The Subplot

The Subplot | Beds, sheds and shopping centres

Welcome to The Subplot, your regular slice of commentary on the North West business and property market from Place North West

This week: beds and sheds are every investor’s hot take on the 2021 property market, but is the lack of viable alternatives clouding judgment? Subplot takes the temperature of the logistics and BTR scenes. Meanwhile, does anyone want to buy the North West’s distressed shopping centres, and can the Greater Manchester Spatial Framework return from the dead?

WAKEY WAKEY

Manchester BTR’s big sleep comes to an end

Manchester BTR’s big sleep comes to an end

The pandemic anaesthetised most of the property market in 2020. But what might have been a coma for some sectors is being touted as barely a snooze for Manchester’s build-to-rent market. That’s what everyone hopes, at least.

Another week, another Manchester build-to-rent scheme secures planning permission. The latest approval sees Packaged Living and investment manager Fiera Real Estate preparing the way for an £80m, 350-apartment project at Heyrod Street in the soon-to-be-booming Piccadilly East district. The scheme joins a queue of 9,899 BTR units with planning permission in the North West, up 40% on 2019, according to just-published British Property Federation/Savills data. Units under construction totalled 7,866, down 23% on 2019 as the market levelled off after a sizzling few years. Subplot toured the Liverpool BTR scene earlier this month (see Subplot, 2 February). How about Manchester?

They love it

Investors and operators from the UK and overseas continue to cruise Manchester for opportunities. Vancouver-based QuadReal Property Group has just acquired the Granby Row scheme owned by fellow Canadian operator Realstar Group, part of a transaction involving its seven London buildings and the Uncle BTR brand. Another Canadian business, AimCo of Alberta, is powering up its UK BTR operations, including a Manchester site acquired through a deal with Ridgeback. Hefty international votes of confidence like these suggest a market with nothing much to worry about.

But coronavirus

Yet there is a stone in the shoe, and nobody can quite forget it. While everyone Subplot spoke to is convinced to the point of zealotry that Manchester BTR is a winner, a clear vision of the future is distorted by a surge in supply in a still-young market, and by a weird last 12 months. This makes it hard to know what the occupational market will look like when it wakes up, post lockdown. Zoopla data seems to show Manchester houses renting appreciably faster than Manchester flats, which suggests demand is heading out of town. At its most brutal, this nagging doubt crystallises into the question ‘will BTR residents flee as the tumbleweed blows down Deansgate?’

Safety first

Adam Brady is executive director at developer HBD. Together with Capital & Centric, HBD is behind Manchester’s £250m Kampus scheme, where the first phase of 533 BTR apartments comes to the market in March. Brady sees many BTR tenants rolling over existing arrangements for safety-first reasons. This makes it hard to judge what they will do when they eventually have a free hand. Brady says: “The number of transactions has been ridiculously low, and we’ve got issues like the disappearance of overseas students, which is going to have an effect on city centre BTR. I have a lot of faith in Manchester BTR but low market activity makes it so hard to judge.” Brady is not alone in wondering what the future holds.

Enough with the guessing

This doesn’t have to be about gut feeling and hunches. Data sets compiled by Urbanbubble and shared exclusively with Subplot, show that the much talked-about resilience of the Manchester BTR sector is a fact. Rental deals in 2020 were at least as numerous as in 2018 and 2019 and, in fact, during summer 2020’s unlockdown the number of rental deals was appreciably above that recorded in the previous two years. The August 2020 peak was a shade under 1,000 deals, sharply up on the 600-800 of more normal years, a surge apparent across the UK BTR sector. The market bottomed out at 200 or so deals in the dire month of November 2020, making it only a little worse than usual. Meanwhile, Manchester BTR rents over the year to Q4 2020 rose, on average, by 5.5%. For comparison, buy-to-let apartments had a miserable year as competition among panicked landlords raged. This explains the weekend’s depressing Zoopla data showing a 0.9% drop in Manchester rents.

Keep the faith

Michael Howard, managing director at Urbanbubble, explains: “We had unprecedented BTR supply coming all at once, while Covid meant amenity was degraded, the city centre was shut and service levels were down, and yet West Tower was all but fully let by the end of the year with hundreds of enquiries for the five remaining units, so there is demand for high quality living.” Howard’s conclusion is: “Keep the faith. We’ve had a year or two of wobbles, but by 2022, the city centre market will have expanded again.”

Bets on beds

Deals like Cheyne Capital’s backing of Mulbury’s £32m plans for Manchester New Cross show how upbeat the market is feeling, says Tom Sinclair, head of BTR investment at CBRE. Local providers like Renaker, Salboy and Vita-Select inspire confidence, and quality product is what everyone wants. German investor ECE buying into the 995-unit Dandara scheme at Chapel Wharf, and Pension Investment Corporation’s £130m backing of 500 units at Victoria Station, are not whims or accidents but cold hard bets on Manchester beds. Yields are stable at 4.25% and when the transactional market in fully let BTR blocks resumes, this could rapidly compress to 4%.

