The Subplot

The Subplot | Birkenhead, Liverpool offices, student housing

Welcome to The Subplot, your regular slice of commentary on the North West business and property market from Place North West.

THIS WEEK

- Birkenhead’s new 2040 Framework promises 21,000 new homes, but it means some brave decisions by Wirral Council. Has it got the bottle?

- The Liverpool office market has hit the bottom. And that means the only way is up.

- A variation on student housing is heading for Lancaster and Liverpool.

EYE-ROLL ACROSS THE MERSEY

Birkenhead’s Big Chance

Birkenhead’s Big Chance

Birkenhead’s new strategy document means less reliance on Peel’s Wirral Waters, a lot more realism, and a serious effort to unlock residential markets by 2040. Can it work?

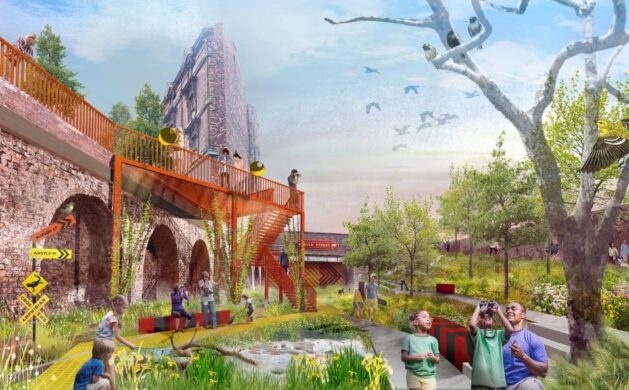

Wirral Council has begun an eight-week consultation on its Birkenhead 2040 Framework. The document, which you can read here, envisages up to 21,000 new homes, an improved Mersey waterfront and a new park (pictured, above) on the former Dock Branch railway. The document slots into Muse and Wirral Council’s plans for 150,000 sq ft offices on Birkenhead’s Milton Pavements site, another 130,000 sq ft offices in the commercial district, and improved retail space. Together this amounts to the biggest rethink in Birkenhead in three generations.

About time, too

Birkenhead has been left behind. But there have also been self-inflicted wounds. A powerful allergic reaction to anything that looks like cross-Mersey co-operation screwed up the prospect that Birkenhead could become the Salford of Merseyside. The bigger self-inflicted wound has been pinning hopes on Wirral Waters, Peel L&P’s mighty but glacially slow-moving plans for 5m sq ft of offices and 15,000 apartments (in skyscraping towers) on the East Float and Vittoria Docks.

We’ll all be dead

The clock began ticking on Wirral Waters with planning permission in 2010. The project has now missed a couple of economic cycles. Consent for 340 modular homes, as part of a joint venture between Peel and Urban Splash, was granted planning permission in 2020 and the first of the two- and three-storey row houses will be ready to view this spring. Richard Mawdsley, development director at Wirral Waters, says: “Construction on the first three residential projects; Legacy, Belong and the Peel/Urban Splash joint venture project will begin this year. All 1,100 waterside homes which will be built as part of these first three developments are on track for to be delivered by 2025.” It is a start, and very welcome, but at this pace of annual completions the full 15,000 units will take until 2065 or later to chalk off in full. Most of us will probably be dead by then. The council wants to move a bit quicker than that.

Wrong type of homes

As well as diversifying away from Wirral Waters, the council’s framework tries to diversify housing away from high-rise one- and two-bed apartments of the kind Peel seemed to have in mind. “Why would you want a small flat in Wirral Waters that is the same price as a nice house in Hoylake?” Subplot was told by one baffled Wirralite. Not everyone is so blunt, but the sentiment is widely shared.

Homes not units

This poses a serious challenge, as Nicola Rigby, principal at Avison Young and one of the framework’s begetters, confesses. “How do you credibly build at density without it being apartment led? That is an exciting challenge, something that, if we get it right can complement Liverpool’s residential ambitions,” she says. If they get it right it will also help Peel by lifting land values, without which Wirral Waters’ skyscraper plan is forever becalmed.

Knock ’em down

This means literally confronting some problems with a wrecking ball. The flyovers to Queensway Tunnel blocking redevelopment around the Central Station and Hind Street area will be removed thanks to an £8.3m investment from the Liverpool City Region Combined Authority’s Transforming Cities Fund. Wirral Council spent £2m buying the 70,000 sq ft House of Fraser store, and is now knocking down Milton Pavements. Alan Evans, Wirral’s director of regeneration and place, says these dramatic interventions are the council’s answer to doubters. “Look, already we’ve taken control of the town centre, there are demolitions, so we’ve started on delivery,” he says, betraying only mild exasperation. “We’re pulling together a team that can really start to increase delivery.” The new mood is a brave breach with the past.

Together, forever

Edging away from a Stockholm-syndrome relationship with Peel is also brave. Evans insists Wirral Waters is still part of the mix but also stresses that the new framework is about having more legs to stand on. “Hopefully this is a strong plan for family homes and getting the heart back into the town centre, alongside the infrastructure work, like the flyovers, that lifts land values,” he says. Andy Delaney, Birkenhead-resident and director at AspinallVerdi, is encouraged. “Peel are still embraced but there are now other strings to the bow, that’s the strength of the framework.”

