HMRC deal sends Liverpool take-up past 500,000 sq ft

The formal completion of HMRC’s consolidation to the India Buildings has been the key factor in 575,700 sq ft being let in the city’s office market over the first half of 2018; nearly surpassing 2017’s total take-up of 653,700 sq ft within six months.

With such an outlier deal, take-up for the first half of the year has understandably been significantly higher than the same period in 2017, which came in at 291,700 sq ft. Deal volume was however greater in 2017’s first half than the first six months of this year.

The figures from the Merseyside Property Forum show take-up in the city centre and city fringe – which includes areas such as the Ropewalks and areas around Lime Street – at 519,550 sq ft, with 56,200 sq ft transacted in the out of town market. The decentralised market played a much larger role in H1 2017, with 102,400 sq ft let, compared to 189,240 sq ft in the city and fringes.

Major deals in the market so far this year have included Everton FC signing for 28,500 sq ft at the Royal Liver Building and the Royal College of Physicians committing to The Spine within the Knowledge Quarter’s Paddington Village. The RCP agreed terms on an initial 70,000 sq ft and is to exercise an option taking this to 80,000 sq ft.

MPF chairman, CBRE’s Andrew Byrne, said: “It’s encouraging to see this level of inward investment into the Liverpool market. Yes, HMRC will close other offices in the area, however Liverpool was chosen as one of the new regional hubs over other locations, and there are a significant number of jobs involved.

“RCP committing to The Spine within the Knowledge Quarter is another example of significant inward investment within the city and a real coup, considering RCP was a footloose requirement. The work done by all involved will have a real benefit for years to come and has set a high standard in design quality for the market.”

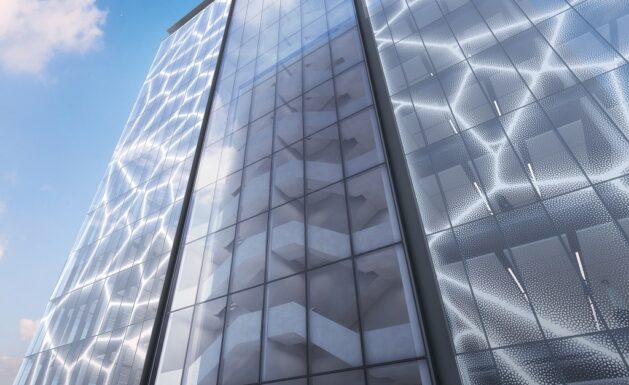

The Spine: set to be home to the Royal College of Physicians

The big question for the rest of 2018 and beyond, says the MPF, is the lack of supply. There is currently just short of 700,000 sq ft of office space available in the Liverpool market, which is less than two years’ supply going off the average annual take-up of 300,000 sq ft to 400,000 sq ft.

Technically, there is no grade A space – classed as high-specification space completed within the last five years – currently available in the city, which has seen virtually no major development since 2011.

Jonathan Lowe, director at GVA said: “Supply is the main issue in the Liverpool market. In the out of town market, it is already affecting take-up – there is simply no space, which is partly why just 56,100 sq ft was taken in the first half of the year.

“Supply is also an issue in the central market. There is good quality space available in the likes of 4 St Paul’s Square, Exchange Station and 20 Chapel Street, but the volume is shrinking all the time.

“The city desperately needs to see a start made on major office buildings such as Pall Mall and 5 Princes Parade, because it will take time to deliver buildings; occupiers are beginning to run out of options in Liverpool.”

Members of the Merseyside Property Forum include CBRE, Eddisons, GVA, Hitchcock Wright & Partners, Keppie Massie, Mason Owen, Mason Partners and Worthington Owen.