised offices on a design and build basis.

The recovery in floorspace let or sold was swift, with take-up doubling the following year and, by 2013, achieving the second highest level of take-up since 1998. Recovery of value was not as swift. Companies wanted to move but not at any cost, and it was a buyer’s market. Rent-free periods and other incentives on offer grew and rents remained suppressed.

It was only as vacancy levels dropped that rents began to return to levels previously seen.

Perhaps the biggest effect of the recession was the lack of confidence in new build among developers and investors. Ironically, this has had a negative effect on take-up. As supply dries up, transactions have again fallen.

The industrial market hit a similar low in 2009, but take-up had already been falling for a couple of years due to a lack of any meaningful development of high-quality modern space.

Source: BE Group

In 2010, the recovery was more dramatic than in the office sector, with floorspace transacted growing from under 500,000 sq ft to more than 1.5m sq ft in just one year, led by renewed demand and additional supply from space vacated during the downturn. The pattern since then has been one of supply and demand following the same path.

Looking ahead – diversification is key

One of Warrington’s greatest strengths is the diversity of its business. In 2019, the town had the fourth highest proportion of private sector jobs of any town or city in the UK, according to research by think tank Centre for Cities. The same research body in 2018 ranked the town as the sixth most successful town or city in attracting jobs and reacting to a changing labour market.

Based on employee numbers, representation in the transport and distribution, energy and utilities, business administration and professional, scientific and technical industries in Warrington are well above the UK average, according to the research, while manufacturing, accommodation and retail fall below the UK average.

Some sectors will prove more resilient in the current economic lockdown. The distribution sector will keep food, medical supplies and other essential goods moving. Warrington has a strong energy sector, based around United Utilities, the nuclear industry and, increasingly, the renewable energy sector. Just before lockdown, global engineering company Jacobs announced the takeover of Birchwood-based nuclear energy firm Wood Group and said the deal would create 300-400 highly skilled jobs in the town.

Less resilient are the retail and leisure sectors, and with around 17,000 people employed in those sectors, Warrington’s future is less certain. Already there have been casualties – the largest in Warrington is the Debenhams’ decision not re-open in Golden Square – and other high street shops face an uncertain future.

Still, Warrington town centre is diversifying, led in no small part by the council and its regeneration company Warrington & Co bringing new uses into the town. A string of residential, leisure and office units are planned particularly within the Time Square development, while the BID team is bringing improvements to the town centre and Warrington is vying for up to £25m from the Government’s Future High Streets Fund.

A key difference between now and the recession after 2008, when the Government significantly reduced expenditure and business support, is that Government and councils are making short-term funds available in to support businesses during and after lockdown.

Last month, Warrington Council leader, Cllr Russ Bowden, announced that £24.3m had been distributed by the council to local businesses – representing around 67% of the town’s allocation of Whitehall’s Covid-19 business support grant.

The immediate future is uncertain for the whole national economy, but Warrington may be better placed to recover. Only time will tell.

Vince Sandwell at the launch of the 2019 Warrington market review