Healthcare upheaval presents opportunity

Around 100 people attended Place's Healthcare Property Forum at Cube in Manchester to discuss changes to the industry and how they affect suppliers in the private sector.

Around 100 people attended Place's Healthcare Property Forum at Cube in Manchester to discuss changes to the industry and how they affect suppliers in the private sector.

There were two excellent keynote presentations from Kathryn Berry, associate director of capital, investment and PFI at NHS North West, and David Hay, managing director of developer Ryhurst.

Copies of the presentations can be downloaded here:

Place Healthcare Forum – Dr David Hay

Place Healthcare Forum – Kathryn Berry

The event was sponsored by Brabners Chaffe Street, Rider Levett Bucknall and Taylor Young.

The keynote speeches were followed by breakout sessions on funding, build, managing budgets, partnerships and asset management.

The pervading uncertainty brought about by the Coalition's radical changes to the health service was the main theme of the day. Despite the current confusion, the majority of delegates saw opportunities ahead, with new health service providers emerging and the reorganisation of estates.

Paul Rushton, director at Taylor Young, chairing the building workshop, said: "The majority of the workshop participants were concerned that there was a lot of unknowns regarding the primary care estate and the abolition of the Primary Care Trusts. It was felt that if GPs were given the responsibility to be in control of the Primary care purse, that there would be a personal agenda driving the spend and there would be a distinct lack of regional 'joined-up' thinking."

The event concluded with a question and answer session with a panel made up of David Hall, senior manager in the North West healthcare unit at NatWest; Paul Rushton, director of Taylor Young; Phil Byrne, associate at Brabners Chaffe Street LLP and Steve Jenkins, buying solutions partner at Rider Levett Bucknall.

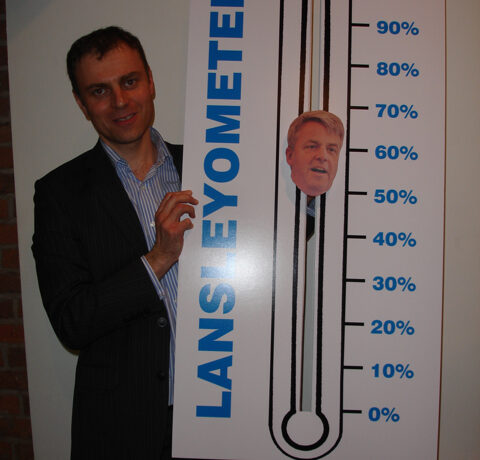

Kicking off the Q&A debate, Rushton unveiled his findings from a straw poll of ten NHS clients on key challenges facing their development programmes. The findings of Rushton's Lansleyometer were:

|

% Yes |

% No |

||

|

Primary Care |

|||

|

1. |

The commissioning of PCT services from the Primary Care Trusts to GP Consortia continues apace. With the GP's already 100% committed to providing clinical care, is this a step too far for GP consortia? |

50% |

50% |

|

2. |

Do you think that the GP consortia will undertake their commissioning services in a similar way with the same specialist personnel being transferred from the PCTs? |

80% |

20% |

|

NHS Cost Savings |

|||

|

3. |

Will the implementation of NHS reform and savings mean that any new development ceases, with new build being replaced for a 'make – do and mend' approach? |

70% |

30% |

|

4. |

Can new projects proceed even in light of cost savings, through efficient design of service delivery to reduce revenue costs? |

100% |

– |

|

5. |

Do you think that we will see an increased number of NHS Trusts merging to share services and reduce costs? |

100% |

– |

|

6. |

Will we see an increased number of NHS Trusts begin to work strategically in partnership (ie; through Service Level Agreements for estates, facilities and maintenance)? |

100% |

– |

|

7. |

In November last year the NHS saw Circle Healthcare Partnership become the first private sector company to win the Management Franchise for Huntingdon's Hinchingbrooke Hospital. Is it likely that this will fast become the 'norm' in the NHS? |

30% |

70% |

|

8. |

There has been much speculation in the press recently that the NHS reforms and the reliance on the GP consortia may harm the quality of mental health, as GPs do not specialise in this area. Do you agree? |

50% |

50% |

|

9. |

Patient choice is still high on the agenda. Will we see more of private sector health specialists 'joint venturing' with NHS Trusts, to offer wider specialism at a reduced cost? |

80% |

20% |

Here is a summary of the findings from the Q&A panel and workshops:

Paul Rushton, director at Taylor Young

Professional fees: Fees are extremely tight, more than cutthroat, making it difficult to maintain the delivery of a high quality service. It was suggested that a better route that the NHS could take would be to set the fee rates for each profession, in order that any bids would be 100% based on quality. Only in this way would the NHS be assured that they would be getting a well-rounded service.

Briefing: The quality of briefing documents provided by NHS organisations were considered to be very poor, making it difficult to provide a fee quotation for. In some cases frameworks have been misleading, with promises of lots of work, meaning that lots of effort and therefore cost was made in the bidding process. These frameworks have delivered very little and in some cases nothing at all.

Old Schemes resurrected: It was discussed that failed NHS lift schemes were being resurrected with an expected 30% reduced project – which was unrealistic.

The positive aspects of the NHS market considered by the workshop were:

New client base: Private providers going forward continue to provide a potential new client base.

NHS Foundation Trusts: The more successful Foundation Trusts continue to provide opportunities for new work.

P21+: It was felt the level of professional fees under the Procure 21 framework were adequate enough to allow all to deliver a quality service.