Nobody wants to go mad

Sinclair says: “There are a lot of well-informed investors, and there is no drying up of capital, but the pandemic has shown the value of investing in only the best locations.” That final point is the key because what gives investors the best feeling of all is that nobody is rushing to generate new supply: the flow is steady, not hectic, and site choice is cautious not bullish. Perhaps three or four BTR funding deals are likely this year because investors have every reason to go slow. Who, after all, wants to have an empty speculative BTR block on their hands in crazy 2021, or potentially crazy-ish 2022?

DRIVING THE WEEK

Amazon goes shopping

Amazon is on the brink of taking an 800,000 sq ft warehouse in Knowsley. But is the online giant’s activity making it hard to see what’s really going on in the shed sector?

Long rumoured, and now believed to be reaching a conclusion, Amazon is understood to be poised to take PLP Property’s K800 site. The 37-acre plot close to junctions 4 and 5 of the M57 and A580 East Lancs Road intersection, is one of the best in the neighbourhood. Joint agents B8 Real Estate and JLL declined to comment, but if true, it is great news in a flourishing sector.

Hoovering up

Nationwide, Amazon is reputed to have as many as 75 requirements as it races to meet its one-day delivery commitment to Prime customers. Many are for smaller urban logistics hubs. In the North West (and Midlands), a super-tight pipeline of potential big box warehouse locations appears to be prompting some occupiers to grab almost anything that looks plausible. Amazon, XPO and other third-party logistics operators have been named. Subplot was told: “They’re hoovering up anything of size, not for an immediate requirement, but just in case they need them later in the year. They are spooked by surging e-commerce demand and a shortage of warehouse supply, and they want to get their hands on space to feel sale. If you have a balance sheet like Amazon’s then you can do that.”

Demanding questions

Everyone uses a different number but, allowing for deals already in progress, there is probably around 11m sq ft of big box demand in the North West. Surely enough to float every scheme currently stuck in planning, or making its way through the development pipeline? Perhaps, but an investment boom is already compressing yields in the North West from 5.25% to 4.25%, and in London has forced yields to heated figures like 3.5%. This sucks in a lot of money that needs to be spent building. And with a finite supply of top-class motorway junction land – much of it already spoken for – inevitably this means a growing share of the investment funding lands on secondary or second-class sites.

Wait a moment

So long as yields keep compressing, everything looks peachy from the buyer’s point of view. But occupiers look at the very same yield-compressed warehouse and see a secondary site with a toppy rent. Canary-in-the-mineshaft areas like Ellesmere Port have bounced back into play because investors are mad keen. One developer active in the Ellesmere Port area told Subplot: “We’ve had a lot of interest from investors, but for every four or five investor calls, we get two or three occupier calls, and that difference is something people haven’t yet noticed.” Not everybody shares this experience, but Subplot has spoken to plenty of developers that understand the sentiment and think ‘Peak Shed’ will arrive much sooner than many investors want to believe.

How does this end?

All bubbles end the same way, with a bang. But don’t worry, it is not imminent. The fundamentals of the logistics sector are still demonstrably strong. According to Knight Frank’s model, every extra billion pounds of online retail sales require 1.36m sq ft of warehouse space. That will keep things afloat for a long time yet. So while demand isn’t about to evaporate, it might turn out to be uneven or perhaps a little magnified by panic-buying of floorspace. Marginal locations will be the first to cool when the market loses a little of its heat. The conclusion? Andy Pexton, North West head of industrial at JLL, says: “Quite a lot of out-of-area funds and developers think the North West is an area where they’re missing out. It’s an opportunity for then. The bubble will stabilise, but I don’t think we’ll see the bubble burst.”

IN CASE YOU MISSED IT…

Debt is dangerous

Debt is dangerous

The directors of Barton Square, the 340,000 sq ft leisure and retail complex next to the Trafford Centre, are now in talks with potential buyers about a £50m-ish sale. It comes as the market begins to digest the implications of a heavily indebted retail property sector.

The centre’s appeal, according to the vendors, is a good mix of leisure and resilient retail, plus space yet to let (Subplot’s back-of-the-envelope calculation suggests about 120,000 sq ft). This provides scope for food and beverage operators, and a chance to rebalance the tenant profile to meet post-pandemic needs. Savills is advising.

Loadsamoney

The price tells the real story. Former parent Intu Properties’ most recent annual report describes Barton Square’s redevelopment as a £75m project, so a lot of presumed value has gone missing. The report also reveals Barton Square’s two debts maturing this year: a £25m term facility, and a development funding facility also of £25m, of which £19.9m was drawn down by 31 December, with a further £5m required this year. It may be no more than a coincidence that this adds up to £50m.

