Event Summary

Future of Retail | Photos and summary

It’s a time of massive change for the retail industry, but it’s definitely not all doom and gloom. That was the overriding message from experts at this Place North West event in Manchester on September 15.

Sponsored by the law firm TLT LLP and Aew Architects, Future of Retail took place at the Museum of Science and Industry.

Here are some of the big talking points from the event.

Scroll down to see photos and slides from the event.

The numbers game

Vaughan Allen, chief executive of CityCo and Manchester BID, opened the conference with a presentation looking back at Manchester city centre retail statistics from when the BID began nearly 10 years ago.

The offer in 2012 was 95% retail and just 5% hospitality – now it’s 70% to 30%. There are also fewer vacant properties than in 2012. “That says something about the health of the city centre,” said Allen.

However, the fight to get footfall back to pre-pandemic levels is ongoing. Overall, it is still running 30% down on 2019, while the number of morning commuters is at around 50%. Yet even this isn’t bad news, said Allen – retail sales are now running ahead of 2019 figures and well ahead of every UK city with the exception of Liverpool, and 2019 was already a very successful year.

He also said the number of customer transactions is well up on 2019, even without the amount of international tourists who visited the city before lockdowns – and that’s the Covid effect. Growing numbers of city centre residents, and those living in the outlying areas, didn’t travel far and are continuing to shop locally.

The biggest example of success Allen gave was the competitive socialising leisure sector – the crazy golf, indoor cricket, axe throwing and so on. But, two areas he particularly singled out were the luxury market – jewellery stores and designer collector shops, such as those selling £5,000 sneakers – and Sunday trading.

“Sundays are a huge growth area,” said Allen. “Our biggest challenge is, can we get the trains running past 5pm?”

Vaughan Allen is the chief executive of CityCo and Manchester BID. Credit: PNW

Current challenges

Julia Hatmaker, deputy editor of Place North West, opened the first panel discussion with a question about the current biggest threats to the retail sector.

Stephen Tregenza, director of retail agency Metis Real Estate, said the slow pace of development was a challenge in terms of ensuring supply, something that was backed up by Heather Lindley-Clapp, director of Nexus Planning, who said local authorities are struggling.

All the panellists agreed with Vaughan Allen when he said the cost of living crisis was going to hit retailers hard and Gabriel Erinle, estates director of Allied London and All+Management, added: “It’s the cost of general overheads in running bricks and mortar retail units. Covid really changed the mindsets of technophobes and they now use online shopping a lot more.”

Joe Meredith, legal director of law firm TLT LLP, said: “There’s been an awful lot of significant, impressive work and investment that’s gone in to diversify the retail offering. I think it’s going to be about retaining the level of investment, not just to see people through a reduced market but to see them come out the other side of it fighting.

“It’s very much about landlords and tenants engaging properly and seeing that there is clear mutual benefit.”

TLT LLP’s Joe Meredith, Nexus Planning’s Heather Lindley-Clapp, Allied London’s Gabriel Erinle, Manchester BID’s Vaughan Allen, and Metis Real Estate’s Stephen Tregenza. Credit: PNW

Pop-up positives

Erinle said creativity was key – finding new ways of using a space that doesn’t fit what was planned for it. He cited the creation of a pub in the middle of Spinningfields that was supposed to be a five-year pop-up in the recession of 2008, but is still there today, and a cupcake company that began in a void unit and now stocks its wares in Selfridges.

Tregenza is a fan of the variety a pop-up can bring: “It means that you come and see something different every time, it can be an opportunity for somebody to trial a store. The challenge is having the right space at the right time.”

F&B figures

Quizzed on whether there was a ‘golden ratio’ for food and drink offerings alongside retail, Allen said: “Five years ago, we were being told that there was far too much F&B in the city centre and the idea that developers would put cafes on their ground floors was ridiculous. We are now thinking we just don’t have enough for all the residents.”

Erinle added: “We’ve found that when hardship comes up, people start spending more on enjoying themselves rather than spending on stuff. That’s when we start changing the retailers in Spinningfields to more of a consumer F&B leisure type of offering. A lot of the operators were concerned, but it’s actually thriving.”

And Lindley-Clapp broadened the subject to include food and drink retail: “Looking beyond the city centre to sub-regional and smaller market towns, the grocery market is still incredibly important for bringing in footfall. Day-to-day amenities are not going to fall away. They’re still so key.”

‘The grocery market is still incredibly important for bringing in footfall’ said Heather Lindley-Clapp. Credit: PNW

Local authority landlords

Asked what councils could be doing to bring retailers in to revive town centres, Tregenza raised concerns about local authorities buying shopping centres. He said: “Some councils are buying in to some big problems down the line. Shopping centres that are 50 years old are not easy things to convert, though the reasons for buying them are good.”

He also said towns need to find their specific purpose: “There is no point being a small poor version of the Trafford Centre within a couple miles of it. No one wants to shop there, they’d go to the Trafford Centre.”

Meredith agreed: “It’s looking at the demographics in the community to avoid creating identikit scenarios, kind of poor versions of the same thing surrounding the town centre, at which point, the draw to that initial success story is watered down.”

