MOAF: 2015 no record-breaker but market remains buoyant

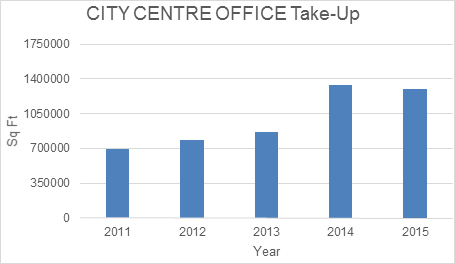

Manchester’s office market did not quite enjoy the record year many predicted but still “performed outstandingly well” according to the latest figures from Manchester Office Agents’ Forum.

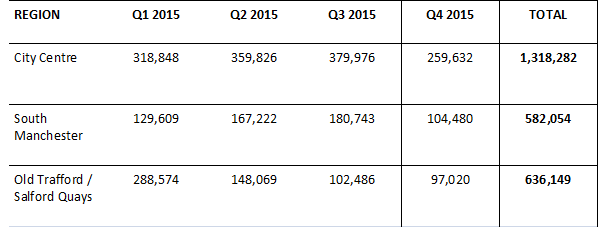

City centre take-up for 2015 finished at 1,318,282 sq ft, slightly below 2014’s total and 15,437 sq ft below the record take-up recorded in 2001. There were 311 deals recorded and the total volume of space transacted was 32.5% above the the 10-year average. MOAF said the shortfall was predominantly due to a quiet final quarter, 32% down on Q4 2014.

Richard Dinsdale, associate director at Edwards & Co and spokesman for MOAF, said: “The buoyant market conditions that the city is experiencing look set to continue with companies selecting Manchester as a location due to its highly skilled labour pool, strong amenity offering and exceptional public transport network. Subsequently, Manchester is flourishing with the supply pipeline for Grade A office accommodation spiking at the highest level recorded since 2008 with rising levels of speculative development across the city. The 2015 figures have been dominated by a significant amount of pre-let activity, 255,956 sq ft, which accounted for 20% of the total city centre take-up.”

Pre-let transactions of note last year included:

- 1 Spinningfields: PWC 49,406 sq ft

- Two St Peters Square: EY 41,628 sq ft

- XYZ: Global Radio 16,669 sq ft

- XYZ: Shoosmiths 32,000 sq ft

- XYZ: NCC Group 60,000 sq ft

MOAF said the significant demand for prime stock within the city centre continues to substantially outweigh supply, and as a consequence six new-build office buildings are soon to be delivered to the market, four of which will complete in 2016. These are Allied London’s XYZ, 160,000 sq ft and fully let, English Cities Fund’s One New Bailey, 125,000 sq ft of which 80,000 sq ft is pre-let to law firm Freshfields Bruckhaus Deringer, and two buildings at Ask’s Embankment, of 166,000 sq ft and 165,000 sq ft. Together these total 616,000 sq ft of which 160,000 sq ft is pre-let. The other two new-build developments, Two St Peter’s Square and No1 Spinningfields, are set to bolster the prime stock even further in 2017 by providing an additional 320,000 sq ft.

Dinsdale added: “This disparity between the supply and demand has assisted in pushing the headline rents on throughout 2015, with the city centre witnessing a headline rental of £34/sq ft on the top floor of Chancery Place, and record quoting rentals of up to £35/sq ft at the likes of Two St Peters Square. Whilst property experts estimate that prime headline rents will grow to £40/sq ft by 2019, it is expected that the upward rental momentum will begin to slow as these new-build developments are delivered to the market.”

With regard to rental growth, the volume of transactions at a rent of £25.00 psf and above remained at a similar level to 2014, however, in terms of amount of space transacted within this prime rental bracket it’s approximately 10% down on last year. This is clearly down to a shortage of prime stock currently available on the market, MOAF said. Rents have also continued to rise within the Grade B / B+ sectors of the office market and all the signs indicate that 2016 looks to follow on in the same fashion.

Other sizeable deals last year included:

- TravelJigsaw trading as Rentalcars.com at 35 Fountain Street, 37,045 sq ft

- Freshfields at Arndale Tower 42,739 sq ft

- CIS Insurance at Arndale Tower 32,619 sq ft

- Ford at First Street 45,000 sq ft

- Gazprom at First Street 51,200 sq ft

- Bestway at Merchants Warehouse 22,409 sq ft

- British Transport Police Authority on a 20-year lease at Peninsula 11,748 sq ft

Outside the city centre, the South Manchester office market saw take-up reach 582,054 sq ft, a 1.5% increase on 2014’s figures. South Manchester deals included Syngenta at Lone Star’s Towers Business Park, for 32,300 sq ft at a record rent of £22.00/sq ft, Mason & Vaughan Group, also at Towers, 11,718 sq ft, Avecto at Trident 29,002 sq ft, Worley Parsons at Manchester Green 20,358 sq ft, Travel Counsellors at Venus 28,500 sq ft, Sky at St Peter’s Square 17,918 sq ft, Citation at Kings Court 18,266 sq ft and pre-sale deal at the old Lamborghini site to Stockport Homes 43,000 sq ft by Quorum Estates.

Dinsdale added: “Due to this recent stock absorption, South Manchester is currently experiencing a lack of large floor plate and self-contained opportunities within the Grade A sector. This supply issue will eventually be addressed through the new development that will take place at the likes of the Bruntwood-owned Booths Park in Knutsford and MAG’s Airport City, although without any pre-lets in place it’s unlikely that either will be built speculatively at this moment in time.”

Dinsdale added: “Due to this recent stock absorption, South Manchester is currently experiencing a lack of large floor plate and self-contained opportunities within the Grade A sector. This supply issue will eventually be addressed through the new development that will take place at the likes of the Bruntwood-owned Booths Park in Knutsford and MAG’s Airport City, although without any pre-lets in place it’s unlikely that either will be built speculatively at this moment in time.”

Whilst the Old Trafford market has struggled, neighbouring Salford Quays flourished, helping take the total figure for the two areas to 636,149 sq ft, more than double 2014.

This is predominantly due to a handful of sizeable transactions such as the pre-let to BUPA at Harbour City, 142,000 sq ft, the consolidation of Government department UK Visas & Immigration at the Soapworks, 54,816 sq ft, Talk Talk at the Soapworks, 106,187 sq ft and the purchase of Wharfside by Missguided, 44,242 sq ft. The highest rental achieved within this region was £24.50/sq ft at Orange Tower in Peel’s MediaCityUK. Peel Media are poised to launch their latest MediaCityUK offering to the market in June of this year, a building named Tomorrow, which will provide a mix of co-working and creative office space totalling 50,000 sq ft across six floors.

Overall the city centre and regional markets combined, excluding Warrington, have achieved a total take up of over 2.5m sq ft, which is almost 330,000 sq ft up on 2014.

Formed in 2009, MOAF members include OBI Property, CBRE, Colliers, Canning O’Neill, Cushman & Wakefield, Edwards & Co, GVA, JLL, Knight Frank, LSH, Matthews & Goodman, Savills, TSG Property Consultants, WHR and BE Group.

Good work, Lads

By Darth V

yes, happy with this year. We hope to show an increase in 2016. Fingers crossed.

By Neil Mort