MOAF: Manchester ends difficult 2020 on a high

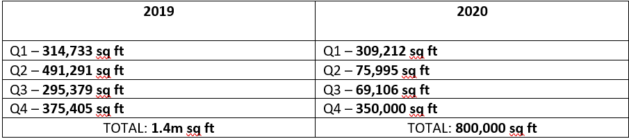

BT’s 175,000 sq ft letting at English Cities Fund’s Four New Bailey saw office take-up for the final quarter of 2020 hit 350,000 sq ft, taking the total for the year to 800,000 sq ft, the first time total annual transactions in the city centre have dropped below 1m sq ft since 2013.

The yearly total for a Covid-hit 2020 is significantly lower than that recorded in 2019 when almost 1.5m sq ft of deals were signed.

However, after a strong final quarter, which saw a 280,000 sq ft jump in space transacted compared to Q3, agents were confident Manchester still has the power to attract occupiers despite the challenging climate.

Mark Garner, associate director of office agency at CBRE, said: “2020 was obviously a very challenging year for the property industry, and the office sector in particular, however, we are already seeing signs of recovery.

“BT’s commitment to Four New Bailey affirmed that major occupiers still have an appetite for large office HQs and remain attracted by the high-quality developments, access to skills and international connectivity that Manchester offers.”

Office take-up in Manchester started strongly in the first three months of 2020 when deals totalling 306,000 sq ft were signed.

These included Hilti’s deal to lease 42,500 sq ft at Bruntwood SciTech’s Circle Square, while BET365 took 25,000 sq ft at the Core on Brown Street.

However, the effects of Covid-19 and the uncertainty it instilled in the market were mirrored in take-up for the next two quarters when a total of 140,000 sq ft was signed across 48 deals. A stark contrast to the 786,000 sq ft transacted in the same period in 2019.

After a dismal six months, BT’s New Bailey deal plus Hana’s commitment to around 30,000 sq ft at Baring Real Estate’s Landmark in St Peter’s Square, saw figures recover in Q4.

However, despite a surge in deals in the final three months of the year, which saw figures climb within reach of the 375,000 sq ft recorded in the same period in 2019, overall office take-up for 2020 was down almost 700,000 sq ft compared to 2019.

Andrew Crabtree, transactions and asset management at OBI, said firms that paused searches for offices would begin to restart the process this year with an increased focus on flexible working and the wellbeing of staff.

“We have already started to see a number of existing financial, legal, and professional service occupiers relocate within the city centre in 2021. We expect this to continue with the addition of occupiers in the e-commerce, fintech and cyber sectors being attracted by Manchester’s digital and tech talent.”

Looking ahead, Garner claims that ‘working from home fatigue’ and confidence around the vaccine roll-out could bolster the city’s office credentials in 2021.

“While offices may be looked at differently going forward, their importance as a collaboration ‘nerve centre’ remains true for many occupiers. The office provides an environment of fast-paced communication which simply can’t be replicated at home.”

Garner added: “With the promising vaccine updates providing light at the end of the tunnel, we are optimistic that take-up will recover well in the future.”

Outside the city centre, the South Manchester office market transacted 272,667 sq ft over 179 deals, significantly down on the 594,490 sq ft recorded during 2019.

The largest deal in South Manchester last year was with product testing firm Hall Analytical, which agreed to lease 21,400 sq ft at Waterside Court in June.

Elsewhere, Salford Quays and Old Trafford recorded 226,598 sq ft over 62 deals, down from 292,071 sq ft in 2019. The largest transaction saw Marlow Fire & Security leasing 25,568 sq ft at 5 Central Park.

Manchester Office Agents Forum comprises Avison Young, BE Group, CBRE, Colliers International, Canning O’Neill, Cushman & Wakefield, Edwards & Co, Hallam Property Consultants, JLL, Knight Frank, LSH, Matthews & Goodman, OBI, Savills, Sixteen and TSG Property Consultants.

Not bad numbers at all to say everyone was shut down for most of last year. Expect a big surge this year as well with all the pent up demand. Record year for this or next could be on the cards. The office is certainly not dead for the big cities.

By Bob

I will be back in the office in Manchester along with many others just as soon as they let us. Sick of working from home!

By Johnson

I expected rather worse in the circumstances. It will be interesting to see the recovery as the year progresses. I expect it to be significant.

By Catherine

Still good numbers.

I do not think the office is dead at all. Home working will be here to stay but I think at least 50% of the time will be in the office.

By Chris