And Allen added: “Since Altrincham food hall opened, every small town has to have a food hall. That’s great for the first view, but you’ve only got so many good providers of those sorts of services. Bury [for example] does not need an auditorium-style food hall because it has an astonishing food market that goes back 100 years and serves food that people come from miles around for. Looking at what you already have, and how you deliver it, is important.”

The stats – and the future

Matt Colledge, board member and project director of the High Streets Task Force, highlighted the change in retail offer over the last 50 years. Back in 1971, 70% of retail sales were generated by 29,000 different retailers and retail groups. In 2000, 70% of retail sales involved just 100 different retailers.

He said: “They are dominated, in part, by major large national multiples. Because of the securities that the multiples could offer, it drove out a lot of the independents, which resulted in the phrase that we’re all hearing a lot of now, the notion of ‘clone towns’.

“We can see that the share of retail spend has been in decline even before we got on to online shopping. [There are] some pretty stark trends that have continued to this day.”

On a positive note, he added: “Retail still has an important component in our centres. People still crave that sense of experience you get from a good retail offer.”

He went on to suggest ways to drive change: “Innovation. Doing things differently, trialling and experimenting, taking a risk, working more widely with the community.

“Appearance and attractiveness. Many retailers just don’t see the world outside of their store doors. Then also thinking about what how we can repurpose space, and what’s the relationship between buildings and their wider place in town, whether that’s through greening or public art and culture, or open spaces for events.”

And he called for a greater spirit of cooperation: “It’s amazing how many places just don’t do place marketing. There’s a real lack of places coming together to really promote that place, not just the individual things within it.

“I don’t just mean a consultative partnership. I mean having everybody who’s got a key stake thinking about the vision, the strategy and the actions.”

High Streets Task Force’s Matt Colledge, Aew Architects’ Danielle Purves, Grosvenor’s Rob Deacon, and Trilogy Real Estate’s Laurence Jones. Credit: PNW

Brave New Store

What does the shopping destination of the future look like? Colledge added: “I think it’s one that isn’t just based on the purely transactional. The destination itself is multifunctional.”

Danielle Purves, director of Aew Architects, said: “The retail industry used to be a service industry. You went and interacted with people, you touched the products, and you came away after having an experience. It’s moved the other way into a real tech business and I think the future really needs to bring it back.”

Rob Deacon, senior asset manager for Grosvenor, agreed: “It’s about connecting with the customer. It’s offering in-store experiences, in-store personalisation of products, having a repair and remake space where you bring your existing products in.”

Laurence Jones, head of asset management and leasing at Trilogy Real Estate, continued: “There’ll be different types of retail destinations to satisfy different needs. If I think about the big flagships, I think we all perceive them as multifaceted event spaces – their showrooms, their places to get expert technical advice. I think it will naturally expand, particularly where brands and businesses are selling lifestyles. Why not have a restaurant in there? Why not have a member’s bar?”

Get outdoors

“I don’t think we can understate the importance and value of public realm,” said Jones. “On a basic human level, we respond well to diverse environments.”

Deacon used Grosvenor’s Liverpool ONE as an example: “Coming out of Covid, the benefit of having a five-acre park within our boundary, we doubled our capacity for outside seating for our F&B operators. Some were doing record weeks of trade just from trading outdoors.”

Rob Deacon spoke about how Liverpool One has doubled its capacity for outdoor seating for F&B vendors. Credit: PNW

The next generation

In terms of a changing audience, Purves said: “I think there’s a great opportunity for the more sustainable and ethical brands to really start telling their stories and play to the next generation that is going to be making slightly different choices.”

Deacon said: “We’ve looked at the concept of co-retailing, and what that might look may look like in the future. And it’s not just a department store rebranded. It’s something different.

“It’s about talking to the future customer, understanding what their needs are, what their wants are, and translating that which is predominantly online into physical retail.”

Colledge talked about a successful initiative in Stockport, The Teenage Market, where young makers take pop-up shops, with some graduating to more permanent premises. He added: “That’s brilliant because it’s creating entrepreneurs, creating jobs, creating wealth, and fundamentally, it’s creating a distinction. I hope that when we think about the changing offer we can think about the incubation space.”

The techie stuff

Asked about how technology should work when setting up a high street store, Purves said: “There are a lot of companies out there that have amazing online platforms that perhaps aren’t reciprocated when you go into the bricks and mortar offering. I think it’s making sure that you have got that connectivity between the two. I think that’s something the younger generation are going to be pushing for.”

But she did sound a note of caution: “I think there are a lot of retailers out there that go headlong into technology, but they don’t educate their customers on actually how to use it.”

Jones said: “Hopefully we see the decline of the kind of pushy salesperson in the store. The desire to purchase is already there so why undermine it by trying to make sure they walk out with a bag in their hand?”

High Streets Task Force’s Matt Colledge, Aew’s Danielle Purves, and Grosvenor’s Rob Deacon. Credit: PNW

Assessing the competition

Hatmaker asked which cities the panel thought were doing well. Colledge’s recommendation was Barnsley: “They’ve got quite a robust retail core that seems to be doing reasonably well without the level of vacancy we would normally expect. That’s because they’ve curated the place with a good mix of independents and multiples.”