All aboard

Early signs are that the new strategy has political buy-in. Last September the council moved from a leader-and-cabinet to a committee model in which all parties and all councillors share in decision-making. Birkenhead/Wallasey Momentum’s influence is therefore diminished. It also helps that everyone understands the plan to build in Birkenhead is the quid pro quo for not building on leafy green-belted West Wirral. The result is that the framework has (or appears to have) wide support and understanding.

Conclusion: for decades Liverpool and Wirral have been exchanging eye-rolls across the Mersey. The truth is that politics on both sides has been seriously malfunctioning, with leaders addicted to headline-grabbing but undeliverable magic bullets. A dose of realism on the Wirral side is welcome.

DRIVING THE WEEK

Liverpool’s missing numbers

Liverpool’s missing numbers

It may be April 2021 but semi-official data on Liverpool’s city region office market in 2020 still hasn’t been published. When the numbers come they will be upsetting but not disastrous.

Almost-final drafts of Professional Liverpool’s property group’s annual office take-up figures are now circulating after months of debate among city agents over what gets included. The big reveal will give us the detail, but it is already clear that across the city region office take-up is down by about 50% compared to 2019, and in Liverpool’s commercial core it has fallen even more dramatically, ending up around 150,000 sq ft.

Rejoice

Comparisons with 2019 are painful, but a comparison with 2010 is instructive. That was also a miserable year, with commercial district take-up of just 207,000 sq ft. But in many ways 2021 is in a better place than 2010. There was a lot of empty Grade A office space to get rid of in 2010 (178,000 sq ft) and it was a drag on the development market for years to come. That is not true today: in 2021 a shortage means rents of £22-23/sq ft are being quoted on refurbished lease renewals.

The next generation

It is also worth remembering that 2010 was the year in which, however bleak it felt, Liverpool’s office market was reborn. It was the first year in which serious growth in the city’s creative, media and digital sector was apparent. Take-up in this sector rocketed between 2009 and 2010, and by year-end the creative sector accounted for one in every eight sq ft let in the city. The current lull may conceal similar growth in the life sciences sector in 2021.

Don’t mope

Stuart Keppie, partner at Keppie Massey, presided over production of the 2010 report and remembers it clearly (disclosure: as does Subplot’s author, who wrote it). Keppie is not disheartened because it is always darkest before the dawn. “We must be approaching a tipping point, because there is no Grade A space available. Developers have to be looking, because they have an opportunity,” he says. “Perhaps that opportunity is out of town, given reluctance to return to public transport. Perhaps it is for a building that caters to smaller-suite occupiers.” The next few months would be the perfect time to act.

IN CASE YOU MISSED IT…

Student housing goes back to the future

Fund manager Moorfield Group and We Are Kin have formed a partnership to revive a very old kind of student housing across the UK. Liverpool and Lancaster are early targets.

We Are Kin says it is a business focused on “redefining student digs” and its £50m proposal is as drenched in mid-century chic as the vinyl avidly collected by its cool young residents. The aim is to create houses of five-to-eight students each (pictured, above) in a portfolio of, initially, around 1,000 beds. This is not normal purpose-built student accommodation (PBSA). In fact it is very old school, and that is entirely the point: for investors like Moorfield it represents diversification in their “beds” portfolio.

Yet more investors

The plan comes as more conventional PBSA in the region hoovers up investment. Last week Liverpool’s Carpenter Investments agreed a £27m refinancing deal with Lloyds Bank on the back of its 355-bed Hardman House student housing scheme. Simultaneously Aventicum debuted in the student housing sector, acquiring a 2,281-bed student housing portfolio, including a site in Manchester. It paid £132.5m in a deal with Unite Group.

Taps on, plug out

Investors have convinced themselves that student housing has been resilient through the pandemic, perhaps giving themselves the benefit of the doubt rather quickly. After all, its been a bumpy ride and students (and their parents) may have learned lessons. What investors certainly have right is the UK’s favourable university-age demographics and rising university participation rates. Data just released by Cushman & Wakefield shows developers are building steadily, adding a net 21,000 beds in 2020/21. They have planning permission for another 60,000. But a quarter of all direct-let beds needed incentives or discounts during the year.

New concepts and lots of new money bode well, but there is a fine line between confidence and uncritically believing your own sales pitch. By September, as another academic year begins, we will learn in which of those the market has been indulging.

The Subplot is brought to you in association with Cratus, Bruntwood Works, Savills and Morgan Sindall.

Good article, maybe a more indepth one for the future comparing Peels Mersey Waters with Manchester Waters and drawing a comparison as to why so little development in the former. I believe all the current offices in Princess Dock and Wirral were built before Peel took over and still nothing of great note. The situation with Offices in Liverpool in particular reflects an earlier post of mine about the “Brain Drain” in Liverpool, it seems it is easy for us to travel to Manchester for the new jobs there, but it is apparently difficult to travel the other way this also applies to the airports. To answer a reply about Liverpool having a high ratio of Civil Service jobs to commercial ones, perhaps this is because of the lack of commercial jobs here. How long the “Brain Drain” can continue may depend on the new civil service allocations which are being muted for the country,but something must be done to create more stimulus here.

By Liverpolitis