Manchester completions maintain upward trend despite pandemic

The number of property schemes to complete in 2020 hit another record high driven by the delivery of new homes, but the pace of growth is levelling out, according to Deloitte.

The consultancy’s latest annual Manchester Crane Survey recorded 35 completions last year compared to 27 in 2019. The delivery of new homes was the highest on record for a single year, at 4,914 units, while the number of residential properties under construction remained above 12,000 (at 12, 322) for the third consecutive year, pointing to continued growth ahead.

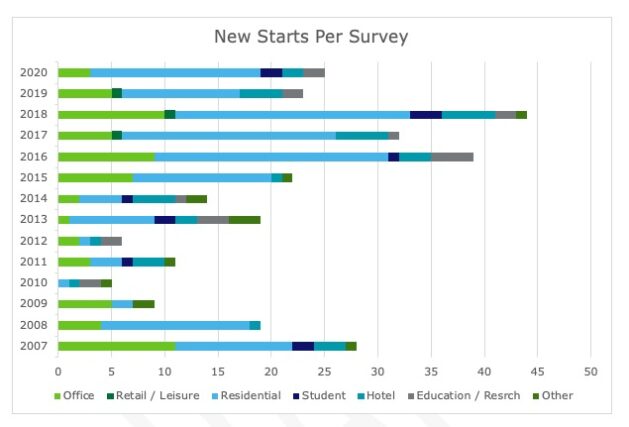

Across all sectors, 24 schemes started on site during 2020, demonstrating a healthy pipeline for the Manchester real estate market, according to Deloitte. A total of 72 schemes were on site last year – 6% fewer than the 77 recorded in the previous year’s survey.

Meanwhile, 2020 saw the largest volume of office floorspace delivered since 2008, at 1.2m sq ft across eight schemes including No.1 and No.2 Circle Square, 125 Deansgate and Landmark, an increase of 179% from the year earlier. However, the amount of office floorspace under construction almost halved to 1.29m sq ft at the end of last year, compared to 2.1m sq ft in 2019.

Three office schemes began construction in Manchester in 2020, bringing the total on site to 1.28m sq ft. Just over one-third (36%) of that is pre-let, and the pipeline for availability of further office space requires new approved developments to commence construction, the survey noted.

Simon Bedford, partner at Deloitte Real Estate, told Place North West: “It’s another record year but we see it as a ‘levelling out’ from the frenetic pace of real estate activity – starts and completions – recorded over the past five years, which peaked in 2018.

“I don’t think things will grow at the same pace in the years ahead and it looks to us like the current picture may represent a sustainable level of development for the city.”

Source: Deloitte’s Manchester Crane Survey 2021

Now in its 22nd year, the Manchester Crane Survey 2021 measures the amount of development taking place across Salford and Manchester city centres, across property types including residential, office, hotel, retail and leisure, student accommodation, education and research facilities, and healthcare.

Schemes must be bigger than 10,000 sq ft, or for residential and hotel schemes, larger than 25 units. The report covers the period from 11 January 2020 to 18 December 2020.

The report showed that overall development levels have remained highly resilient throughout the Covid-19 pandemic and this is largely thanks to the Government’s decision to swiftly reopen construction sites after a brief pause last March, Bedford told Place North West.

“Sites have not been closed since, and financial institutions have not withdrawn funding for pipeline schemes – we’ve seen relatively few administrations and business failures attributed purely to the Covid-19 crisis and this is testament to the strength and resilience of Manchester’s development community.”

Resi uplift

The continued uptick in construction activity is being helped by the residential sector, where demand has remained strong throughout the pandemic, Bedford added.

An additional 12,322 housing units are under construction across 46 sites, according to the survey, while 16 residential schemes broke ground in 2020 – a 45% increase in new starts compared to 2019. Key schemes include Greengate Park Tower, CityView, Crown Street, New Victoria, Viadux and Union by Vita.

Looking ahead, six major planning applications for residential development have been submitted within the survey area since the beginning of last March, comprising 2,831 potential new homes, the report said. Of those, 934 are already on site, demonstrating that residential permissions are still being built out at pace and there is “more petrol in the tank”, according to Bedford.

“Undoubtedly, there have been new challenges, but the long-term nature of construction appears to be working in the city’s favour, as developers continue to ‘build back better’, bringing forward new schemes and instilling optimism about the future in the wider community,” he said.

Render of Salboy’s 40-store Viadux tower

While Manchester’s retail, leisure and hotel businesses have been the hardest hit by the pandemic, the survey provided some optimism for the future, with 480,000 sq ft of retail floorspace currently on site across 18 schemes, well above the average volume since 2007.

Meanwhile, the number of hotel beds under construction at the end of last year fell for the first time since 2015, but the overall pipeline – 2,397 beds under construction – is still double the 994-bed average since 2007, the survey said.

Future shifts

Still, “there is always the possibility that we will see the delayed effects of the pandemic on levels of development activity in Manchester in the years ahead, which is why it is critical we reopen the city as soon as possible and show investors there is still very much a live marketplace here,” Bedford told Place North West.

The current working from home scenario is unlikely to negatively impact the office sector long term, he added, but there will be significant shifts in 2021 – demonstrated by churn in planning, refurbishment and leasing activity – as businesses right-size and adjust to changing workforce demands.

Joanne Roney, chief executive of Manchester City Council, said: “Over the past decade, Manchester has firmly established itself as a globally significant city, setting itself apart as a leading destination to work, live or visit. Its success has been reflected in the city skyline, with a diverse range of developments being brought forward to committee.

“The findings from this year’s report are highly encouraging and I look forward to taking stock of our position following conclusion of the pandemic.”

And John Cooper, partner at Deloitte, added: “Manchester’s vibrant culture is a huge selling point for the city and will play a hugely important role in its economic recovery, providing a boost to businesses of all sizes.

“Confirmation that Oakview Group is set to bring forward £350m of private investment into the city through the construction of its 23,500-capacity entertainment arena in Eastlands demonstrates confidence that the hospitality industry will recover.

“Not only will this allow the city to attract the highest profile sporting and cultural events, but it will deliver significant benefits to local communities through the creation of new jobs, training opportunities and community assets, helping to make that bounce back a reality.”

Deloitte Real Estate in Manchester, from left: partner Bedford, planner Jennifer Chatfield and senior planner Michael Percival. c.Chris Bull/UNP

And its only going to get better, endless amount of stuff in the pipeline, mainly looking forward to new cross area, Mayfield and St Michaels starting, anyone any news on St Michaels seems to have gone quiet?

By Bob

Too bad St Michael’s and High Street CEG building aren’t happening, they were the best ones.

By Ron

I really don’t like the Viadux scheme. So much prime land in Manchester and the scheme just looks like the squeezing of towers in a tiny space!

By Rich

St Michael’s like so much has been delayed but I’m pretty sure work to the sir Ralph Abercrombie has been approved and this will hopefully be the start. Should look amazing especially when all of the work to Albert Sq and the Town hall has been completed in a few years.

By Sir Ralph’s mate

I used to think Manchester was all about Huge apartment blocks and little else but having seen the scale and number of Offices being built as well as hotels and transport infrastructure it’s clear there has been something special happening for some time now. It has to tail off at some point but with so much of significance in the pipeline still it hard to see when.

By JohnP

I understand these are the cities outside London that have the most development in terms of Hotels,retail, offices homes etc. Manchester, Leeds, Birmingham and Belfast. It’s the first time I’ve looked at these reports in any detail and I was almost shocked when you compare the figures For Manchester and the other 3 cities over the past few years .The scale of development in Manchester is really brought into focus when you look at the data..hugely impressive.

By Nve