Interserve posts £6m loss as restructuring continues

Interserve, the construction and support services firm, has reported a £6m pre-tax loss for the first half of 2018 as it continues to grapple with a restructuring programme which has led to the loss of 470 jobs in the last six months.

The company has been undergoing a significant restructure since it reported mounting losses from its energy-from-waste division, which led to a £244m pre-tax loss in its full-year results, covering the year to 31 December 2017.

In the North West, Interserve has offices in Wigan, Skelmersdale, Liverpool, and Salford Quays.

In its latest results, covering the six months to 30 June 2018, the company reported a pre-tax loss of £6m on a revenue of £1.49bn. This compares to a revenue of £1.65bn and a pre-tax profit of £24.9m in the same period a year earlier.

The restructuring programme, named Fit For Growth, has already led to job losses and a further 470 redundancies took place in the first half of 2018. The restructure is expected to deliver £15m of operating profit to the group in its 2018 financial year, and is expected to generate between £40m and £50m of savings per year by 2020.

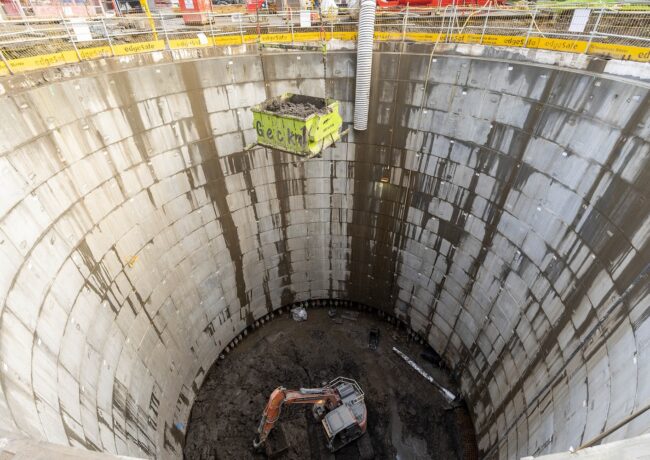

Interserve’s UK construction business, which is active in the North West, posted a revenue of £396m and a £5.6m operating profit, leaving it with an operating margin of 1.4%. This is down from 1.9% in the same period a year earlier.

Projects the company’s construction arm is working on in the region include the £35m Rutherford Cancer Centre at Liverpool’s Knowledge Quarter, and the £15m Liverpool Women’s Hospital.

It has also secured a place on Procure North West’s £2bn framework, and is bidding for two lots on the £1.5bn North West Construction Hub high value framework.

An exit from its London construction business generated a loss of £6.5m in the first half of this year, adding to a £4.3m loss in the first half of 2017.

Chief executive officer Debbie White said: “The first half of 2018 was an important period for Interserve as the new management team took actions to bring stability to the business and agree the direction of the Group’s future strategy.

“The ‘Fit for Growth’ initiatives we are implementing are delivering material cost savings and will result in a simpler, more focused and more effective Interserve. The refinancing that we completed in April provides a firmer financial footing from which to execute these plans.

“Today we have a strategy that provides a clear direction, leveraging our areas of strength, where Interserve can provide compelling customer propositions, delivered with rigorous operational and financial discipline. Whilst there remains a significant amount of work to do, we have energy and momentum in the business as evidenced by the significant new contracts wins secured in the first half of the year.”

Interserve’s share price opened at 70.05p this morning, before dropping to 64.00p. At the time of writing it has recovered to 69.21p.