Appetite for change: It was felt that there is now an appetite for change in the NHS, his is a chance to get it right. A lot of learning has taken place through the P21 project frameworks, and there is now hope that this will continue to trickle down into other projects.

Opportunities going forward with the NHS market under reforms were:

GP consortia: Any new organisations such as GP consortia are likely to require new premises, through making 'patient centred' decisions. Even though the future plans are unknown, the more optimistic among the workshop felt sure that there would be opportunity here.

NHS Work: It was felt that acute NHS work will become more piecemeal, but may see NHS Trusts merging to reduce costs.

David Hall, senior manager in the North West healthcare unit at NatWest

It is difficulty to provide long-term funding to Foundation Trusts due to the uncertainty regards to the so-called 'failure regime', the fact the Crown owns the assets and the view that Foundation Trusts can fail and therefore there is no guarantee of repayments.

There are possible opportunities for joint ventures with the private sector to maximise assets.

However, the uncertainty surrounding Government policy and the transfer of services from the acute sector to the primary sector will restrict opportunities to the acute sector during this period of change.

Primary care sector: Again the widespread uncertainty surrounding Government policy will restrict opportunities. This may lead to a very fragmented approach to providing for the sector. The estates policy is not defined and there is no detail regarding rental payments.

However, there may be an opportunity to provide support to GP on a case-by-case basis. A high percentage of current surgery stock is not fit for purpose.

The main areas to consider are healthcare opportunities for the area in question, the support of local GPs for change, and the opportunity for joint ventures such as pharmacies, and the need for assessment on an individual basis.

Steven Jenkins, buying solutions partner, Rider Levett Bucknall

A number of areas were reviewed to establish how budgets and costs could be reduced and to analyse where savings could be generated.

The group discussed the fragmentation of the health and social care providers and the impact this may have on procurement. It was felt that fragmentation would lead to there being more purchasers of goods, services and construction projects which could lead to an overall increase in costs, even though procurement would be at a lower volume.

This is because there would be more repetition, with providers needing to spend money on the same things but losing the economies of scale presently available. To combat this, it would be advisable for providers to band together and develop procurement hubs or bespoke vehicles so that they are able to negotiate with suppliers on volume discount.

Rider Levett Bucknall has undertaken a review on how supermarket chains were procuring at lower costs than in healthcare and had established a wider use of standardised product selections such as doors, lifts, flooring etc and the use of consistent constructional detailing, leading to savings in the region of 10% – 20%. Although this is a potential answer to the issue, it was felt that an NHS Trust would increasingly seek to differentiate its offer based on services and patient environment and as such, would be unlikely to move towards standardisation.

The second area the group felt that savings opportunities could be identified in is when trusts invite design-and-build teams to respond to a brief. In the majority of instances trusts include Room Data Sheet Packs within tender documentation identifying the sizes and contents of a number of spaces that they require to form the project. The group felt that in doing so a 'jigsaw puzzle' of spaces is being requested, with each bidder providing a slightly different version but essentially the same size and format.

Utilising the designer's expertise by stating desired outcomes from a project might lead to a smaller, more operationally efficient version of the jigsaw, with spaces tailored to the functional and end user's needs. Therefore the group concluded that an output-based specification for the delivery of services could yield new ways of working and a more efficient building in support of this, compared with a more prescriptive space based brief.

Phil Byrne, associate, Brabners Chaffe Street

Healthcare providers will need increasing commercial advice in respect of the spectrum of healthcare property issues, including repairs, maintenance and investment, with a practical and commercial knowledge of the various new and existing target performance requirements. It seems that there will be inevitable gaps between expectation and delivery, particularly in respect of funding.

If private finance is to be attracted into the healthcare market, advice will be needed in respect of financing options and legal structures in the context of new, as yet unknown, service provision structures within the context of complex treasury management issues delivery requirements.

Crucially, the continued provision of new healthcare centres will continue to be difficult than ever and imaginative funding and development methods must be identified and implemented.

An asset management plan must develop to provide the detail necessary to provide a clear direction for the management of the assets that health authorities or GP Consortia manage which maximises opportunities and customer accountability.

Such a plan will require:

- Definition and Purpose

- Corporate Goals and Objectives

- Lifespan and review process – setting targets and aims

- Data Sources – how and where will information be obtained

- Identification of the current position

- What is the best use of (existing and future) Resources

- Review of Asset Management

Considerations

- Audit Commission, CQC and QIPP requirements – fit for purpose?

- Strategic and local commissioning including reviewing stock condition surveys

- Investment planning and delivery – flexible and accountable?

- Procurement advice and support

- DLO reviews and change management

- Partnership reviews initiatives

- Feasibility studies and options appraisals

- Patient/user consultation and engagement – key to public funding

- Interim management

- Raising new finance initiatives

- Quality benchmarking

- Debt restructuring

- Treasury policy, procedures and strategy

- Risk management

- Training

- Due diligence

- Treasury policy and procedures review and training updates etc

- Helpline for day-to-day advice

- Monthly and quarterly bulletins (UK, and Eurozone)

- Arms-length management organisations

- Business planning and strategic business review

- Financial health checks and modelling

- Cost benchmarking, cost reduction and spend analysis

- Advice on new joint venture models

- Stock transfer

- Development programme management and review

- Project management and options appraisal

- Advice on delivery mechanisms for major development projects

- Identify potential sites

- Review development capacity of sites

- Sales valuation and build cost advice

- Identify planning and stakeholder issues

- Coordinate and prepare grant bids