Complexities

Subplot sought clarification from Barton Square Ltd on the loans’ status – whether terms have been breached and if so how far, but nothing was forthcoming. KPMG, advising on the disposal of former Intu assets, has already said the majority of centres are worth less than the debt secured on them. There may be other complexities at Barton Square. The Intu report adds: “Under the terms of the group’s acquisition of Intu Trafford Centre from Peel in 2011, Peel has provided a guarantee in respect of Section 106 planning obligation liabilities at Barton Square, which at 31 December 2019, totalled £13m (2018: £12.4m).” It might make sense if Peel was the buyer, which would be interesting.

A price to pay

So far, lenders have been forbearing on retail debt. Only a handful of centres have fallen into administration, including Preston’s St Georges and Ashton-under-Lyne’s Ladysmith. But the mood is hardening. NatWest has appointed PwC to make the best of loans secured against 25 centres, and other lenders will not be far behind. Barton Square is new, well located, and provides its aspiring owners with scope to refashion the mix to suit a changed world: it may come out of this crisis looking good. Others may not come out at all.

IN CASE YOU ALSO MISSED IT…

Stoxit and the Greater Manchester Spatial plan

Stoxit and the Greater Manchester Spatial plan

Stockport’s self-isolation will not kill the idea of shared strategic planning in Greater Manchester. But it raises questions everyone would have preferred to ignore.

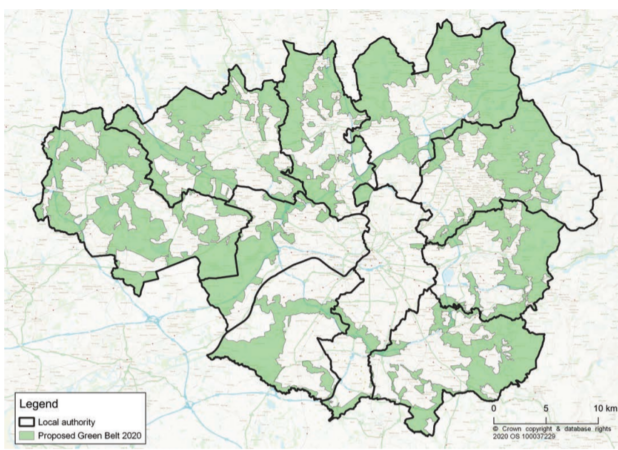

Late last year, Stockport pulled out of the Greater Manchester Spatial Framework. The plan’s final version envisaged 180,000 new homes, a loss of 4,600 acres of Green Belt, about 44m sq ft of new industrial floorspace and 26m sq ft of new offices, all by 2038. The remaining nine Greater Manchester boroughs are now pursuing their own strategy through new mechanisms.

Plan-IX

The consensus among observers and politicians is that the new ‘plan of nine’ will not look wildly different to the existing GMSF. But the danger, and it is not just a theoretical danger, is that ‘Stoxit’ has broken the three-decades-long taboo against endangering GM unity. After all, Stockport wasn’t the only borough to get burned on the Green Belt issue. Greg Dickson, planning director at Barton Willmore, says: “Why is it in the interests of the northern boroughs to pursue the existing plan, which aided Stockport, when Stockport is no longer a part of it?” Boroughs haven’t yet started to peel away, but they could. The mechanisms exist and in some cases are being set in motion (see Trafford’s new local plan process).

You had one job

The second question nobody wants to ask is what this masterclass in political failure tells us about the mayoral process in general, and the mayor in particular. Let’s remember that before Andy Burnham was elected, all 10 boroughs had agreed a plan, which he then junked. It’s all history now, but there were alternative approaches not taken. Others point out that the moment the plan moved from grand strategy to detailed site allocations it was bound to get mired in hundreds of toxic local disputes. Jeremy Hinds, planning director at Savills, says: “The GMSF wasn’t too ambitious but it was too broad. There were a vast array of things it wanted to engage with that created controversy on too many fronts.”

Carry on regardless

Something like the GMSF is unavoidable. Says Hinds: “Like it or not we need this plan. Liverpool is getting one, soon Leeds and West Yorkshire, Manchester needs this. The future of Greater Manchester attracting inward investment depends on a plan that covers all boroughs. That nine of them are coming together indicates a high level of agreement, and it is a positive sign.” The big bonus of the new approach is that the GMSF is now off the agenda for the May mayoral elections. Big sighs of relief all round, but at the price of abdicating political leadership.

The Subplot is brought to you in association with Cratus, Bruntwood Works and Savills.

Rents have gone down, including at West Tower where tenants have been given discounts.

By Mitch