Tritax takes £254m stake in DB Symmetry

Tritax Big Box REIT has conditionally agreed to acquire a majority stake in warehouse developer DB Symmetry for £254m, paid in a mix of cash and shares.

DB Symmetry is one of the largest privately-owned developers in the UK, and was formed out of a 60:40 joint venture between clients of Delancey and Barwood. The business is led by four directors; Andrew Dickman in the Manchester office, and Richard Bowen, Henry Chapman and Christian Matthews in Northampton.

DBS HoldCo, a wholly-owned subsidiary of Tritax, is set to acquire 87% of DB Symmetry, through a payment of £202.4m in cash, equalling 69.1% of DB’s equity value, and £52.6m in shares, equalling 17.9% of the value.

The four DB Symmetry directors hold 40% of the business, while the remaining 60% is owned by DV4 Properties, Delancey’s fund which invested in the business on behalf of clients. The deal with Tritax will see Delancey bought out of the business.

Dickman, Bowen, Chapman and Matthews will all retain a 13% interest in DB Symmetry, through shares in the DBS HoldCo, representing a £38.1m value.

DB Symmetry as a whole is valued at £370m, with a portfolio of over 2,500 acres with the potential to deliver 38.2 million sq ft of industrial and logistics space. Currently, five assets totalling 600,000 sq ft are currently under construction, all due for completion within the next six months. Tritax Big Box REIT has an existing portfolio of 29.8 million sq ft.

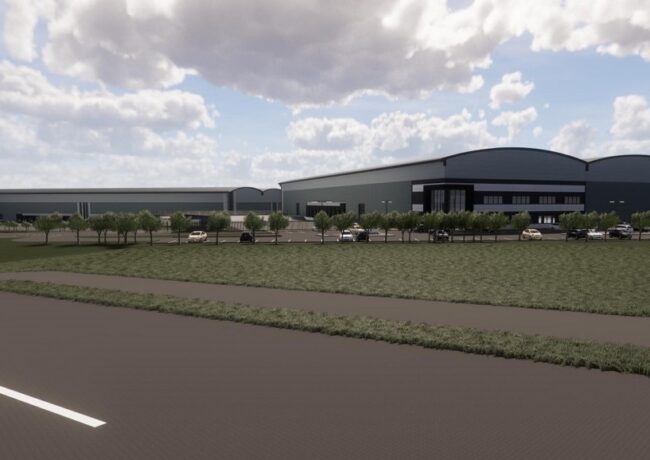

In the North West, DB Symmetry is working with Pochin’s in a joint venture to deliver Ma6nitude, a potential 600,000 sq ft industrial park in Middlewich, Cheshire. A planning application for a 1.6m sq ft development in Wigan is also under consideration, as well as a masterplan with Liverpool City Council for 1.6m sq ft at Speke.

In September last year, Tritax agreed to forward-fund a 360,000 sq ft warehouse in Haydock, being delivered by Bericote for an occupier understood to be Amazon. The fund also owns warehouses across the region, including in Manchester’s Trafford Park, and at Carlisle Lake District Airport.

In order to fund the acquisition, Tritax is proposing to raise approximately £250m through a share issue, releasing 192,291,313 new ordinary shares at an issue price of 130. The deal is set to complete in February.