Jones cited Amsterdam for its multifaceted venues: “Let it be a gallery during the day, a cafe, a nightclub – a raft of different experiences at any given time.”

Deacon said: “In Liverpool and Manchester, we’ve got two of the UK’s strongest cities from a retail perspective. I would only compare them to London. Don’t be too focused on others. Look at what works well and how that can fit in with what you’re doing.”

Slides

The next Place North West conference is Place RESI, which is being held on 13 October at the Science and Industry Museum in Manchester. Tickets for this in-person event are currently available.

Click any image to launch gallery

- High Streets Task Force's Matt Colledge, Aew Architects' Danielle Purves, Grosvenor's Rob Deacon, and Trilogy Real Estate's Laurence Jones. Credit: PNW

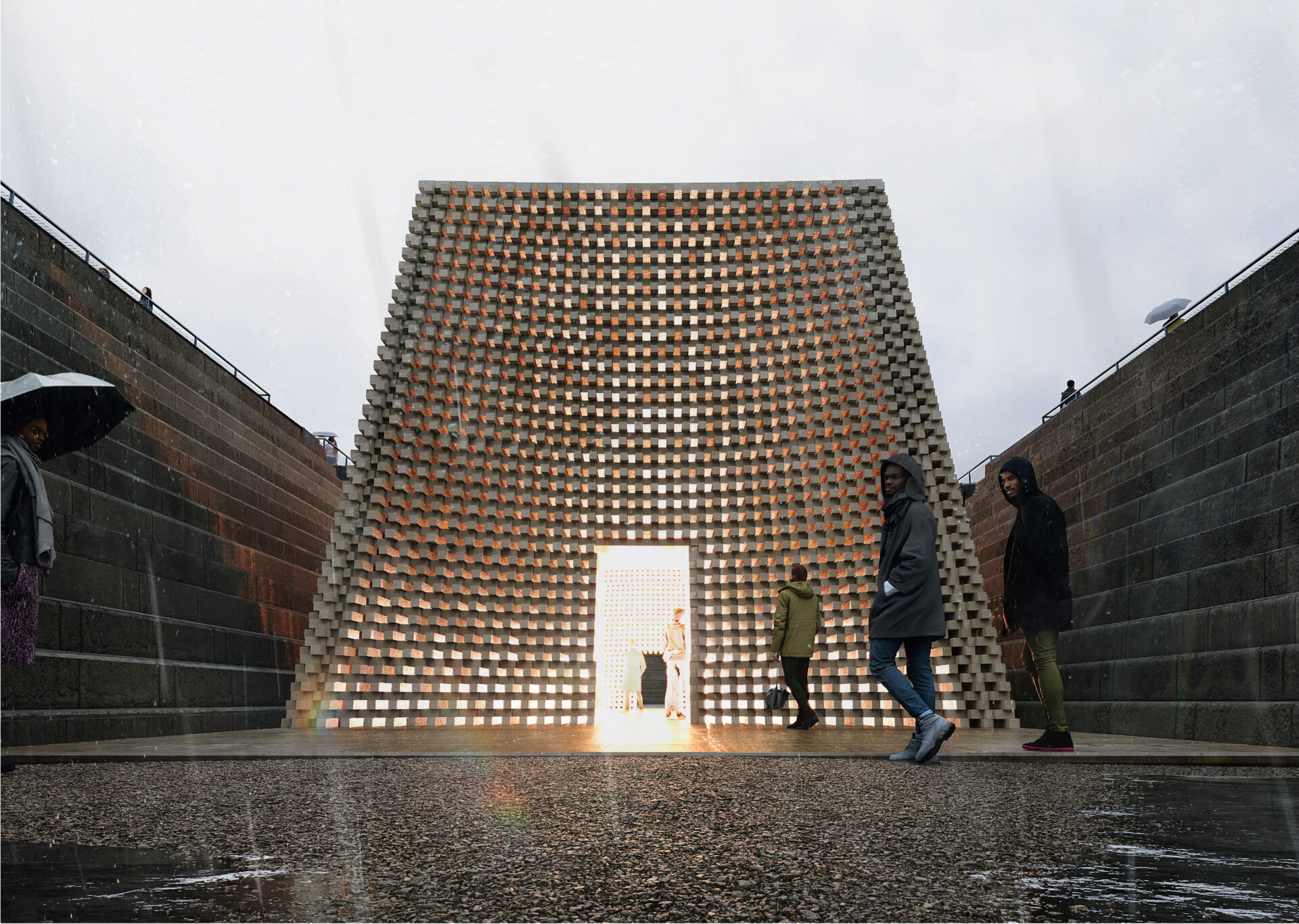

- Credit: PNW

- High Streets Task Force's Matt Colledge, Aew Architects' Danielle Purves, Grosvenor's Rob Deacon, and Trilogy Real Estate's Laurence Jones. Credit: PNW