Countrywide: Manchester is first-time buyer hotspot

One in three residential properties sold in Manchester last year was purchased by a first time buyer, who put down an average deposit of £26,000, according to new research.

In 2013, there were 10,000 properties in Manchester bought by first time buyers, the highest number since 2007.

A higher proportion of mortgage lending in Manchester goes to first time buyers than in any other English city outside of London, with half of all mortgages going to first time buyers, according to Countrywide's inaugural City Focus Market Review.

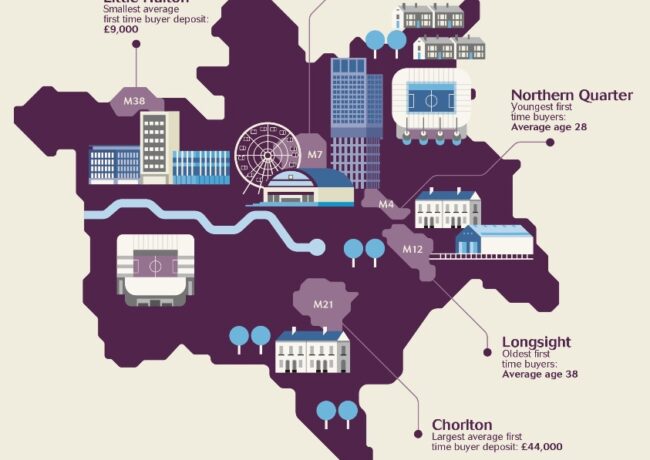

The average age of a first time buyer in Manchester is 32, the same age as the average first time buyer nationally. The research makes the link between the average age of oldest and youngest first time buyers and where they are buying in Manchester. The oldest first time buyers generally purchase in cheaper areas of Northern and Eastern Manchester. First time buyers in Longsight are on average 38 years old, followed by Gorton where the average age is 37 and Salford Quays where the average age is 36. In comparison, the youngest first time buyers are purchasing in some of the most expensive areas of central Manchester, in particular the Northern Quarter where the average age of a first time buyer is 28, followed by Radcliffe, the City Centre and Deansgate, where the average age is 29.

Taking into account cash buyers, 35% of properties in Manchester are bought by first time buyers. In 2013, first time buyers put down an average deposit of £26,000, an increase of 13% from 2012. Those purchasing in Sale and Chorlton put down the largest deposits, an average of £44,000.

An improving housing market has translated into the number of first time buyers growing at twice the rate of homeowners. In 2013, there were a total of 10,000 first time buyers in the city. While significant, this compares to 20,000 first time buyers who got onto the housing ladder in 2007.

In 1990, the number of homes built in Manchester was similar to the number built in Cheshire and Lancashire combined. By 2008 Manchester was building more than double the total number built in Cheshire and Lancashire. While this differential has been narrowed by the 2008 recession, in 2012/13 Manchester still built a third more homes than in the two neighbouring authorities.

The most popular locations for first time buyers are the 12 postcodes that encircle the city centre. Smaller Victorian terraces and excellent transport links into the city centre attract first time buyers and students alike. The area of Broughton in M7 has the highest proportion of mortgage lending to first time buyers at 69%, closely followed by Heaton Chapel (M19) and Salford Quays (M50) at 66% and Pendleton (M6) at 65%.

First time buyers who choose to live in Chorlton (M20), Didsbury (M21) and Sale (M33) put down the largest deposits and pay an average of £157,000 for a property. This is 34% more than the price paid by the average first time buyer in Manchester.

Didsbury is M20 and Chorlton is M21.

By George

Since when has fact ever bothered estate agents?! 😉

By McrLass

Heaton Chapel is SK4, Levenshulme and Burnage are M19

By Jon

Good to see that Stockport and Salford are now being classed as being in ‘Manchester’.

By Barbara E

Ancoats is M4, Sale is M33. Doh-rah-me, A-B-C. So what?

By mancboi