RESOURCES | Toys R Us deliver out of town parks warning

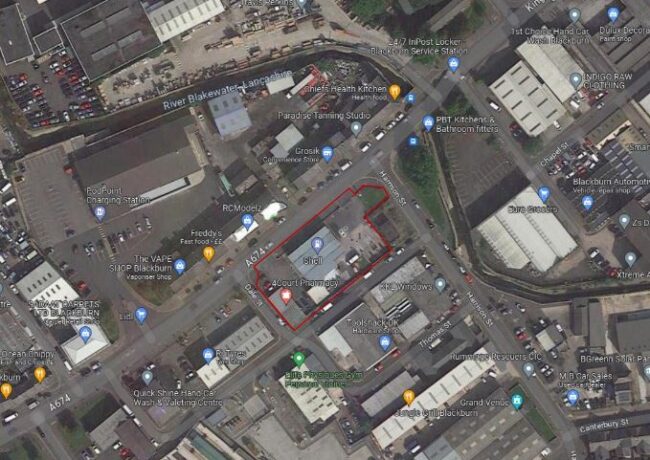

One of the retailer’s former stores

Simon Maddox of Slater Heelis writes:

There are fewer sights sadder than a closed sign on the gates of an amusement park.

Think Blackpool Pleasure Beach in the depths of winter where only seagulls dare venture.

Where there should be screams of fun and excitement, there is only the whistle of cold wind around empty rollercoasters and candy floss stands.

Last week’s news of the Toys R Us collapse had the same impact on me.

What was once a place of wonder for children had, over time, become a place the kids, and their parents, didn’t really want to go anymore.

The retail and brand experts can point to a number of obvious reasons for this failure.

Toys R Us hadn’t really moved with the times; its ‘stack-it-high’ sales policy had long ago lost its magic and with little to no fun interaction between staff and customers, a distinct lack of ‘theatre’ in the overall experience and aggressive competition from more technically advanced and savvy brands, it was only a matter of time before Toys R Us had the same appeal as Margate seafront on a stormy Saturday night in February.

Toys R Us going into administration should also make the property market sit up and take notice. Its large portfolio could clearly have been managed more effectively. Rather than investing in its stores and consolidating its portfolio where appropriate, it instead rested on its laurels and let a once dominant position in the market place slip.

This is one of the first major retailers to have failed so spectacularly having pinned its colours firmly to the “out-of-town parks” mast.

So what does this mean to the out-of-town landlords who will no doubt have noticed that even a tired brand like Toys R Us seemed to trade better from smaller High Street outlets than from their mammoth – some upwards of 50,000sq.ft – retail park sheds?

I suspect this may be the start of a migration of large retail parks away from purely destination leisure to more essential forms of shopping.

Discount supermarkets are expected to lead the queue to snap up Toys R Us sheds with the potential to sub-divide larger stores.

Where once stood floor to ceiling Barbies, I expect to soon see Bavarian Bratwursts.

As with all landlords, whether small residential buy-to-lets or the largest commercial sheds, staying one step ahead of your tenants, and in some ways second guessing what’s around the corner can limit your exposure to potentially huge risk.

My advice is to tune into what professional advisers and brand experts are saying about the sectors in which your tenants operate. Agents have a canny knack of successfully predicting the up and coming brands to watch out for and the branding gurus are usually the first to spot a tired brand in decline.

Arming yourself with knowledge from well-respected third parties operating in your tenants’ sectors can be worth its weight in gold.

This article was originally published on Place Resources.