Regional office markets continue to toil on Covid

Office take-up across the nine biggest cities outside London reached 783,420 sq ft in Q1 of 2021, down 41% on the 10-year quarterly average, as the pandemic continues to impact the sector.

Manchester was the best performing of the regional cities in terms of city centre lettings, recording 234,000 sq ft of transactions in the first three months of 2021, but this was down from 309,000 sq ft for the same three-month period in 2020, according to Avison Young’s Big Nine report.

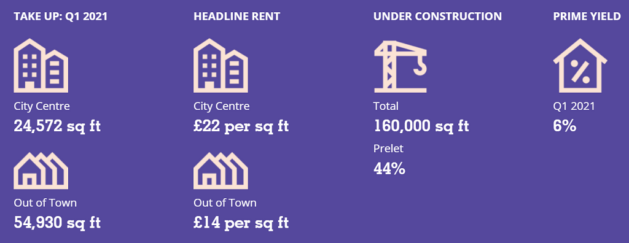

Meanwhile, Liverpool completed just 24,000 sq ft of deals in the same three-month period, down 50% year-on-year.

Leeds city centre, with deals totalling 145,000 sq ft, came in second behind Manchester while only Cardiff, which saw 14,000 sq ft of deals completed, performed worse than Liverpool in Q1.

Of the Big Nine, only Newcastle bettered its 10-year quarterly average for city centre lettings, while Manchester and Liverpool’s take-up fell by 57,000 sq ft and 74,500 sq ft respectively.

Leeds recorded the largest city centre letting of the quarter, an 83,000 sq ft deal to bring DLA Piper UK to City Square House.

Manchester’s biggest city centre deal was the 30,000 sq ft letting to serviced office provider Orega at Arkwright House.

Liverpool’s pipeline of city centre office space totals 160,000 sq ft, while Manchester has 1.6m sq ft of offices under construction, more than half of which are pre-let.

The out-of-town markets studied in the Big Nine report fared better than the city centres, with the cities recording a total of 676,000 sq ft of lettings, down 14% on the 10-year quarterly average but an improvement on the 574,000 sq ft signed in the first quarter of 2020.

Finance firm Lowell Group’s 133,000 sq ft letting at Thorpe Park helped Leeds to scoop the spot of best-performing out-of-town office market of the Big Nine cities in Q1, with 214,000 sq ft of deals completing overall.

Manchester’s 159,000 sq ft of out-of-town deals was enough to bag the city second place behind its Yorkshire rival, while Liverpool’s 55,000 sq ft of lettings – including 9,500 sq ft to Instant Offices at Liverpool Innovation Park – saw it better its 10-year quarterly average for suburban take-up by 20,000 sq ft.

Total investment volumes for Q1 amounted to £177m across the Big Nine, 70% down on the 10-year average, but Q2 volumes have already surpassed this figure, according to AY.

AY’s Big Nine report covers the nine core cities outside of London: Birmingham, Bristol, Cardiff, Edinburgh, Glasgow, Leeds, Liverpool, Manchester and Newcastle.

Very commendable office space take up in Manchester for Q1 of 2021. With regards to Liverpool, the council should hang their heads in shame – how can there by any upswing in office take up if planning permission is granted to convert 1960s office blocks into resi use. Once those buildings become resi it is very hard to get those footprints in the city centre business district back into office space/use. It is not rocket science.

By Old Hall Street

Ok , I accept it was probably inevitable that Manchester would top the list again but there are two figures I can’t be the only one to pick up on that stand out and are in my opinion quite shocking. They are the the city centre lettings and more tellingly the Pipeline figures between Manchester and Liverpool, each one a factor of 10x greater for Manchester. Offices bring jobs, hotels , transport infrastructure and wealth, yes even after covid. What is it LCC doesn’t understand about that?

By Anonymous