Savills: Investors venturing up risk curve

Savills’ latest annual property finance presentation, delivered in Manchester this week, asked whether there is too much competition in the lending market.

Download report below

The advisor identified 46 new entrants to the lending market over the last 12 months, totalling 150 new lenders in the last three years. The firm indicated this competition has sparked a focus on loan syndication for the bigger ticket deals, with French and Japanese banks increasingly active as well as other nationalities.

Jonathan Langstaff, valuations director at Savills in Manchester, said: “The negative sentiment of previous years has been left far behind. We are seeing the interest in identifying lending opportunities in Manchester and the North West mirror the wall of investment equity targeting the region, with a range of both UK and international banks and institutions in the market. The lending community faces the same challenge as investors in that the availability of ‘dry’ lending opportunities is limited relative to demand.

“However, opportunities for lenders willing to venture higher up the risk curve are plentiful with newbuild development activity and major refurbishments being proposed and brought forward across all sectors. In the office sector in particular purchasers are seeing investments with shorter term leases as an opportunity rather than a threat. It remains to be seen how far the lending community will support this sentiment, but it is clear that in most cases there is a positive view of the property sector.”

Savills presented a case for a finance market that is neither too hot nor too cold. Whilst there has been a jump in overall lending by 50%, the debt mountain is reducing and real estate lending is presenting higher returns when compared to other asset classes. Yields are low but so is the cost of money, indicating there is scope for yields to go lower. Savills did however note that whilst LTVs (loan to value ratios) for senior debt remain low, the addition of mezzanine debt can see LTVs rise from circa 60% to over 80% – levels seen in 2006.

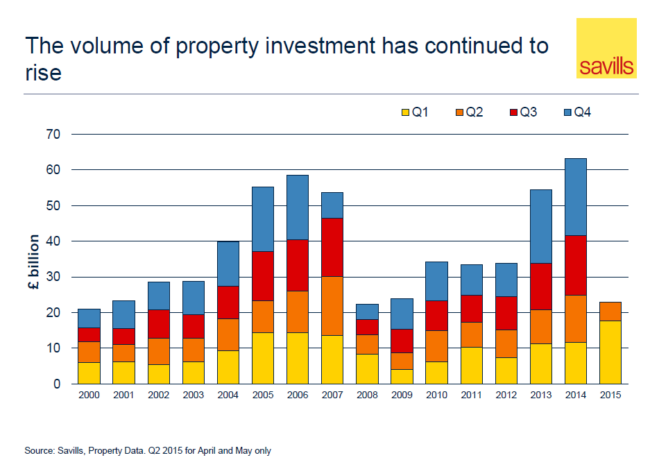

Savills notes that further to its 2014 prediction for regional recovery, the commercial property markets have seen increased confidence with more than 50% of total capital invested in the UK being outside London. Furthermore, figures show that 2014 saw the highest ever volume invested by non-domestic parties outside London, and this looks likely to continue in 2015. Real estate continues to outperform other asset classes and consequently institutional weightings to property remain higher than normal. Savills outlined future opportunities in the core sectors of retail, office and industrial but noted that alternative sectors such as leisure, student housing, senior and healthcare all offer long leases and growth in demand. Indeed 75% of the largest deals that have taken place during 2015 include alternative investment sectors, in particular student housing and hotels.

Mat Oakley, head of commercial research at Savills, said: “With nearly every sector across the board showing yields within 25 basis points of the lowest level recorded, identifying the areas of strong tenant demand and rental growth prospects has never been more important. The best opportunities for this will increasingly be outside London, with the Midlands and the North West leading the pack.”

In terms of the residential markets, Savills notes sobriety in the transactional arena as a result of mortgage market review. With a contraction of secured credit and demand lower than previous years, the firm reports that there has been limited capacity for house price growth in particular in London. While house price growth over the next five years is expected to total over 25% in the South East, East and South West, in London it is forecast to be much lower at 10.4%.

Edward Green, residential research analyst at Savills, said: “London has been seen as a developers’ gold mine but we expect to see increasing attention on the regional development markets over the next five years.”

Click link below to download presentation slides