Whittaker spends £80m on Intu shares

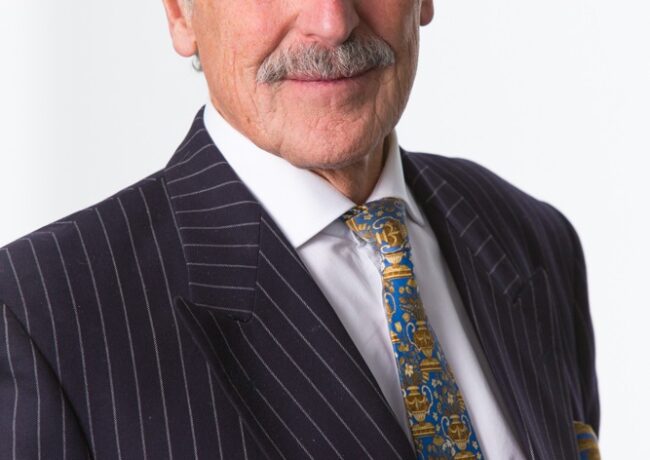

John Whittaker has added 24.7m shares to his stake in Intu Properties at a cost of £80.2m, taking his total holding in the company to 25.1%.

Whittaker has been on a share acquisition drive since the beginning of March, with £3.4m spent in one transaction on Wednesday 11 March and a further £1.7m on Thursday 12 March.

At the end of April he spent £4.9m on shares, and then a further £7m in five transactions in May.

The recent acquisition on 11 June has taken Whittaker’s holdings in Intu from 22.9% to 25.1%, a total of 336,460,751 shares.

Whittaker is chairman of Peel and non-executive non-independent deputy chairman of Intu, owner of the Intu Trafford Centre, since 2011.

Intu Properties is valued at £4.5bn.

According to a stock market analyst, Whittaker’s various acquisitions are opportunistic and reflect the recent weaker performance of Intu shares, rather than a strategy of increasing his holdings as a prelude to a bid for the company.

Intu shares have been underperforming the wider real estate market for the past six to eight weeks.

Company assets include five regional centres: Trafford Centre, Lakeside, Metrocentre, Braehead and Cribbs Causeway. There are also town and city centre malls including Manchester Arndale, St David’s, Eldon Square, Watford, Victoria Centre, Midsummer Place, Chapelfield, Uxbridge, Potteries and Bromley.

Shares in Intu were down 0.8p this morning to 312.1p.