Manchester dominates regional deals, says Big Nine report

Manchester’s investment market outstripped regional competitors in the second quarter of 2021, while the opening of The Spine should help reignite the Liverpool market, according to Avison Young’s round-up of regional markets.

The Big Nine report evaluates office take-up and investment deals in regional markets. Along with the two North West cities, it covers Birmingham, Bristol, Cardiff, Edinburgh, Glasgow, Leeds and Newcastle.

Although still below its ten-year average, the Manchester market saw take-up of 220,183 sq ft and 153,355 sq ft in the city centre and out-of-town markets respectively in Q2, as reported last week by the Manchester Office Agents Forum.

The £82m sale of No.8 First Street to Ashtrom and Morgan Capital’s £60m forward-funding of Muse Developments’ New Victoria office scheme were investment highlights, as Manchester tallied up £220m in deals. Birmingham’s deal total was the second-highest, coming in at £160m.

The report shows a trend in sub-5,000 sq ft deals continuing to gain traction, as occupiers lean towards a more agile approach and landlords become more accepting of shorter leases.

Chris Cheap, principal and managing director of Avison Young’s Manchester office, said that delayed government advice had stalled the much-anticipated return to offices, also causing a “staggering” of deals.

He added: “There is a desire to adopt new adapted working patterns, with a huge population of workers craving some of the regularity of the pre-pandemic working week. So 220,183 sq ft take-up is a testament to Manchester’s resilience and the overall need to return to the office, in whatever guise that may be.”

Supply is the main concern in Liverpool, where office take-up in Q2 reached 50,297 sq ft in the city centre and 23,277 out-of-town, which overall is 43% down on the ten-year average.

Availability of space across the city region is at a quarter of its 2014 peak, said Avison Young, meaning that the recent completion of The Spine, where 60,000 sq ft is up for grabs, could be “critical” for the city.

The firm also pointed out the rise of Birkenhead as a factor. The Hythe development at Wirral Waters will bring 25,000 sq ft, while the first commercial space at Wirral Growth Company’s Birkenhead town centre project will bring 58,000 sq ft – albeit not until mid-2023.

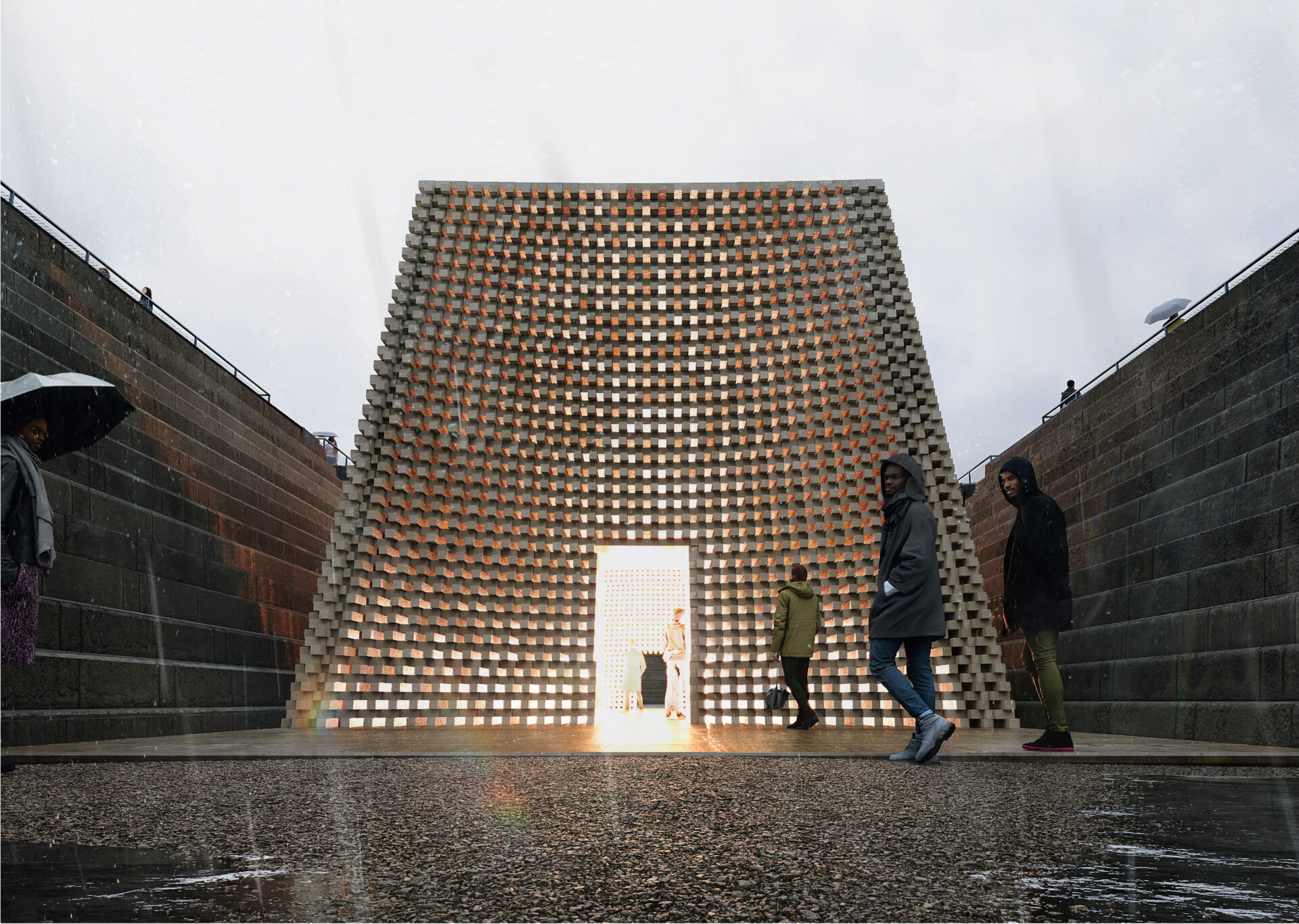

The Spine building stands at the eastern gateway of Liverpool’s innovation district

The market does have active requirements: Pinnacle is seeking 10,000 to 15,000 sq ft, Liverpool John Mores University wants 20,000 to 35,000 sq ft, and serviced space provider Orega is after 20,000 to 30,000 sq ft.

Ian Steele, principal in the Liverpool office, said: “The increasing shortage of good quality office space in the Liverpool City Region has been part of a huge debate in the market over recent years.

“Whilst it’s encouraging to see developments such as The Spine reaching completion, it is critical that solutions are found so that more new space is delivered to the market.”

One source of hope is a speedy return to the workplace: according to Avison Young’s UK Cities Recovery Index, Liverpool’s Return to Office Index experienced the strongest growth of 2021 so far. Steele said: “We expect this slow return to normality to act as a catalyst to re-energising those searches.”

Across the Big Nine as a whole, take-up during Q2 was 1.56m sq ft, 26% down on the ten-year average, while healthcare and flexible workspace were named as the most active sectors.